In brief

- Find out what an insurance ecosystem is and why it is vital for enhancing customer experience and operational efficiency

- Discover the benefits of joining or building an insurance ecosystem, including new revenue streams and improved customer retention

- Explore key drivers like insurtech disruption and growing customer expectations that are pushing insurers towards ecosystem participation

- Gain insight into a step-by-step approach to successfully building an insurance ecosystem, from vision to execution

Insurance customers want excellent digital experiences and convenient, integrated customer journeys. And insurers haven’t remained deaf to this shift in customer demands. Improving customer experience and operational efficiency have replaced growing revenue and launching new products as the driving force for insurance digital transformation, according to Gartner.

Insurance ecosystems are a vital ingredient for redefining experiences to meet customer demands. From embedded insurance, a $3 trillion market opportunity, to risk prevention, an insurance ecosystem can allow insurers to boost customer retention and loyalty and tailor experiences to individual needs, all while leveraging new revenue streams.

But what is an ecosystem in insurance? Why should you consider joining or building one? What are the challenges of ecosystem building? Let’s answer these questions – and break down what makes an ecosystem successful and how to build one.

What is a digital ecosystem in insurance?

A digital insurance ecosystem is a network of interconnected stakeholders that provide services that, integrated, together create value for end customers (i.e., policyholders). The created value is greater than a single insurer could deliver on its own.

An insurance ecosystem can include both insurance companies and outside players. Consider embedded insurance ecosystems, where insurance companies partner up with airlines to offer their travel insurance products to consumers when they book a flight. Or take the example of Spot, which partnered up with Ikon Pass to offer injury insurance to ski pass buyers.

Insurers can also launch non-core products as a part of their ecosystem strategy. For example, Discovery, a South African insurer, launched its own health and wellness management platform. A study showed a 28% decline in hospital stays and a 10% decrease in chronic conditions among its users.

8 benefits of insurance ecosystems

Why should insurers consider insurance ecosystems and join or build one? Here are the eight benefits they stand to reap from digital ecosystems:

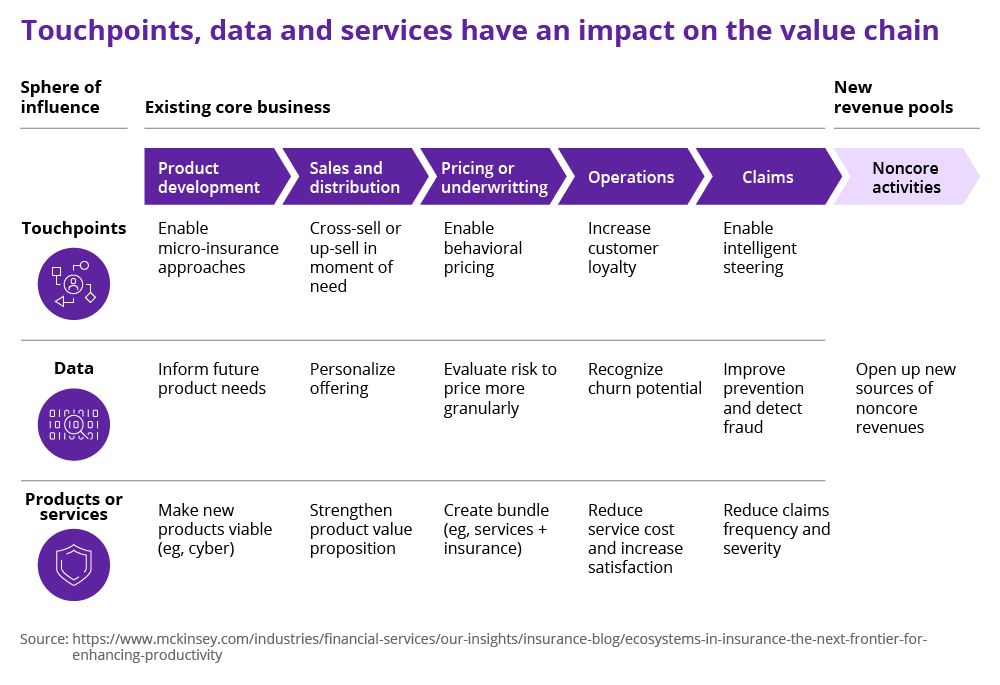

- Gaining access to new customer segments and generating new leads

- Leveraging additional revenue streams

- Improving customer retention and loyalty via seamless integrated experiences and better personalization

