In brief

- Integrating mainframes with hybrid cloud architecture offers the best of both worlds: Mainframe reliability and security, plus cloud scalability and innovation potential

- Although COBOL is considered a legacy system, it supports 80% of in-person credit card transactions, handles 95% of all ATM transactions, and powers systems that generate more than $3 billion USD of commerce each day. Due to superior stability and processing power, it continues to play an integral role in helping businesses maintain apps and programs in existing architectures

- As soon as you increase product depth and complexity or expand corporate retail and wealth management, Java’s economic gain shrinks. The sheer weight of activity that mainframes lift every second, minute, hour, day, week, month and year beats wholesale cloud cost savings hands down. Plus, any expansion of Oracle’s Java licensing is bound to aggravate the TCO issue

Adopting Capital Markets as-a-Service and migrating platforms to the cloud offer firms the perfect opportunity to reimagine their businesses.

Gaining substantial operational efficiency, including critical system transition, business transformation, application servicing, optimized support and enhanced security operations, increases market differentiation. It sharpens an organization’s competitive edge, positioning it to lead the capital markets field for CLM, treasury and trading.

It pays to collaborate

However, to reap the true benefits of aaS adoption, firms need the kind of customization, fluid integration, risk/change management, specialist knowledge, deep technical expertise and continuing support that only an experienced systems integrator can provide.

Systems integrators bring industry-standard cost estimation, resource planning and vendor negotiation skills that are often lacking in internal teams. They also have the crucial ability to share ecosystem understanding via bespoke stakeholder training.

Partners can make a real difference

Also, having a trusted partner manage the transition allows firms to focus on improving their businesses rather than getting bogged down in the day-to-day running of a technology platform.

Collaboration boosts agility, freeing resources to respond to business opportunities and regulatory requirements. Partnerships with talented external specialists can go a long way toward increasing retention too, by ensuring that key internal team members work on interesting and strategic projects, expanding their skill sets while absorbing valuable cross-industry insights.

Okay, why adopt Capital Markets as-a-Service in the first place?

The capital markets landscape can be tough to negotiate. Increasingly, technology is both a means and a measure of success. Trying to increase profitability and market reach on the back of outmoded technology or an expensive modernization project can prove challenging, to say the least.

Vulnerable legacy systems and processes are wasteful, underpowered and high maintenance compared to cloud-native applications. Added to which, the cost of deploying ad-hoc fixes and upgrading outdated technology is soaring — that fact alone underlines a major benefit of Capital Markets as-a-Service solutions. They help organizations keep operational expenditure in check.

And that’s vital because mounting compliance directives, ballooning product ranges/features, escalating transactions, briefer payment deadlines, steepling data speeds, smarter villains and keeping people/applications connected all cost a fortune to keep on top of.

Adopting Capital Markets as-a-Service means:

Less downtime: Firms operating Capital Markets as-a-Service can look forward to greater operational resilience and significantly less downtime by adopting strong, reliable cybersecurity tactics and techniques. This is especially valuable for securities trading groups. It also helps organizations avoid hefty fines and possible reputational erosion for breaks in business continuity.

Smoother compliance: Currently, global regulations are prioritizing data, privacy and resilience, increasing the complex nature of compliance technology. Trade reporting, risk management and market transparency also call for meticulous real-time reporting and documentation.

More working capital: Subscribing to Capital Markets as-a-Service or paying as you go avoids having to invest heavily in advance, and releases cash for other activities. Reduced maintenance expenditure and economic scaling enable decision-makers to forecast issues and allocate budgets more accurately.

Tighter security: To a greater or lesser extent, aaS providers have teams of security experts to constantly monitor, flag up and analyze emerging threats and critical vulnerabilities, minimizing response times and maximizing stability. Disaster recovery plans, backup systems and redundant infrastructure are all built-in features of the Capital Markets as-a-Service model.

