In brief

- Hyper-personalization involves tailoring customer experiences to every individual customer based on real-time data analytics

- Powered by artificial intelligence and machine learning, hyper-personalization requires solid customer data capture and management, analytics and behavioral data science capabilities, as well as a trust-building customer policy

- Use cases for hyper-personalization in banking include tailored financial product recommendations, finance management advice, personalized loan offers, tailored marketing copy and customer support interactions, and personalized user experiences

“Money ain't got no soul. Money ain't got no heart,” one of Disney's songs says. While it might be true from a moral standpoint, let’s bring it down to earth and look at it from a digital native’s perspective.

What if a bank was more than a place to park your money? What if it were your personal financial assistant instead? Your money-savvy mate who knows your life goals and struggles, offers actionable insights into your finance management and suggests the right savings and loan options every time.

More and more banking customers want such an option. Today, almost two-thirds of customers expect personalized recommendations from financial institutions. Just as many are ready to switch providers if they feel treated like a number, not a person.

If your bank is to retain its market share, offering personalized financial services should be a priority in your strategy. Here’s how hyper-personalization fits into it.

Hyper-personalization 101: What is it and why does it matter?

Hyper-personalization essentially means treating every customer in a unique way. It involves collecting and analyzing swaths of customer data to tailor recommendations and experiences to their preferences and needs in real time.

Hyper-personalization goes beyond replacing a placeholder with the customer’s name in a marketing copy. It employs real-time data analytics, powered by artificial intelligence and machine learning, to forecast individual customer needs and provide customers with more relatable services.

Implementing hyper-personalization allows financial institutions to reap benefits like:

- Improved customer satisfaction. Superior customer experiences enable banks to foster customer loyalty and improve retention rates and net promoter scores.

- Increased marketing cost-efficiency. Narrowly targeting marketing messages allows for more efficient use of the marketing spend, lowering acquisition costs as a result.

- Enhanced revenue growth. Loyal customers and tailored recommendations lead to a higher customer lifetime value.

- Secured competitive advantage. As customers are ready to switch providers due to a lack of personalization in their customer experience, hyper-personalization can easily become a competitive advantage.

