In brief

- In financial services, AI is used to detect and prevent financial crime, improve customer experience with virtual assistants and personalization, improve risk management, power algorithmic trading and trade optimization, enhance cybersecurity, and boost employee productivity

- Key benefits of AI in finance include new operational efficiencies, enhanced customer experiences, better risk mitigation, additional revenue stream\s and business opportunities, faster decision-making, and new competitive advantages

- Adopting AI in finance requires addressing regulatory compliance risks, potential errors and bias, data challenges, lack of AI talent, and legacy burdens

Is there anything artificial intelligence can’t do? With the latest advances in the field, AI tools can now converse with customers like a human would, appraise vehicle damage during an insurance claim processing, and even outperform the S&P 500 index.

But staying at the forefront of the AI revolution in banking and financial services is no easy feat. Adopting AI in finance requires a careful assessment of its risks — and selecting the right business use case to start with.

Here’s all you need to know about the technology, from benefits and applications to success stories and potential adoption challenges.

State of AI in finance

Analytical artificial intelligence (AI) and machine learning (ML) are nothing new in the world of finance. It already powers data classification, process automation, pattern detection, and event prediction.

Banking, financial services, and insurance represent 18% of the global ML market. This makes the financial services industry one of the largest users of the technology, rivaled only by IT and telecommunications (19%).

Financial institutions leverage AI in the form of:

- Data analytics (69%)

- Data processing (57%)

- Natural language processing (47%)

- Large language models (46%)

- Generative AI (43%)

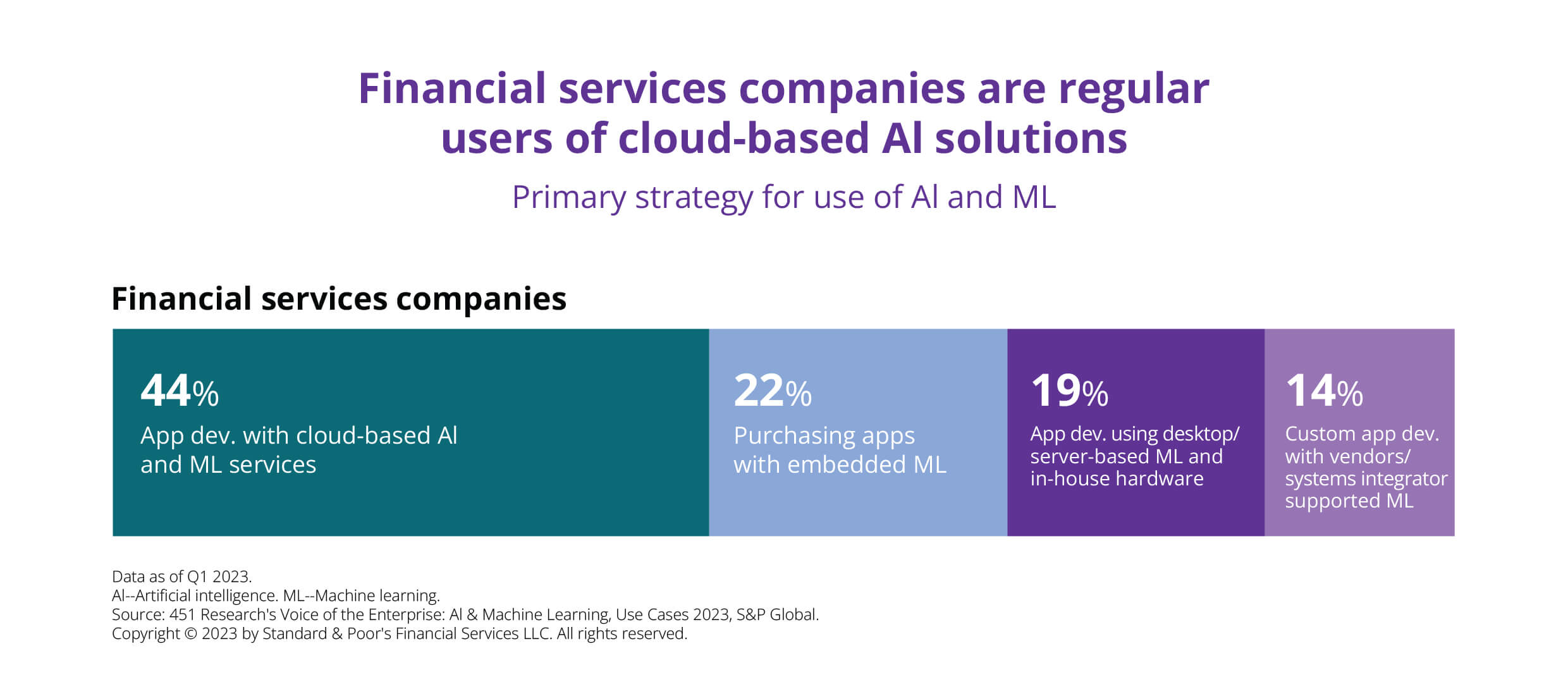

App development with cloud-based AI and ML services is the most common AI and ML adoption strategy among financial services organizations. It was named the primary strategy by 44% of companies surveyed by S&P Global. In turn, 22% of organizations in the financial sector selected the buy approach for ML adoption, purchasing apps with embedded ML.