- Leveraging customer, product, and operational data to identify new product needs

- Offering micro-insurance services and personalized pricing

- Personalizing cross-selling and upselling to offer the right service at the right time

- Identifying churn potential and preventing it with personalized offers

- Enhancing and streamlining fraud detection and prevention

Insurtech disruption: Key driver for ecosystem participation

Insurance technology, or insurtech, is the leading driver behind the disruption in the industry. Insurtech companies redefine customer experiences with three-second claim settlements and instant personalized underwriting via chatbots. On top of that, outside players like Tesla venture into the insurance market as well and launch their own products (e.g., Tesla Insurance).

While some insurtech companies like Lemonade and Hippo are operating in the B2C sector, a significant part of the insurtech market consists of B2B companies that offer solutions for insurers. Prominent examples include:

- Shift: AI-powered fraud detection for P&C insurers

- Planck: generative AI tools for underwriting and risk assessment

- Flobotics: robotic process automation for insurance

- Smart Submission by Send: generative AI for automating data ingestion from unstructured data sources

- AdInsure: digitalization and legacy core replacement solution for insurers

3 more drivers for ecosystem participation

While tech-driven insurance companies present the key driver for ecosystem adoption, this is far from the only one. Here are three other drivers that should push traditional insurers to take a closer look at ecosystem participation.

Customer expectations

More than two-thirds of policyholders expect their user journeys to be hybrid or fully digital. However, those expectations are not always met.

McKinsey’s research found that 30% of North American insurance customers are dissatisfied with the digital channels of their carriers. and only 20% of customers opt for a digital channel to interact with the carrier. This dissatisfaction can push customers to consider ecosystem alternatives that provide better value and personalization.

Embedded insurance proliferation

Considered both a threat and an opportunity, embedded insurance is expected to generate $700 billion in P&C sales globally by 2030. If traditional insurers don’t get in on embedded insurance, they risk seeing their revenue diverted to non-insurers launching their own products (e.g., Tesla Insurance).

Increasing data volumes

Seven out of 10 customers are ready to share personal data to gain tangible benefits. Those benefits include highly personalized cross-selling and upselling offers, instant underwriting, and individual risk assessment.

The rising volumes of customer data – including data from IoT devices and ecosystem partners – are the key to powering convenient, fast, and intuitive digital experiences. This data also paves the way for new products like usage-based insurance.

3 challenges that hinder traditional players’ competitiveness

B2C insurtech players represent a competitive threat to traditional insurers, while collaboration with B2B insurtech companies can give them a competitive edge. However, to reap the benefits of ecosystem participation, traditional insurers may have to face the following three challenges:

- Technical debt. Traditional insurers have to grapple with significant technical debt as their IT systems’ age averages 18 years. The technical debt has to be dealt with before traditional insurers can leverage advanced technologies like intelligent automation and predictive analytics

- Siloed data. Lemonade states that it uses 100 times more data points per customer than traditional insurers. Breaking the data siloes and increasing the number of data points, however, require modern IT systems to enable data analytics and management

- Organizational siloes. Reducing technical debt and adopting cutting-edge solutions requires close collaboration and coordination throughout the organization. The lack of it can lead to contradictory priorities, fragmented execution, and overlooked potential gains