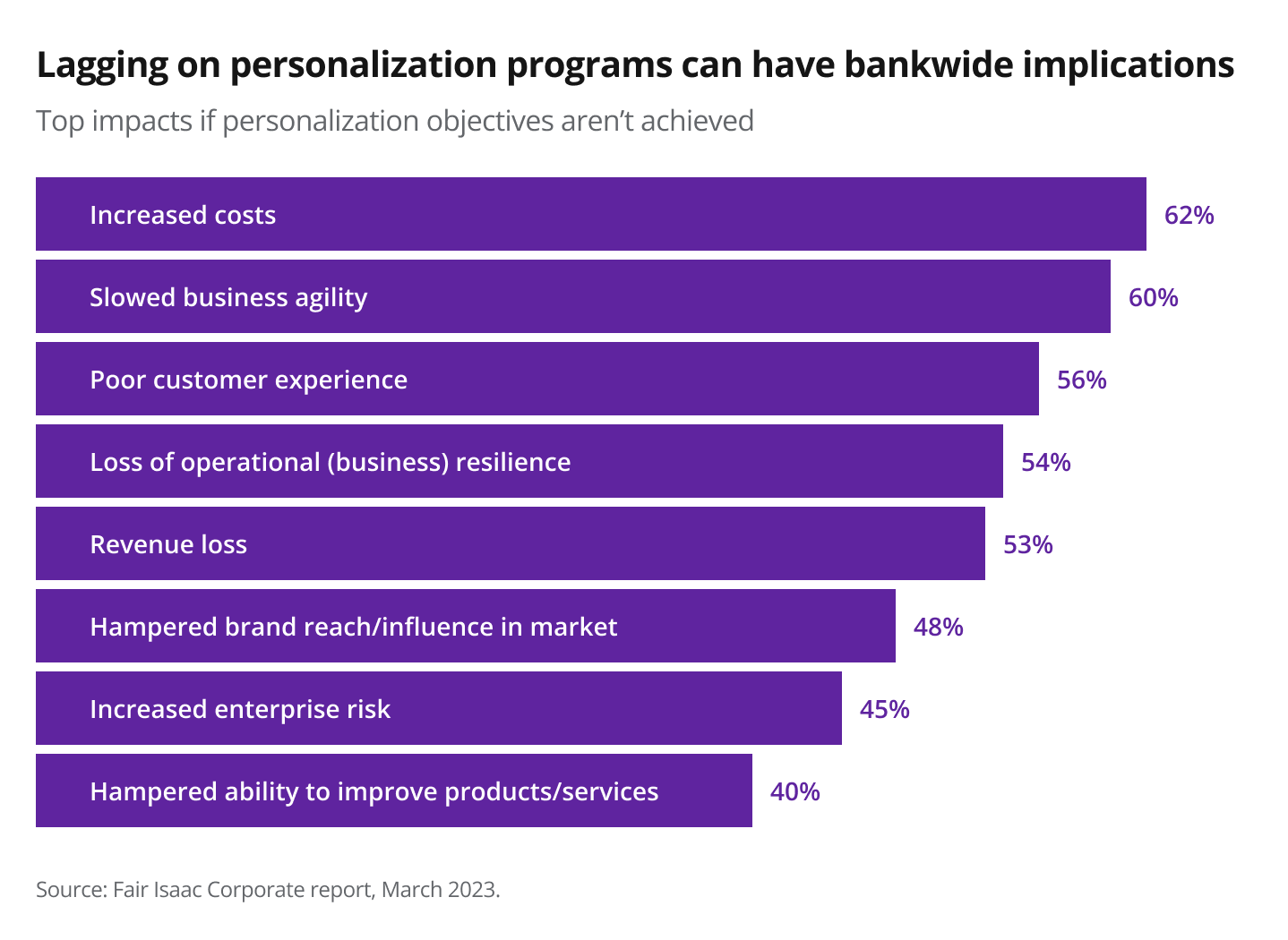

Neglecting personalization in banking, in turn, leads not only to subpar banking experiences but also to increased costs, slowed business agility, and loss of operational resilience.

Four building blocks of hyper-personalization in banking

To implement highly personalized banking, you’ll need to ramp up your customer data capture and analytics capabilities, draw up transparent policies, and invest in behavioral science capabilities.

Customer data

Before you can predict customer behavior and needs, you need data — a lot of it. Implement a customer data platform if you haven’t yet and collect real-time data across all digital channels: websites, mobile apps, social media, customer support channels, etc. Don’t overlook insights from in-person interactions, either.

Leverage advances in generative AI, too. For instance, automate the capture of unstructured data from emails, customer support messages, and so on.

Consider collecting alternative data, as well. It can include open banking data, public records, social media activity, etc.

Data analytics

With the combination of artificial intelligence and machine learning, you can get the following insights out of your collected customer data:

- Descriptive insights visualize your customers’ account data: spending, payments, investments, etc.

- Diagnostic insights provide explanations for customer behaviors, allowing for better know-your-customer (KYC) processes

- Predictive insights describe the most likely future needs and behaviors of each customer

- Prescriptive insights suggest the best next action for each customer based on the three previous types of insights

Behavioral data science

Data analytics models applied to customer behavior must accept a simple truth: consumers aren’t always rational. Human behavior is shaped by biases. The status quo bias, for example, prevents people from pursuing better investment opportunities to preserve the status quo.

When it comes to hyper-personalization, behavioral data provides the necessary foundation for shaping customer habits and helping consumers overcome these biases.

