In brief

- Luxoft's EarlyResolution stands at the forefront of innovation, offering a comprehensive solution that not only streamlines processes and mitigates risks but also strengthens the connection between financial institutions and their clients in the ever-evolving landscape of the trillion-dollar auto loans industry

- Designed with a deep understanding of the loan servicing industry’s needs, Luxoft’s EarlyResolution offers an unparalleled level of flexibility, scalability, and security, with a system architecture designed to adapt seamlessly to changes in regulatory and compliance requirements

- Industry challenges demand to be addressed, Luxoft’s EarlyResolution, developed specifically as a proactive response, is providing ever more digital savvy customers with the kind of service they expect and banks the platform they always dreamt of

The digital age is revolutionizing the financial sector at an incredible rate. Online banking, digital banks, automated loan origination, and other digital services have become ubiquitous over the last few years. Customers have seamlessly adapted to the convenience, speed, and reliability of consumer banking and have come to expect these benefits for all banking interactions. According to the report ‘Accelerating digital transformation in banking’, by Val Srinivas and Angus Ross, of Deloitte, over 60% of customers now interact with their banks through mobile or online channels at least twice a month, ushering in a new era of digital financial services. As the consumer digital footprint expands, the expectation for a seamless and efficient digital banking experience in the auto industry follows suit.

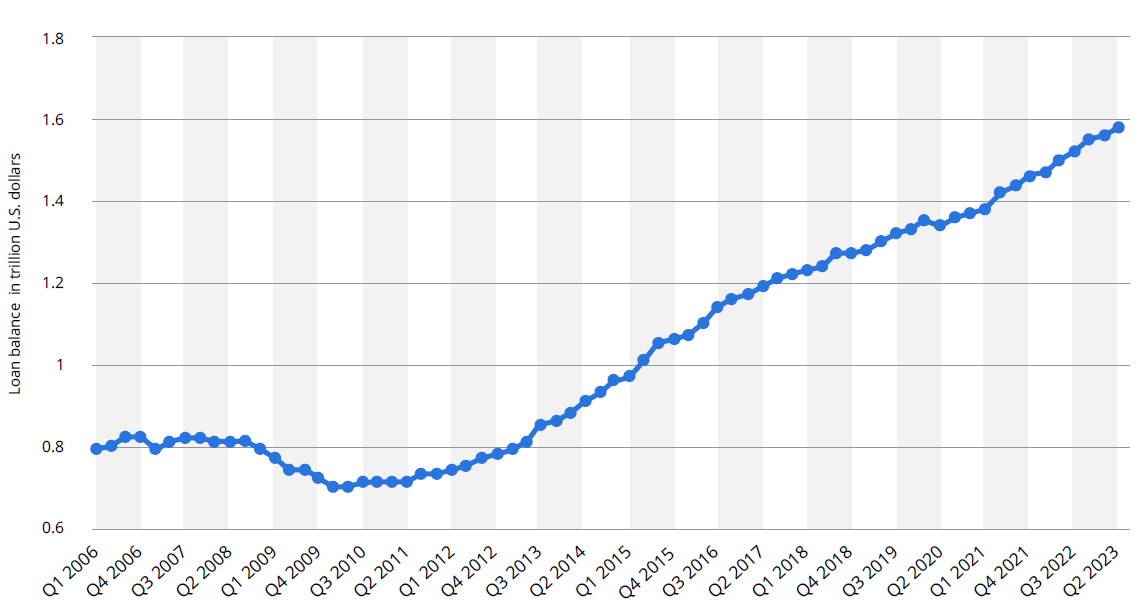

The automotive loans industry has blossomed into a trillion-dollar business in the US alone. Auto loan servicers have become proficient at managing these loans during normal conditions but are behind other parts of the bank when it comes to customers who experience difficulties making payments. The historical default rate for automotive loans in the United States has been around 1%, rising about 50% to ~1.6% after the 2008 recession. During economic downturns or periods of financial stress, pandemics, this rate increases significantly. According to YCharts: US auto loans delinquent by 90 or more days were 3.82% for Q2 2023, levels that haven’t been seen for decades.