4 roles insurers can take on in an insurance ecosystem

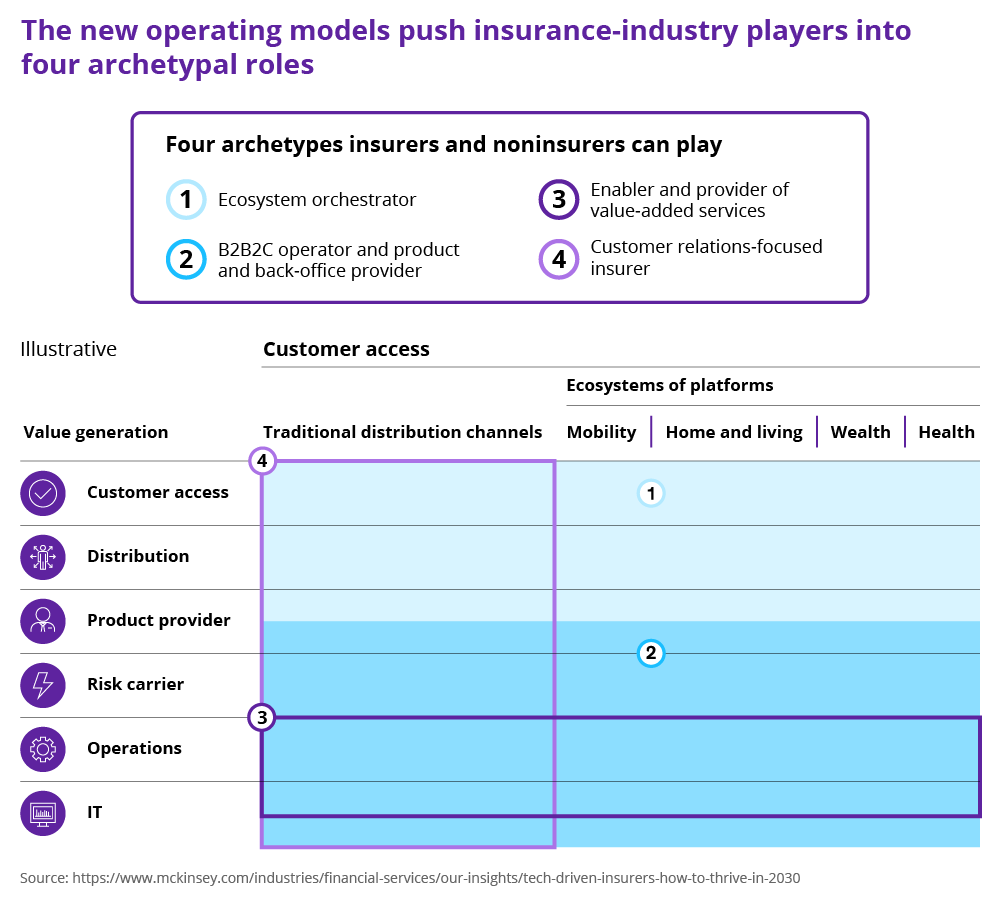

In an insurance ecosystem, insurers, as well as non-insurers, can play one of four archetypical roles:

- Ecosystem orchestrators. They own the customer relationship and offer a wide range of services that go beyond insurance, such as wellness management platforms

- B2B2C operator/product and back-office provider. These actors leverage digitalization and scale efficiencies to streamline operations and provide well-rounded insurance services. However, they don’t engage with distribution directly and don’t have direct customer access. Examples include closed-book life insurance players and insurance-as-a-service providers

- Value-added service enabler/provider. Such companies include core systems and other solution vendors, as well as specialist service providers. They power other insurance companies’ operations and IT

- Customer-relations-focused insurer. These insurers leverage traditional distribution channels, own the customer relationship, and have a high level of vertical integration. They focus on fostering excellent customer experiences with their own technical and distribution capabilities

6 markings of successful insurance ecosystems

While digital ecosystems have great potential to enhance customer experiences, not all ecosystems are created equal. Some are more successful than others – and here are the six characteristics that set them apart.

Consistent buy-in

The buy-in should come from the top management (C-level executives and the board) from the very beginning. It should also remain consistent throughout the ecosystem’s life cycle to ensure its success.

Customer-centric metrics

An organization should use customer-centric metrics to track the ecosystem’s success at every organizational level and customer journey stage. Otherwise, it’s impossible to determine whether the ecosystem manages to deliver greater value to customers than standalone services.

Brand trust

This is a necessary prerequisite to making any ecosystem work: customers have to be ready to share personal information with ecosystem partners. Luckily, over two-thirds of consumers say they’re willing to share personal data in exchange for tangible benefits. This means your ecosystem only has to prove it provides tangible value to build that trust.

A solid hook

To initiate the customer journey in the ecosystem, successful insurance players have a powerful hook that effectively addresses a specific pain point. This hook has to demonstrate tangible value that customers stand to gain by joining in, such as facilitated doctor search.

Aligned product distribution

Successful ecosystem adopters break down vertical distribution siloes for multiple products and services to make them a part of a single ecosystem with a consistent experience. On top of removing siloes, such organizations also design the ecosystem in such a way that it benefits all of its members.

Consistent customer experiences

Customer experiences have to be consistent throughout the whole ecosystem, i.e. all of the company’s products and services, for it to be successful. This may require redefining the legacy customer journey and user flows.