Policy

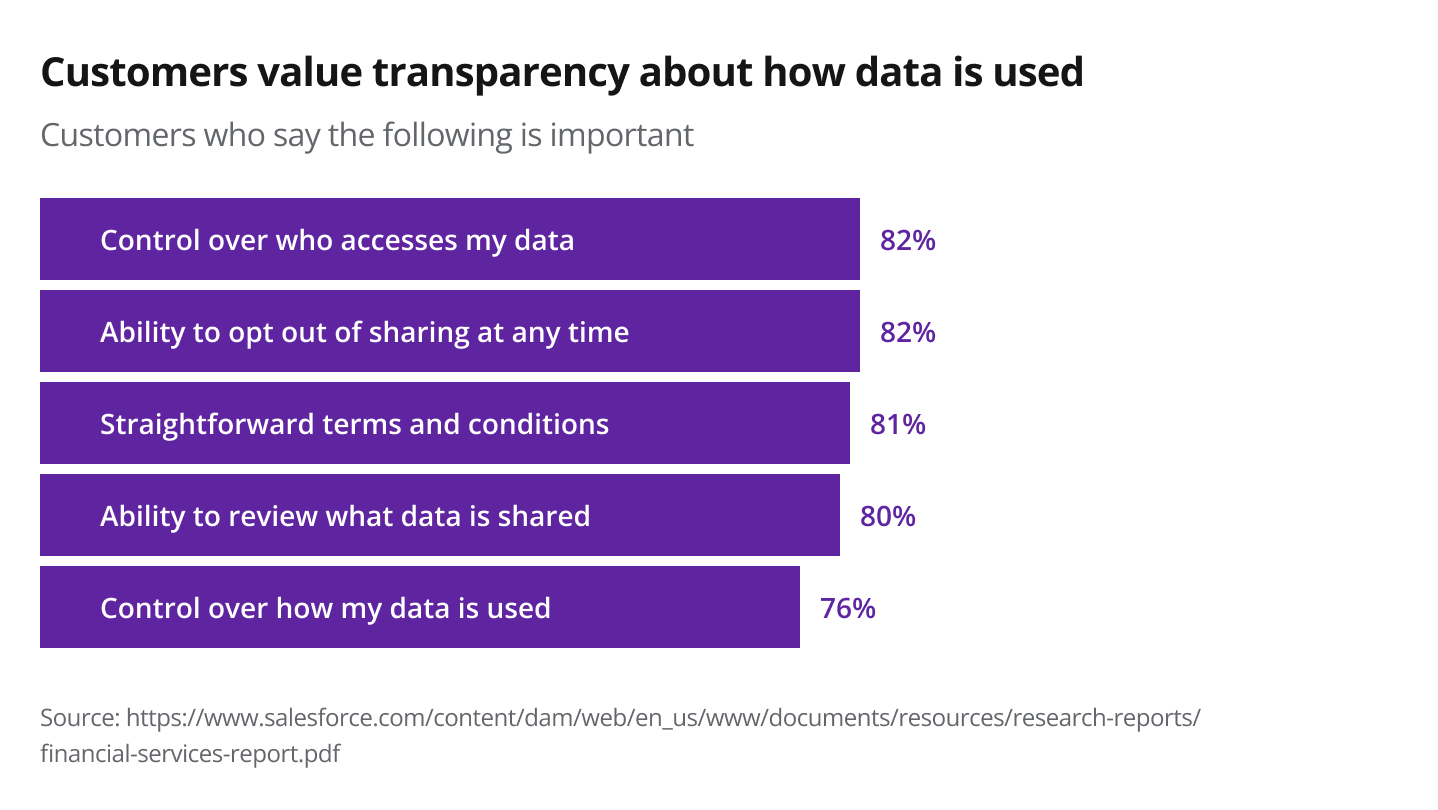

While customers expect a hyper-personalized digital banking experience, they are also mindful of the privacy and security challenges surrounding personal data sharing.

Only 56% of financial services customers are ready to share their data in exchange for personalized experiences. At the same time, over 80% of customers find data controls, opt-out options, and transparency over data sharing important.

That’s why your hyper-personalization efforts should include a clear policy protecting customer privacy and personal data security. Otherwise, you may fail to build trust among your customer base.

Note: The banking industry is subject to stricter privacy and security regulations, so ensure your personalized digital banking experiences also align with legal requirements.

Bringing your personalization strategy in line with customer needs

Implementing AI in personalization isn’t a silver bullet for customer dissatisfaction on its own. Any changes in your digital banking experiences should deliver tangible value to customers, such as:

- Reduced banking costs. Combining hyper-personalization with automation can reduce financial services costs by eliminating the need for manual work and intermediaries.

- Financial inclusion. Predictive models can assess more risk factors with a higher degree of accuracy, reducing the reliance on old-fashioned parameters like age or occupation. So, financial institutions can expand their credit product coverage to traditionally underbanked customer segments.

- Better customer service. Hyper-personalization can speed up resolution time and improve response quality with a holistic understanding of the customer’s situation.

- Simplified, tailored experiences. Financial products can be notoriously complex to navigate. Hyper-personalization can facilitate the process with tailored recommendations that increase customer satisfaction.

Six use cases for hyper-personalization in digital banking

Hyper-personalization can power various new customer experiences, from tailored recommendations to financial robo-advisors and tailored loan offers.

Hyper-personalized recommendations

Data analytics solutions can pinpoint relatable services for customers based on their historical behavior and predictive and prescriptive insights into their needs. Such a personalized recommendation engine for financial services can suggest the right product at the right moment.