As for the current applications of AI solutions in the financial sector, financial services organizations report using AI for operations (48%), risk and compliance (45%), marketing (34%), and sales (27%).

Gen AI continues to lead the way

Generative AI is the key technology shaping the future of AI in finance. Almost half of financial services organizations already leverage generative AI and large language models: 43% and 46%, respectively.

Generative AI in banking can power:

- Intelligent coding co-pilots to speed up digital transformation

- Chat-your-data solutions to democratize enterprise data access

- Synthetic data generation to train AI and ML models

- Report generation and summarization for risk and compliance functions

- Personal virtual assistants for customers

- Hyper-personalized sales and marketing campaigns

- Automated insurance claims report generation

- Virtual damage rendering for insurance claim processing

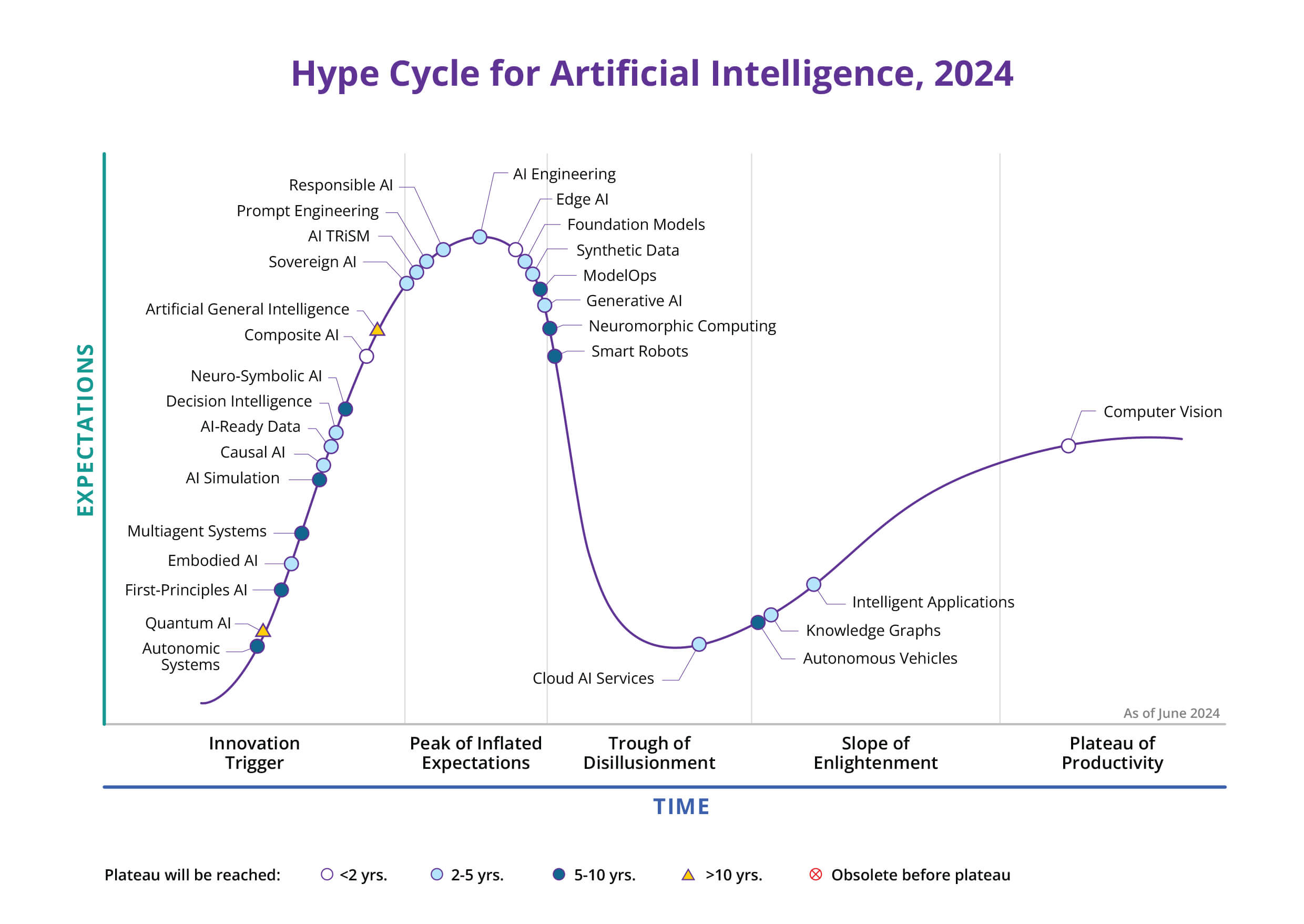

That said, generative AI is inching closer toward the phase of the trough of disillusionment, according to Gartner’s 2024 AI Hype Cycle. Gartner analysts, however, expect the technology to provide transformational benefits to adopters and reach wide adoption in two to five years.