Better time-to-value: AI, GenAI, ML, automation, easier scaling and greater flexibility improve data management, operational efficiency and time-to-value. Capital Markets as-a-Service and managed services providers control the infrastructure, updates, patches and performance issues, leaving internal business teams to do what they do best.

And why use DXC Luxoft for Capital Markets as-a-Service?

Market combatants and the independent software vendors (ISVs) that support them have always been slow to innovate and adopt technological developments. Complex and ever-changing compliance, overly integrated systems and potential outage penalties are central to industry discretion. Disrupters’ rapid uptake of cloud-native technology gives them the single-minded agility and optimal cost-to-income ratio to point the way forward with innovative client solutions.

Luxoft Beyond

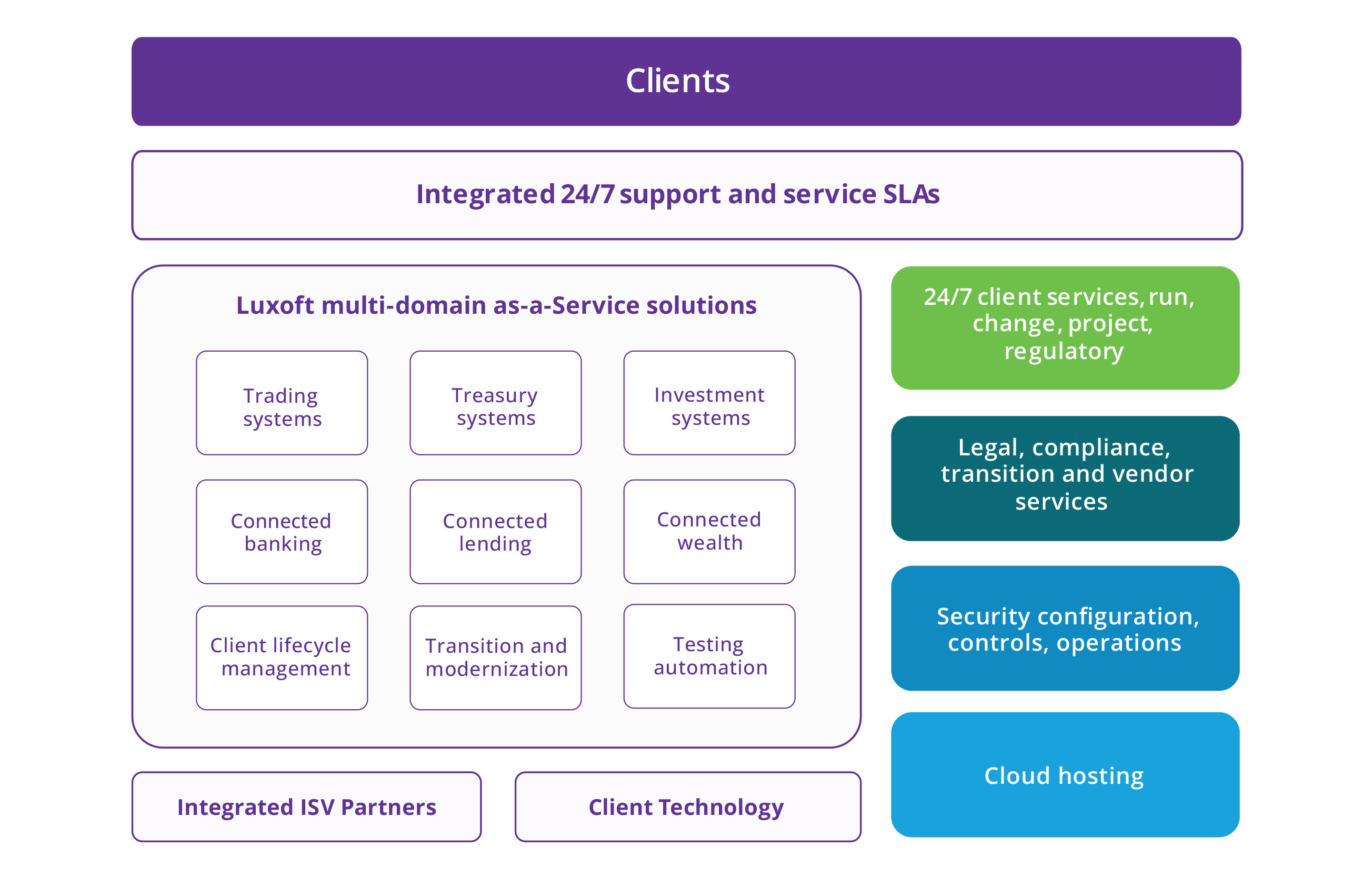

DXC Luxoft’s answer was to create Luxoft Beyond, a bank of partner-enabled as-a-Service solutions. This combination of independent software vendors, hosting services and innovative partners speeds up the manifestation of as-a-Service benefits. Offerings include bespoke engineering, cloud hosting and migration, systems integration and run and change services. Our dedicated ecosystem addresses cost and service issues, acknowledging a future requirement for added-value hyperconnection capabilities.

Capital markets aaS solutions (e.g., Treasury/Trading Systems as-a-Service) streamline platform management, ensuring cost transparency and consistency while allowing decision-makers to channel precious internal headcount into more valuable tasks. This increases client engagement and retention, enabling further market differentiation and revenue maximization.

Get to the heart of the matter faster

EarlyResolution provides audit, security and compliance services for almost half of the US default market and is one of Luxoft Beyond as-a-Service’s time-served linchpins. DXC Luxoft focuses on delivering aaS solutions for core banking, lending and the accompanying complex transition programs. Regarding insurance, the DXC Luxoft Analytics (LXA) platform offers ML-based fraud detection and claims management with user-adaptable claim types, languages and customizable fields. LXA also allows rapid implementation to speed up insurer value assessment.