AI and ML can then create micro-segments of customers based on their needs and behavior, allowing banks to tailor marketing messages to each micro-segment. Combined with real-time behavior analytics, these messages can then be triggered by a particular event or behavioral pattern.

Case in point:

Ma French Bank leveraged Personetics’ Engagement Builder to create marketing campaigns that suggest the right product to the right customer at the right time. The solution analyzes first-party customer data in real time to identify customer needs and reach out with the right offer. The neobank saw a 68% increase in customer engagement year-on-year.

Personalized finance management

Combined with generative AI chatbot capabilities, banks can offer finance management guidance tailored to every customer, driving customer engagement. Such a financial robo-advisor can:

- Enable customers to set financial goals and track their progress

- Provide insights into customers’ spending and saving habits

- Perform financial tasks like payments and investments

- Provide personalized recommendations for attaining the set goals

- Offer tailored investment and financial product recommendations

Cases in point:

Wells Fargo rolled out LifeSync for its retail banking customers in 2023. Available in the mobile app, LifeSync allows customers to set financial goals and track their progress in real time.

Bank of America’s chatbot, Erica, leverages generative AI to provide instant information on the customer’s account, weekly spending updates and credit score changes.

Tailored loan offers

With the help of AI and ML, banks assess credit risk using more data points — and obtain more accurate risk assessments. Thus, they kill two birds with one stone by improving financial inclusion and mitigating risk while also reducing margins.

Case in point:

Experian, one of the leading credit score agencies in the U.S., leverages predictive models to assess credit risk and help financial institutions mitigate it. Its clients include Educational Federal Credit Union and Clear Mountain Bank.

Personalized marketing content

While almost 90% of banks segment their customers based on behavioral patterns, less than 30% use communication variants adapted to different customer personas.

Creating those message variants can be time-consuming. But this is where generative AI can come in and draft marketing copies tailored to each customer persona.

Case in point:

OCBC made its generative AI chatbot available to all employees in 2023. Developed in partnership with OpenAI, the chatbot is meant to be a productivity tool across business functions, including marketing.

Personalized customer support interactions

Generative AI copilots can also draft personalized messages for customer support agents, improving customer experience while slashing response time. Alternatively, generative AI chatbots can be deployed to handle more complex queries independently.

Case in point:

NatWest partnered with IBM to develop Cora+, a GenAI chatbot that can answer complex customer support queries by offering information from multiple secure sources.

Personalized user experiences

Banks can also leverage data analytics to identify which features their users will find most useful — and put them front and center in the interface. User experience can be further personalized with useful prompts and push notifications based on real-time user behavior.

Case in point:

Royal Bank of Canada has multiple versions of its mobile banking app tailored to its various segments. Its mobile app comes in small business, student and investor editions — but all those editions require a single download.

What the future holds for hyper-personalization in digital banking

Despite consumers wanting personalized experiences, the banking industry doesn’t seem to meet their expectations.

Lack of personalization remains one of the three biggest frustrations with digital banking for customers of all generations. The entry of younger generations into the workforce and investment landscape is significantly raising the bar for digital experiences, particularly in traditionally analog sectors such as banking. These tech-savvy individuals, having grown up with advanced technology, expect seamless digital interactions and services. This shift in expectations is not a temporary phenomenon; millennials, anticipated to become one of the wealthiest generations due to substantial inheritances, will continue to exert pressure on these industries to innovate and digitize. Businesses must recognize and respond to this trend to stay competitive and meet the evolving demands of this influential demographic. Yet, according to Deloitte, two out of three banks fail to analyze the context of the customer’s situation outside of a single interaction.

Generative AI enters the chat

Leading banks are already experimenting with generative AI in their personalization efforts. At ABN Amro, generative AI sums up conversations with customers and gathers data for real-time issue resolution. JP Morgan, in turn, recently unveiled its IndexGPT, a GPT-4 chatbot that can suggest a wider range of companies to invest in.

Buying solutions remains the go-to option for banks seeking to ramp up their generative AI capabilities. According to Capgemini’s 2024 World Retail Banking Report, 56% of bank CXOs intend to buy solutions to explore the potential value of generative AI capabilities. A third expand their capabilities via partnership, and just 10% build an LLM model from scratch.

Regulations are getting tighter

AI-specific regulations are cropping up around the world. The mentions of the technology in legislative proceedings almost doubled between 2022 and 2023.

The most notable example is the AI Act passed in the European Union, which will set the framework for AI use across all industries, including finance. The most significant piece of legislation in the United States is last year’s executive order that directed federal agencies to draft rules for AI use in their respective industries.