McKinsey analysts, in turn, predict that generative AI will create a 2.8-4.7% increase in the global banking industry revenue and 1.8-2.8% in insurance. In both industries, the highest impact is expected in marketing and sales, customer operations, and software engineering.

Seven applications of AI in financial services

AI use cases in financial services are varied, spanning from fraud protection and enhanced risk management to hyper-personalized customer experiences and employee productivity tools.

Financial crime prevention

Fraud schemes led to $485.6 billion in losses in 2023 alone. The same year, $3.1 trillion in illicit funds moved through the global financial system.

As financial crime poses both reputational and financial risks, it’s no wonder why 90% of financial organizations consider preventing them a top priority.

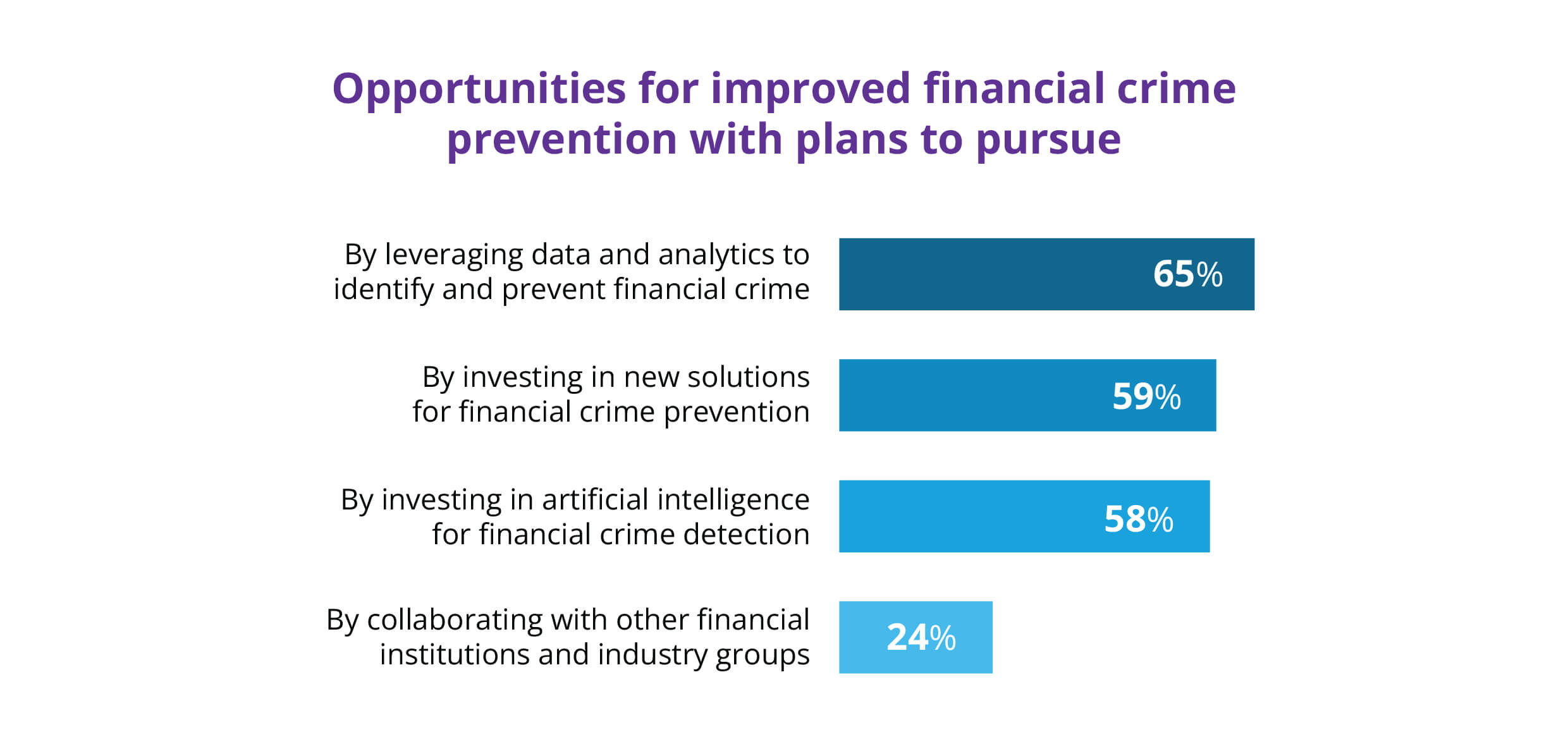

Leveraging data analytics to identify and prevent financial crime is the leading opportunity for improving efficacy on this front. In fact, 65% of organizations plan to pursue this avenue, and 58% want to invest in AI to ramp up their financial crime and fraud detection capabilities.