How to implement an insurance ecosystem in 7 steps

Before we get into the step-by-step guide for adopting the ecosystem approach, there are two types of prerequisites you need to consider first:

- Technology. Ecosystem implementation requires an API-based architecture and flexible infrastructure since APIs are the go-to solution for integrating multiple services. Data siloes also have to be dismantled beforehand to enable data management and analytics

- Organization. Joining or forming an ecosystem requires resources and know-how for efficient partner management and consistent cross-channel experience. Another prerequisite is the legal foundation for integrating different services while ensuring compliance

If you’re a forward-thinking insurer looking to build your own ecosystem, here are the seven steps you should take:

- Identify your vision. Pinpoint how exactly your business can benefit from the ecosystem approach and what goals it would pursue by forming or joining an ecosystem (e.g., lead generation). This will inform the ecosystem type most suitable for entering and whether it’s better to join one or multiple ecosystems. Secure the buy-in at the top management level

- Determine use cases. Explore the various use cases for your customers and narrow them down to the highest-impact ones in terms of value for both the customers and the organization. Aim for a mix of short-term and long-term wins and prioritize feasible use cases that leverage existing partnerships

- Pinpoint the value proposition. Outline how the ecosystem-powered services will improve customer experience and how those improvements will translate into value for the business

- Lay the organizational groundwork. Ramp up partner management capabilities and determine the value-sharing model. You may need to move away from the traditional cooperation mode to one that offers more agility and autonomy to collaborate with numerous partners

- Identify technology requirements. Consider the tech talent required to make the ecosystem a reality. Identify which needs will be closed in-house and which ones will be met by collaborating with a partner. Ensure existing applications are ready for integration with partner software

- Create a proof-of-concept. Introduce the integrations required for the ecosystem’s high-priority use case using APIs. Ensure the data exchange is secure. Analyze the use case’s performance and adoption and improve it if necessary using the iterative approach

- Scale and repeat. Make the ecosystem available to more customers and collect and analyze data at scale. Expand into other high-priority use cases using the make, buy, or partner approaches

In conclusion

Leveraging the ecosystem approach to transform customer experience comes with numerous benefits, from new revenue streams to better churn prevention. However, implementing an ecosystem requires a certain level of digital maturity on the insurer’s part. Otherwise, organizational and data siloes and legacy technology will undermine all efforts.

Laying the groundwork for ecosystem implementation is no easy feat. Building the ecosystem capability can be a lengthy undertaking for traditional insurers that requires deep technology and domain expertise, as well as advanced problem-solving acumen.

If you envision the transition to a digital ecosystem, DXC Luxoft’s insurance industry experience and technology expertise are at your service. From defining the strategy and building business cases to delivering a proof-of-value and implementing the solution, we provide end-to-end support to our clients. Contact us to discuss your insurance ecosystem needs.

Frequently asked questions

What is a digital ecosystem in insurance?

An ecosystem is an interconnected set of services that together comprise a seamless integrated customer experience. In insurance, an ecosystem is built through partnerships between insurers, insurtech companies, and non-insurers.

The key benefit of an ecosystem is that it enables its members to deliver a greater value to the customer than any single company could on its own.

How can ecosystems benefit insurance companies?

Joining or building a digital ecosystem can allow insurers to:

- Capture new leads and convert them more effectively

- Create new revenue streams (e.g., service + insurance bundles)

- Personalize pricing and continuously update it using real-time data

- Improve customer experiences, fostering loyalty and preventing churn as a result

- Cross-sell and upsell more efficiently with microtargeted, well-timed offers

- Identify product needs based on customer and sales data

What are examples of ecosystems in insurance?

Here are three examples of insurance ecosystems:

- Ping An Insurance. This Chinese insurance company secured a majority stake in Autohome, an online car sales platform, which allows it to collect data and benefit from a valuable distribution channel. It also owns Haofang, a property sales platform, which provided a new revenue stream to the insurer

- Discovery. This South African insurer launched Vitality, a wellness and lifestyle platform that helps users make healthier choices and adopt an active lifestyle. Discovery offers the platform not just to its own policyholders but to insurance partners around the globe

- Generali Group. Based in Italy, this insurer partnered with NestLabs to transform its home insurance products. NestLabs sensors can alert policyholders about smoke and abnormal carbon monoxide levels via phone notification