Banks should pay close attention to the regulatory landscape and mitigate regulatory and compliance risks.

Challenges in AI adoption remain

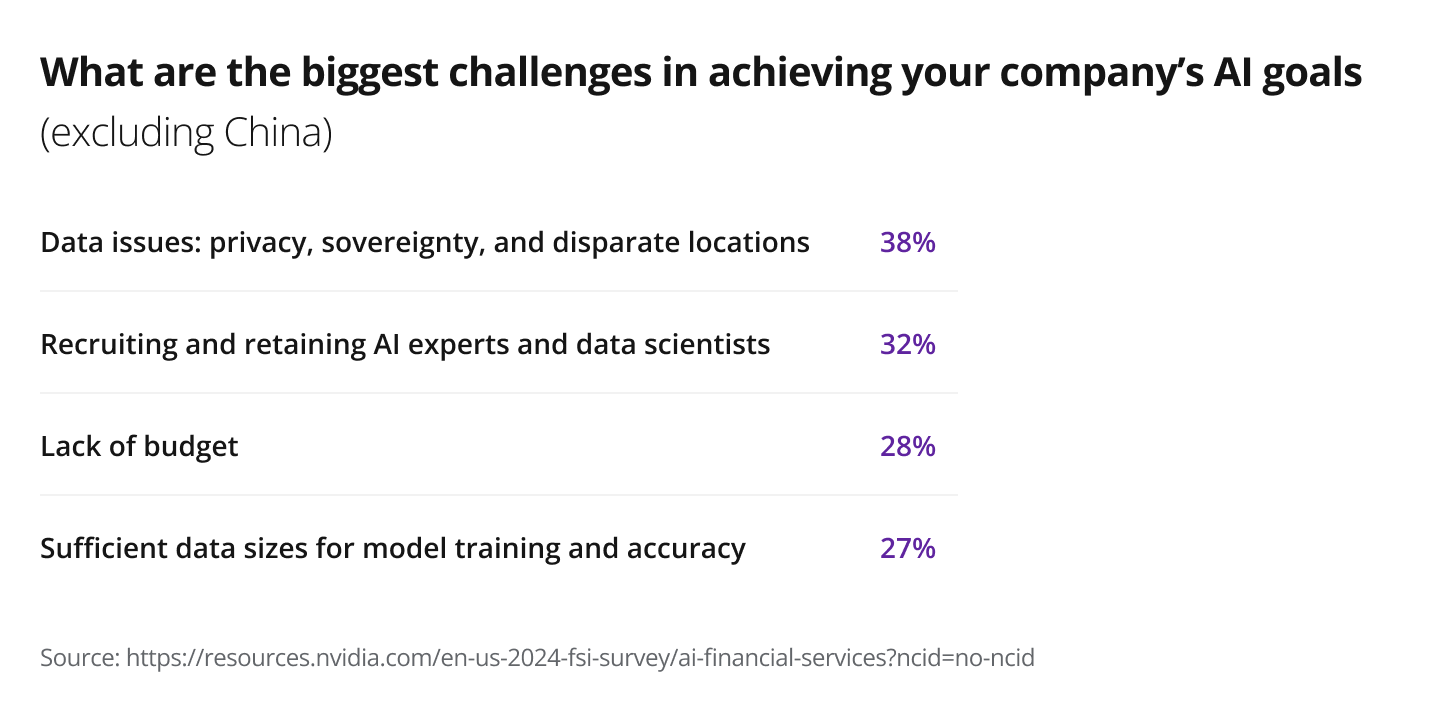

Besides a shifting regulatory landscape, four challenges may hinder AI adoption in digital banking, be it for personalization or other purposes:

- Data-related issues. Financial institutions have to deal with data scattered across multiple jurisdictions, privacy risks, and data sovereignty challenges

- Lack of talent. Organizations struggle to recruit AI experts and data scientists to power their AI initiatives

- Lack of budget. The third most common barrier is a lack of budget, which can stem from insufficient stakeholder buy-in or an unfavorable macroeconomic environment

- Insufficient data volumes. Training AI models for digital banking requires high-quality, diverse datasets, which can be hard to obtain due to the data issues described above

Let’s talk

Ready to deliver a superior customer experience driven by hyper-personalization? Contact our experts to discuss how we can help you ramp up your data capture and analytics capabilities to make it happen.