Using AI to prevent fraud involves:

- Continuously monitoring transactions and other account activity by analyzing big data

- Detecting the likelihood of a financial crime occurring using predictive analytics

- Flagging the transaction or account for further review if necessary

- Automating anti-money laundering (AML) and know-your-customer (KYC) checks

For an example of this application of AI in banking, take a look at Barclays. The bank implemented an AI tool that monitors merchant transactions in real time and uses predictive analytics to assess the likelihood of fraud.

In financial services, in turn, PayPal used AI to reduce the number of missed fraud transactions by 30x, while reducing hardware costs threefold.

Virtual assistants

What if you could put a personal financial advisor, available 24/7, in front of every customer? That’s the promise of the new generation of AI-powered chatbots, enhanced with Gen AI.

Former generations of chatbots still possess solid natural language processing capabilities. Yet, they are still mostly rule-based, which limits the range of responses and scenarios they could handle.

As a form of deep learning, Gen AI allows for more sophisticated chatbots that can tailor their responses to each customer’s explicit demands and implicit expectations. Responses also become more human-like, preserving the personal touch during the interactions.

As for the range of purposes AI-powered chatbots can serve, they include:

- Investment choice recommendations

- Banking account management

- Personal finance management advice

- Self-service customer support

- Automated debt collection

Hyper-personalization at scale

Do you know what every individual customer of yours expects of you? Probably not. Yet, almost three-quarters of financial services customers (73%) expect their financial services providers to understand their unique needs and expectations. Furthermore, customers don’t want to be treated like a number: 62% are ready to switch providers if they feel this way.

Leveraging AI in finance to gain that 360-degree customer view and personalize interactions at scale lets you treat every customer like a segment of one.

Here’s how AI-powered data analytics tools help you power your customer-centric strategy:

- Grouping customers into micro-segments based on their needs and preferences

- Powering recommendation engines and boosting customer lifetime value with tailored marketing campaigns and product suggestions

- Forecasting customer churn and determining the next best action to prevent it using predictive analytics and sentiment analysis

- Providing personalized investment and personal finance management advice

Risk management

Loan and insurance underwriting traditionally rely on a limited range of data points, such as occupation and credit history. However, these data points no longer paint the full picture. Furthermore, analyzing hundreds of data entries manually makes the process resource-consuming and lengthy, leading to customer dissatisfaction.

AI tools can collect and analyze big data to generate more accurate and granular credit scoring and risk assessment for loan and insurance underwriting. This data can include traditional and novel data sources (for instance, the applicant’s social media activity).

Furthermore, this application of AI in finance can also power risk assessment for corporate risk management, identifying novel and established risks and suggesting mitigation strategies.

Finally, AI in finance can also power risk assessment solutions for financial institutions’ customers. These solutions can inform customers’ investment and lending decisions. For example, Banco Santander offers one such tool to its corporate clients, dubbed Kairos.

Algorithmic trading and trade optimization

Algorithms have been governing trade for some time now. For instance, J.P. Morgan leveraged deep neural networks to allow machine-trading programs to identify the most profitable way to execute trades back in 2019.

AI models trained for algorithmic trading in particular can ingest and analyze hundreds of data points reflecting market conditions and identify trends using historical and real-time data. Combined with natural language processing, they can also extract data from unstructured sources (e.g., news reports).

Using AI and machine learning in financial services doesn’t stop at algorithmic trading. In capital markets, AI tools can also power:

- Forecasting asset pricing based on historical and real-time data

- Identifying the best asset allocation strategy to maximize the ROI

- Assessing liquidity risks for a given asset, including based on news data

- Detecting potential market manipulation

- Automating high-frequency trading

Cybersecurity

Data breaches can cost you dearly: An average one incurs $4.88 million in losses, representing a 10% year-on-year increase compared to 2023.