Source: Statista car financing and leasing in the US, p. 5

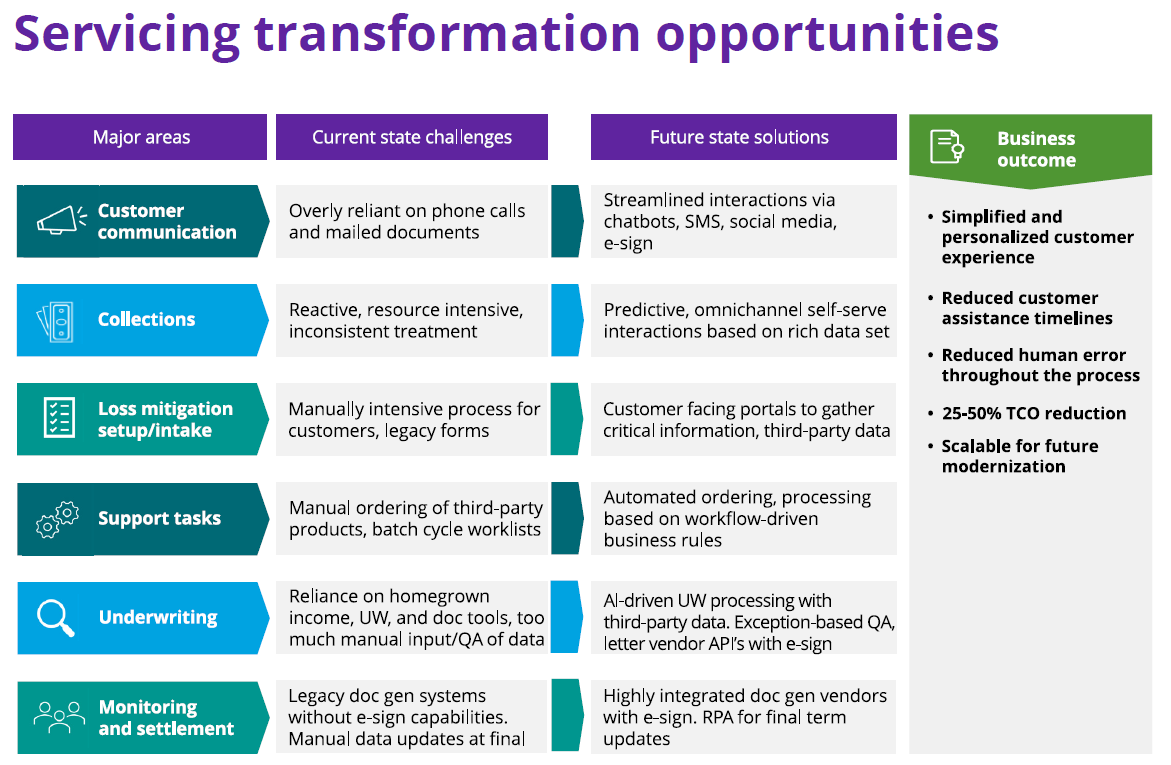

The traditional methods of recovering default loan balances are time consuming, costly, inefficient and don’t typically rely on online capabilities, self-service portals, AI chat bots, or other more modern methods. The customer experience continues to be sub-par, falling way behind the loan originations experience. Loan servicers struggle with nearly a dozen disparate pieces of technology, cobbled together with data living across the ecosystems. All of this leads to a lack of internal coherency when dealing with customers who are struggling with hardship.

Luckily, there are better ways to help customers, such as Luxoft’s EarlyResolution, which can replace or unify all the traditional technologies and data into a single platform. EarlyResolution provides customers with a self-service platform, significantly revolutionizing the way borrowers engage with their servicer during challenging times.

Make a strong digital commitment

Luxoft’s EarlyResolution: Pioneering automation in auto loan default management

Luxoft’s EarlyResolution platform has emerged as a trusted and robust solution to solve many of the loan servicing industry’s challenges. With a proven record of over 15 years as an enterprise-class default management suite, EarlyResolution has successfully demonstrated its ability to reduce operational costs and credit losses, while dramatically improving the customer experience.