Migrating complex systems and applications to an as-a-Service model can prove both punishing and stimulating. Success relies on adding the specialist skills of an experienced independent collaborator to navigate the complexities. Trusted partners introduce new solutions, sharing the risk and investment while providing invaluable and impartial insights to sketch the ideal operating model.

Delivering beyond expectations

Only DXC Luxoft has the capital markets vision and experience to perform beyond client expectations. Our domain experts bring confidence and an unrivaled track record, making Capital Markets as-a-Service journeys a predictable reality. We tailor the as-a-Service model, offering a flexible, client-specific solution to meet its unique needs and demonstrating a clear ROI and multiple cost benefits.

Our competitive advantages include depth of experience in managed services and complex implementations, long-term relationships and deep expertise with independent software vendor (ISV) systems, the ability to leverage a large, global workforce for cost-effective solutions and a reliable methodology that enables us to deliver complex projects on time, within budget and without fail.

We’re inveterate problem solvers

For instance, clients and ISV partners endure increased costs owing to working with legacy-deployed software and putting resource talent on hold to focus on generating profit and differentiating activities.

DXC Luxoft offers a complete solution for transitioning, hosting and servicing ISV solutions to the cloud, solving many of the contributing elements to legacy-deployed software and including:

- Complex application management: Simplifies the operation of complex applications by hosting, managing, upgrading and providing daily support

- Resource management: Handles team management from recruitment to retention

- Data center exit strategies: Eases the transition from data center operations to cloud environments

- Cost reduction/Stabilization: Transforms CAPEX into manageable OPEX, reducing overall IT costs and technical debt

Client benefits

Cost:

- Single fee includes run, change, platform hosting and upgrades

- TCO is stabilized throughout the life of the deal

- Other applications can be added

- Common enablement services (helpdesk, governance, reporting) which can reduce TCO

Platform:

- The extendable functional scope covers end-to-end treasury and trading needs

- Service mutualization

- Predictability, transparency and economies of scale

- Automated testing improvements with upgrade timelines

- Infrastructure-agnostic secured, consolidated and standardized technology, operated and maintained by specialists

- A scalable services model makes it easier to respond to change

Resourcing:

- DXC Luxoft is responsible for managing the teams. All recruitment, retention and attrition issues are handled by DXC Luxoft, ensuring a dedicated team is always close to the client

Upgrades:

- The platform is kept up to date with frequent upgrades

- OS, DB and tooling are evergreened

Client challenges

Realigning systems and processes as part of Capital Markets as-a-Service deployment can sometimes be mistakenly seen as being “just about the tech”. It’s not. It’s a crucial tipping point in developing an organization’s business, requiring a delicate balance between operational adaptation and adoption that leaves business continuity well alone. Meaningful and free-flowing dialogue, shared responsibilities and robust project management help avoid confusion and the inevitable consequences.

Let someone else take the strain

Traditionally, financial services organizations have managed their own applications, but they don’t have to do it alone.

If firms are managing third-party applications, several SaaS providers, systems migrations and integrations, DXC Luxoft’s vendor-agnostic managed services platform and partner network could be just the ticket. We ensure maximum flexibility with minimum risk while helping firms master expensive legacy architecture, compliance commitments and cyberthreats. The software vendor remains responsible for new modules, versions and functionality, plus vendor support where appropriate, taking extra weight off clients’ shoulders.

DXC Luxoft takes on the following aspects of keeping systems running while our clients focus on application strategy and governance:

- User support

- Application technical support

- Application change and upgrades

- Tech ops

- Infrastructure service

This division of labor approach results in <50% in client cost savings. Our specialist managers and partners anticipate costs and add value, simplifying operations and enabling you to regain control of the precious resources needed to deliver growth, sustainability and profitability.

Benefits

Owning trading and risk systems translates into high costs, software management complexity, and slow time-to-market. Switching to Capital Markets as-a-Service overcomes these challenges, allowing organizations to:

- Focus on business activities: While an XaaS vendor takes care of system maintenance and management, organizations can have their teams focus on what matters most — realizing the business strategy

- Accelerate time-to-market: Organizations no longer need to invest in establishing a DevOps or automation framework. They can be provided as native features

- Tighten security: XaaS solutions have high-level security standards implemented natively and at no extra charge. This allows for streamlining compliance and readily adopting security best practices

- Switch to a more transparent cost structure: Instead of a miscellany of expenditures, you get transparent pricing that corresponds to organizational needs

- Reduce costs: XaaS adopters can optimize their IT spending and TCO

- Simplify regulatory reporting: Compliance requires complex calculations and increased data processing. AI, ML, automation and cloud working streamline reporting and overcome challenges

- Predict risk more accurately: A fragmented application stack makes it complicated and sometimes next to impossible to assess and predict risks with precision. Adopting a unified XaaS solution resolves this issue

- Master AML and KYC compliance: High-level automation coupled with AI and cloud computing streamline compliance, increasing operational efficiency

- Faster fraud detection: Pinpointing suspicious activity means sifting through mountains of data. XaaS solutions accelerate the process thanks to almost limitless scalability and AI/ML functionality

- Rapid trade surveillance: Compiling audit data is lightning-fast via in-built features and data centralization in a single platform

About DXC Luxoft

DXC Luxoft's expertise centers on developing and implementing bespoke technology solutions in collaboration with the company's network of premier capital markets software vendors. We pride ourselves on bringing ultra-talented people together to create a diverse and highly skilled team of engineers, designers and domain experts. Our teams work closely with each client to understand their unique needs and develop innovative strategies to overcome specific challenges and manifest opportunities.

Go deeper

To learn more about how DXC Luxoft is changing the way capital markets firms think about technology by challenging traditional operating models and enabling tech consumption as-a-Service, contact us.