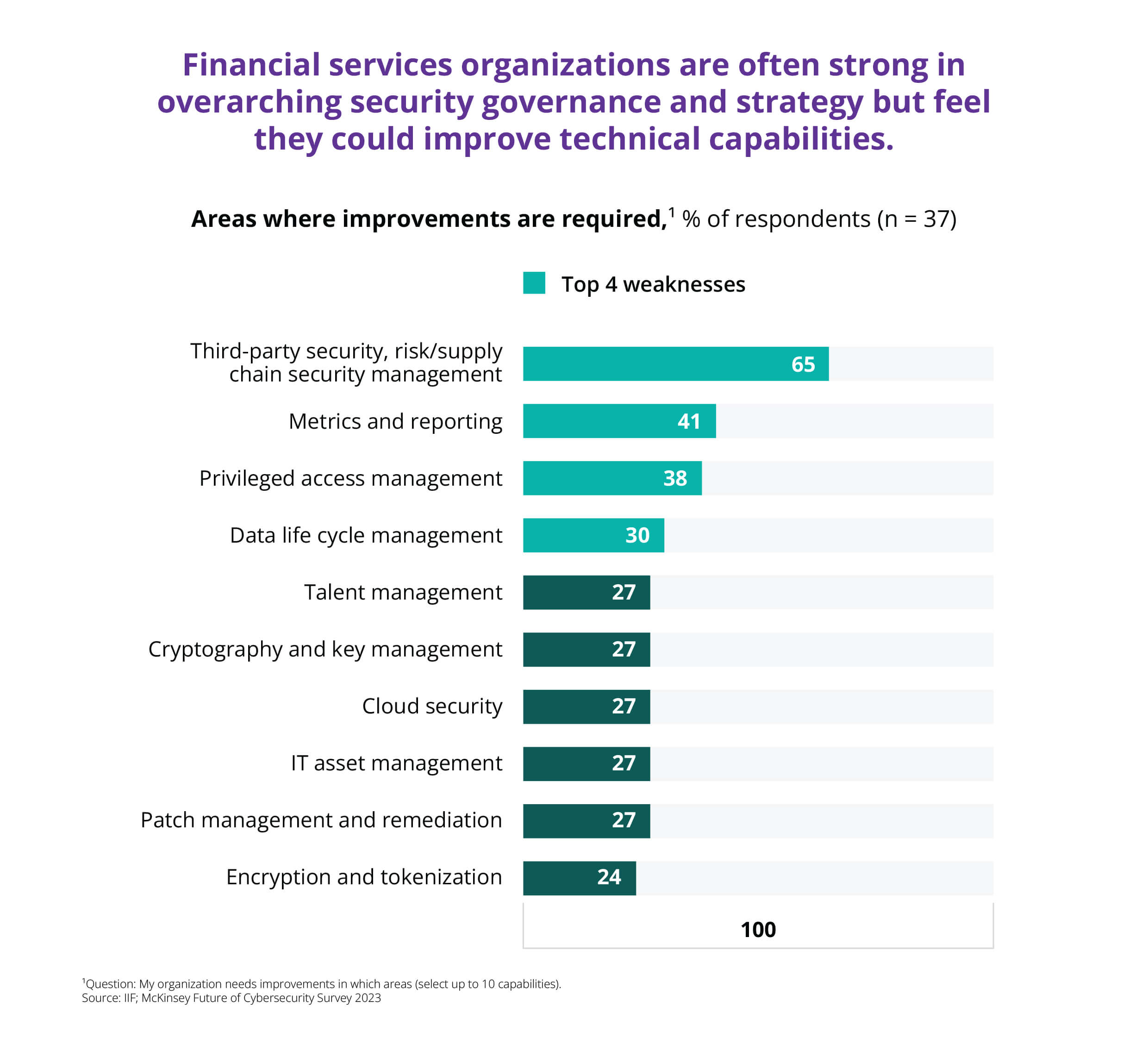

Staying one step ahead of attackers remains a top risk priority for financial services organizations. Yet, some areas still require improvement. They include third-party security, metrics and reporting, and access management.

This is yet another application of artificial intelligence in banking and financial services: Identifying threats, maintaining real-time threat intelligence, and automating incident response.

AI use cases in the cybersecurity domain include:

- Identity and access management: Monitoring log-in activity; detecting suspicious behavior to predict potential account takeover; responding with a forced password reset and 2FA

- Endpoint security and management: Identifying all endpoints; ensuring they remain up to date; detecting malware

- Cloud security: Providing visibility into security vulnerabilities across multiple clouds and providers

- Threat detection: Detecting anomalous behavior across apps, user accounts, and endpoints; alerting the team or responding automatically to the threat

- Information protection: Identifying and labeling sensitive data; detecting potential data theft

- Incident investigation and response: Identifying the most useful information for incident investigation and response for the cybersecurity team

Thanks to advances in Gen AI, modern cybersecurity tools can also:

- Synthesize data into recommendations and insights to facilitate incident investigations

- Generate incident reports and cybersecurity presentations

- Analyze existing codebase for security vulnerabilities and provide suggestions on removing them

- Answer questions on incidents or cybersecurity measures in easy-to-grasp natural language

Employee productivity tools

Finally, AI in banking and finance can help employees become more productive across functions, from risk and compliance and customer service to marketing and sales.