Designed with a deep understanding of the loan servicing industry’s needs, EarlyResolution offers an unparalleled level of flexibility, scalability and security. The platform's system architecture is designed to adapt seamlessly to changes in regulatory and compliance requirements, without the need for software code alterations. This offers loan servicers an unparalleled advantage, enabling them to implement system modifications swiftly and efficiently, thereby reducing the turnaround time from months to just days or weeks. Designed in close collaboration with industry stakeholders, EarlyResolution is constantly evolving to meet changing industry needs. The platform integrates effortlessly with applications from verified third-party providers in the fintech ecosystem, expanding its utility and scope.

Overcome your everyday challenges

Operational challenges

- Inefficient processes

- Excessive number of handovers

- Prolonged waiting: < 90% of the total process period

Regulatory

- Heightened compliance involvement as lenders grow in size and global influence

- Excessive process updates and staff training, leaving little time or budget to address new business demands

- Non-compliance ramifications can be severe — heavy penalties, sanctions and reputational damage

Digital

- Inflexible legacy platforms that are costly to maintain and prevent agile product deployment

- Siloed systems to manage different loan types

- Loss of strategic focus and minimal product advancement

- High cost of servicing

- Hesitancy in adopting a digital-led approach

Human and financial resources

- The initial investment in (and on-going cost of) technology

- Retaining talent

Feel the force

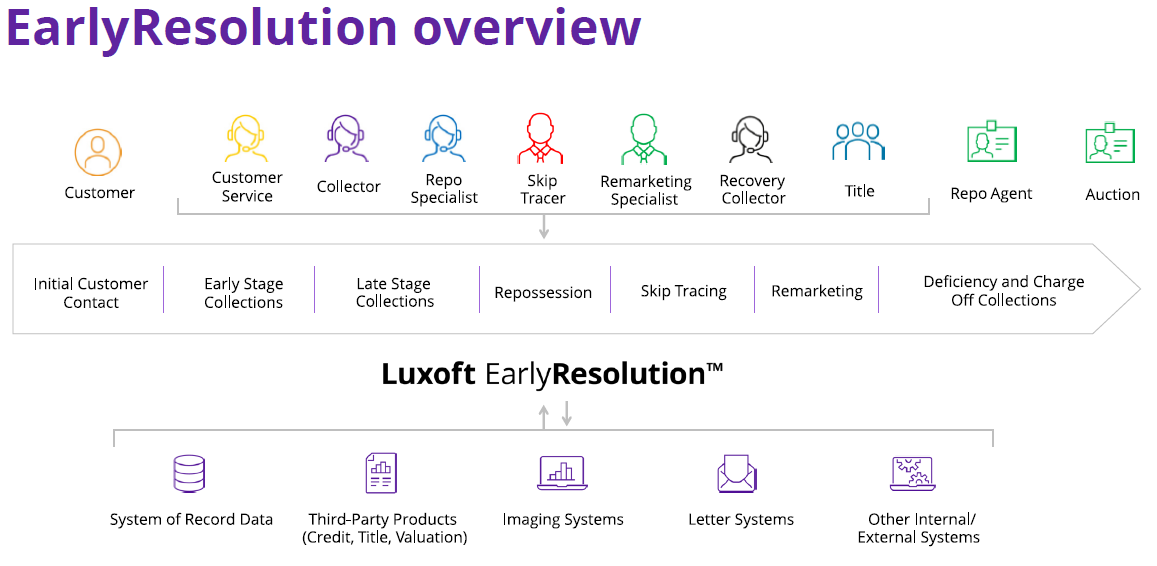

Luxoft’s powerful EarlyResolution platform helps automate the loan default management process from initial contact through collections and into repossession.

The best-in-class, SaaS-based default management solution is highly flexible and configurable, ensuring compliance, greater efficiency and an exceptional customer experience (CX). EarlyResolution allows you to communicate with customers via their preferred channels. This reduces call management costs, providing 25-30% savings in productivity. Our solution also enables core collection scripting, customer service, workflow and repossession activities.