Gen AI tools in particular are at the forefront of innovation in this area. Applications of generative artificial intelligence in finance in this area are ubiquitous:

- Summarizing lengthy documents, such as new regulations and reports (e.g., for accounting research, competitor analysis, and financial reporting)

- Providing response suggestions to customer support agents in real time, boosting productivity as a result

- Generating code snippets and suggesting improvements to existing code as part of AI-powered code review (e.g., Goldman Sachs is experimenting with this business case)

- Extracting data from unstructured sources (e.g., emails), classifying it, and providing response suggestions

However, Gen AI isn’t the only AI technology delivering efficiency gains:

- Computer vision capabilities can extract data from visual sources (images and videos) to automate, for example, damage appraisal in insurance claims or ID verification during digital account opening

- Intelligent document processing involves data extraction from structured and unstructured sources and its automated verification (e.g., in loan servicing)

- Speech recognition can power more effective customer support triaging for call centers

- Predictive analytics can determine the next best action during customer interactions, marketing campaigns, and investment decisions

How AI can benefit your financial services organization

AI solutions for finance come with a wide range of potential benefits, from improved customer experiences and better operational efficiency to faster decision-making.

Enhanced operational efficiency

New operational efficiencies are among the most commonly cited benefits of AI in finance. The reason is simple: AI models can automate traditionally manual banking processes, such as data verification during account opening or creating risk and compliance reports.

Improved customer experiences

With AI-powered personalization, virtual assistants, and intelligent automation that expedites back-office processes, customers can enjoy smoother, frictionless experiences. As a result, leveraging AI and ML in finance can help you increase customer lifetime value, reduce churn, lower acquisition costs, and more.

Mitigated risks

Leveraging AI in finance can protect your organization from reputational and financial losses stemming from missed financial crime and non-compliance with more accurate fraud detection and a more robust AML and KYC framework. However, using AI can represent a risk in and of itself, which is imperative to address.

New revenue streams

In some financial services industry sectors, AI is already powering qualitatively new operating models, products, and services. For example, AI powers usage-based car insurance that calculates premiums based on driver behavior.

Faster decision-making

With chat-your-data solutions and powerful data analytics, AI in financial services can enable faster decision-making across business functions. Predictive modeling in particular can inform decisions regarding risk mitigation strategies, loan and insurance underwriting, and more.

Competitive advantage

AI can enable you to offer superior customer experiences, reduce operational costs via efficiency gains, and launch innovative AI-powered products and services. All of that translates into a competitive edge that AI pioneers gain over their slower counterparts.

How organizations are already using AI in financial services

These five organizations have implemented AI solutions to detect fraud, improve risk management, facilitate data retrieval and access, and more.

Retrieval augmented generation (RAG) for insurance documents

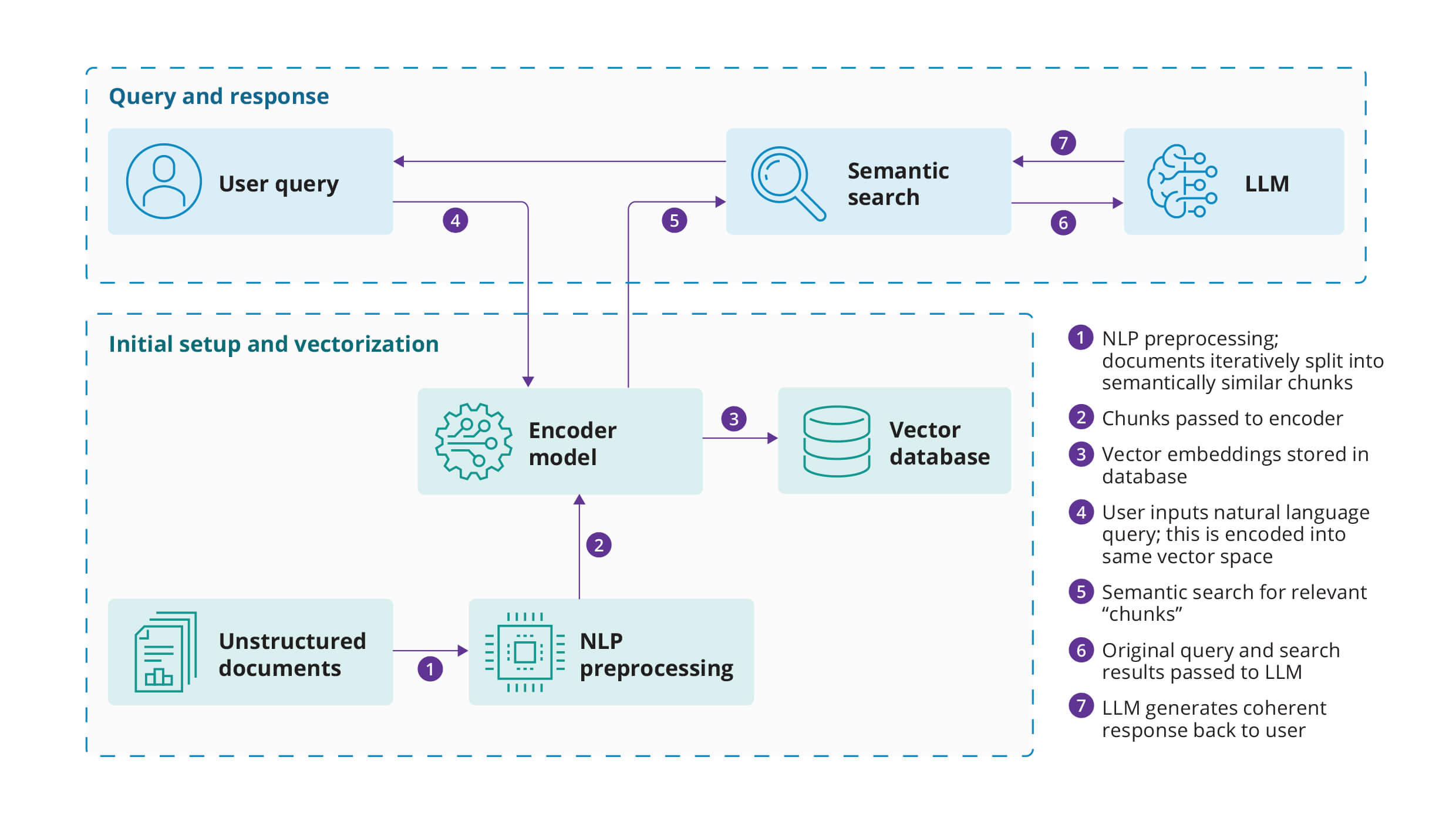

DXC Luxoft’s client, an insurance company, approached our experts with a request to facilitate data extraction and processing from thousands of documents, with some dating back to 2005. The company’s employees had to extract data manually, which was time-consuming and costly.

DXC Luxoft’s RAG solution combined information retrieval and generative AI capabilities to enable the company’s business analysts to access data via a natural -language Q&A user interface. The solution also automatically loads and vectorizes all documents into a machine-readable reference system.

As a result, employees can find the right document section to answer their questions in 38.3ms, with over a million vectors searched. At the same time, the RAG tool allows users to get responses to complex queries (e.g., pricing comparison for a specific policyholder profile) by posing a single question.

Fraud detection and prevention for merchant transactions

MasterCard turned to Amazon Web Services (AWS) to ramp up its AI and ML capabilities to detect and prevent fraud in merchant transactions. As fraud became more sophisticated and rapidly evolving, the company had to move beyond rule-based systems to stay ahead of innovative fraud schemes.

With the help of AI and ML, MasterCard improved fraud detection rates threefold while reducing false positives tenfold. Higher detection rates and a lower risk of false positives also enhanced merchant experience with MasterCard’s services.

Predictive offers and customer experience improvement

Scotia Bank turned to Google Cloud to enhance customer experiences with its AI banking capabilities. The bank transferred its customer data to Google Cloud and pursued three key vectors:

- Personalized product offers: Leveraging ML models to identify the best offers based on customer sentiment insights

- Customer interactions: Using natural language processing, voice recognition, and computer vision to automate onboarding and document processing

- Data unification: Breaking data silos to uncover more insights and power better financial advice to customers

Portfolio optimization

HSBC partnered up with EquBot to improve its portfolio performance with big data. The bank’s AI-Powered US Equity Index (AiPEX) leverages EquBot AI to select stocks with the highest growth potential within the Russell 1000 index.

The solution identifies the potential high-growth stocks more accurately than human analysts, using the wealth of data locked away in natural language format and unstructured sources. As a result, AiPEX outperformed the S&P 500 index by 123% over the past decade.

Developer productivity

Westfield Insurance turned to IBM to boost developer productivity and, therefore, business agility, with generative AI capabilities. The Gen AI capabilities were designed to aid application development and developer onboarding for COBOL, Assembler, and JCL solutions.

Thanks to Generative AI, the company’s developers require 80% less time to get acquainted with an application and 30% less time to explain and document code. The Gen AI capabilities also sped up application modernization and reduced change management costs.

AI implementation isn’t without its challenges

While AI in finance can seem a modern miracle worker, diving head-first into implementing an AI solution has to come with a careful assessment of these five inherent challenges.

Regulatory compliance risks

Regulators around the world have turned their attention to AI use, both in finance specifically and across industries. In the European Union, the passing of the Artificial Intelligence Act marked a new era in AI regulations. In the U.S., state regulators are working to protect consumers against algorithmic bias and other AI risks.