EarlyResolution delivers a single source of truth across all management and digital channels, guaranteeing a consistent service for borrowers in whichever way they interact with you. EarlyResolution generates:

- Streamlined workflows: Workflow management is critical and can result in a 20-25% increase in efficiencies. Team members benefit from user-friendly dashboards and customized reporting, contributing to rapid and better-informed decision-making

- Faster approvals, sharper CX: Automated rules engines, integrated applications, and a single platform for sharing documentation create a 20% quicker decision process with fewer errors

- Online borrower access: Secure, self-service account access and management. Total progress transparency, plus the uploading and digital signing of documents. The system automatically updates user-account status, reducing inbound call volume significantly

- Celent feedback:

- "This highly configurable tool enables financial institutions to quickly add or modify the system in days or weeks, not months.”

- "Luxoft experts and technology resources understand business and technology and partner to deliver solutions.”

- "The Collections function is better able to meet quick deadlines (new regulation, investor requirement) and maintain collections activity quality."

Examine these compelling developments

Luxoft is making significant progress in identifying, building, and delivering new capabilities across the default management process to create a more profitable future state:

- Chatbots, SMS: Omnichannel capabilities to resolve delinquencies immediately

- Self-serve portals: Borrower direct, integrated e-sign

- Decision service: Luxoft-managed workout plans extended to various front ends, reducing upkeep costs

- Data over docs: Partnerships with leading data providers to gather critical customer data

- AI processing: Utilizing automation, AI, and RPA within workflow tools to reduce manual steps

Try our practical approach to transformation

Luxoft built EarlyResolution in response to industry demands. Developed in close collaboration with loan servicers, EarlyResolution has a 15-year track record as an enterprise-class decisioning engine. This best-in-class solution is a proven factor in reducing default operation costs and credit losses.

Our lending solutions have the in-depth scalability, security and flexibility demanded by the industry. We also strengthen access to the fintech ecosystem by rapidly integrating applications from authenticated third-party providers.

The architecture helps servicers keep pace with regulatory and compliance changes without making changes to the software code.

EarlyResolution guarantees:

- Industry best practices: Industry approved processes and templates implemented on day one. Highly flexible, mainly real-time architecture

- Innovation focus: Transformational capabilities delivered and new integrations added on a regular basis

- Servicing expertise: Deep industry experience across the team

- Established integrations: Dozens of proven, scalable integrations maintained with major industry systems

The numbers:

- 45% of the U.S. mortgage servicing industry uses EarlyResolution

- 750k workout decisions annually

- 2.6 million transactions each month

- 20% faster decisioning

- < 30% call-management and productivity savings

- < 50% workflow improvement

- > 20 technology partners

Review our services

Call management

Guide team members to the best resolution for collections, customer service and other functions:

- Enhance the customer experience

- < 30% savings in cycle time and resource productivity

- Improve consistency in customer treatment

Portals

Scale underwriting with investor eligibility and affordability waterfall rules built in:

- Shorten decision timelines by 20%

- Increase underwriting capacity by < 30%

- Sharpen underwriting consistency and quality

Workflow

Manage downstream actors/processes and third-party interactions in a single case:

- < 50% lift in resource and efficiency gains

- Orchestrate the entire process and data in a single solution

- Expand visibility into the status of all work within the organization

Decisioning

Extend EarlyResolution directly to customers and automotive sales:

- Cut inbound status calls by < 35%

- Simplify customer interaction with the bank

- Reduce short sales timelines

Luxoft can help your organization

In an era characterized by rapid digital transformation, an efficient, secure, and adaptable solution to manage auto loan defaults is not a luxury but a necessity. Luxoft's EarlyResolution is poised to meet these challenges head-on, paving the way for a streamlined, customer-friendly, and a cost-effective loan default management process.

With its proven record and commitment to continuous evolution, EarlyResolution stands as a beacon of hope in the auto loan industry. As financial institutions grapple with the complexities of digital transformation and rising regulatory pressures, EarlyResolution offers a viable path to navigate these challenges, underscoring the power of automation in revolutionizing the auto loan default management landscape.

Ready to know more?

If you’d like to discuss your organization’s primary business and technical pain points or arrange a live onsite demonstration of the streamlined power and control of EarlyResolution, contact us.