Your AI implementation strategy also has to be in line with other regulatory requirements on consumer privacy (e.g., HIPAA, GDPR, CCPA), cybersecurity (e.g., DORA), and market conduct.

Mitigation strategies:

- Review all regulatory requirements that may impact AI model development and rollout

- Ensure robust AI governance

- Adopt explainable and responsible AI principles

- Establish an AI ethics board and conduct regular reviews

Potential errors and bias

While hallucination is a top concern for generative AI models, traditional AI and ML models aren’t unbeatable when it comes to mistakes and bias. Since AI in banking and finance deals with sensitive data and can impact customers’ lives, preventing these errors and biases is crucial.

Mitigation strategies:

- Ensure the training datasets are diverse and representative

- Regularly review the models for bias and error and fix any revealed issues

- Apply anti-bias techniques to training (e.g., re-weighting, adversarial training)

- Educate end users on the limitations of AI tools

- Keep a human in the loop

Data challenges

While AI and ML models can rival human intelligence in many aspects, they’re only as good as the data used to train them. However, data silos, privacy issues, and insufficient volumes all pose substantial challenges in obtaining enough quality data for training models. Data issues are the leading challenge for financial institutions, with 38% facing them.

Mitigation strategies:

- Protect sensitive data with robust cybersecurity measures to avoid data theft

- Consider generating synthetic data for model training with Gen AI

- Consolidate data and break silos before implementing AI

Lack of talent

In 2022, recruiting and retaining AI specialists was the number one challenge for financial services organizations. In 2023, it slid down to the second most pressing challenge, with 32% of organizations still struggling with it.

Mitigation strategies:

- Build a strong employer value proposition

- Assess candidates’ potential alongside their current technical skills

- Align your business needs with skill requirements adequately

- Expand your search to remote and global talent pools

- Consider sourcing AI talent via partnerships with service vendors

Legacy burdens

Traditional banks and insurance companies have notoriously old legacy IT estate, with a median age reaching over a decade in both cases. Adopting AI tools may prove challenging or even impossible without addressing technical debt and modernizing the legacy IT estate first.

Mitigation strategies:

- Conduct a digital maturity assessment

- Reduce IT estate complexity

- Avoid underestimating scope, time, and budget during legacy modernization

- Break down organizational silos along with software and data ones

What is the future of AI in finance?

The push for explainable and responsible AI, physical and behavioral biometrics, and advances in quantum computing are the key AI trends in banking and financial services to shape the industry’s future.

Explainable, responsible AI

Securing consumer trust is key to ensuring AI adoption is successful. However, only 21% of financial services customers trust Gen AI chatbots, for instance.

So, as ethical concerns take the center of the stage, the push for explainable and responsible AI is bound to amplify.

Financial institutions already recognize the need for transparency and explainability when adopting AI in finance, however. In fact, 84% of respondents told NVIDIA they had measures in place to ensure their AI models remain trustworthy.

Nevertheless, explainable AI is still not a mature technology. Its full-scale adoption will require addressing certain challenges, such as slower computations and lower accuracy rates in exchange for higher interpretability.

Biometrics

Synthetic identity theft is the fastest-growing financial crime in the United States, and Generative AI is becoming a potent tool for fraudsters. Projected to cause $23 billion in losses by 2030, this type of financial crime, however, can be countered with physical and behavioral biometrics.

Such biometrics systems use AI to continuously analyze customer behavior and conduct comprehensive KYC and AML checks. Behavioral biometrics as an application of AI in banking is a promising field as it can create a unique profile for each customer based on how fast they enter a password or how they navigate the mobile app.

Facial recognition can also serve as a convenient and secure authentication and authorization method.

Organizations like MasterCard and BNP Paribas already leverage biometrics to provide next-generation security to cardholders.

Fusion of AI and quantum technologies (AQ)

Quantum technologies are the next frontier of technological progress, with the field seeing record investments. That said, however, quantum computers aren’t expected to be viable within the next 10-15 years.

Still, quantum computing has the potential to upend the golden cybersecurity standards of today as the tremendous computation power may be able to crack asymmetric encryption methods. That’s why certain financial institutions like HSBC are already taking precautions to enhance cryptography management and prepare for quantum-era cryptography.

Combined with AI, quantum-inspired algorithms can also power more sophisticated market conditions and portfolio risk assessments, far more complex than Monte Carlo simulations. Fraud detection can also greatly benefit from AQ with enhanced learning quality.

Let’s talk

Ready to go all in on AI as part of your digital transformation journey? Contact us to discuss how DXC Luxoft’s AI and digital transformation expertise can help you delight customers, outperform competitors, and gain new operational efficiencies.