In brief

- DXC Luxoft experts come at fraud from a more enlightened perspective than common fraud tools, using data science techniques in an open-box environment to make you the owner of your fraud story

- Our fraud mitigation methodology runs deep, using data science and advanced analytics to search for, and deal with, cases of OFWA — overspend, fraud, waste and abuse. Here’s how

- We don’t just say, “Install this, and we'll flag all your fraud claims going forward.” DXC Luxoft offers insights into how processes can be upgraded because although tech partners can identify fraud, it's up to internal processes to prevent it

People can be surprising creatures, treading the same familiar paths day after day after day after day, then out of the blue, wham!

They spark up a Gitanes, start blanking Maccy-D’s or sip a Crème de Menthe — small but significant actions completely out of character.

Why?

Good question, but just how do you arrive at an accurate and actionable response? In our case, advanced analytics.

Advanced data analytics helps us know the unknown, in this case, why people deviate from expected behaviors. Analyzing wave upon wave of social, commercial and insurance claims data to identify fraudulent activity strengthens security and improves operational efficiency. It also helps you develop more innovative business strategies.

Best of all, analytics defines hazy knowledge, resolving obscure situations and finally answering the enduring question adored by toddlers and decision-makers alike, “Why?”

Break open the fraud box

Applying data analytics to fraud-hunting is a world away from the application of common fraud tools.

Standard fraud tools say, “I'm a black box; give me your data, and I'll tell you the cases I think you should investigate.” DXC Luxoft’s data science and advanced analytics methodology differs entirely. Our experts come at it from a more enlightened perspective, using data science techniques in an open-box environment to make you the owner of your fraud story.

It’s the opposite of a narrow black-box solution; we focus on the crucial elements — cause, comprehension, and capability. So, if you discover a fraudulent claim and ask, “Why?,” analytics gives you chapter and verse, pinpointing which trends and patterns triggered the event.

Also, DXC Luxoft leaves clients with the necessary tools and knowledge to run the project themselves as opposed to a fraud engine that flags up claims but doesn’t tell you why they’re occurring. Ours is a much more holistic approach. We bring a proven methodology and then work with you to build your own end-to-end fraud solution. And importantly, our approach doesn't just cover fraud but also overspending and other factors, as in the OFWA.

Picking up OFWA

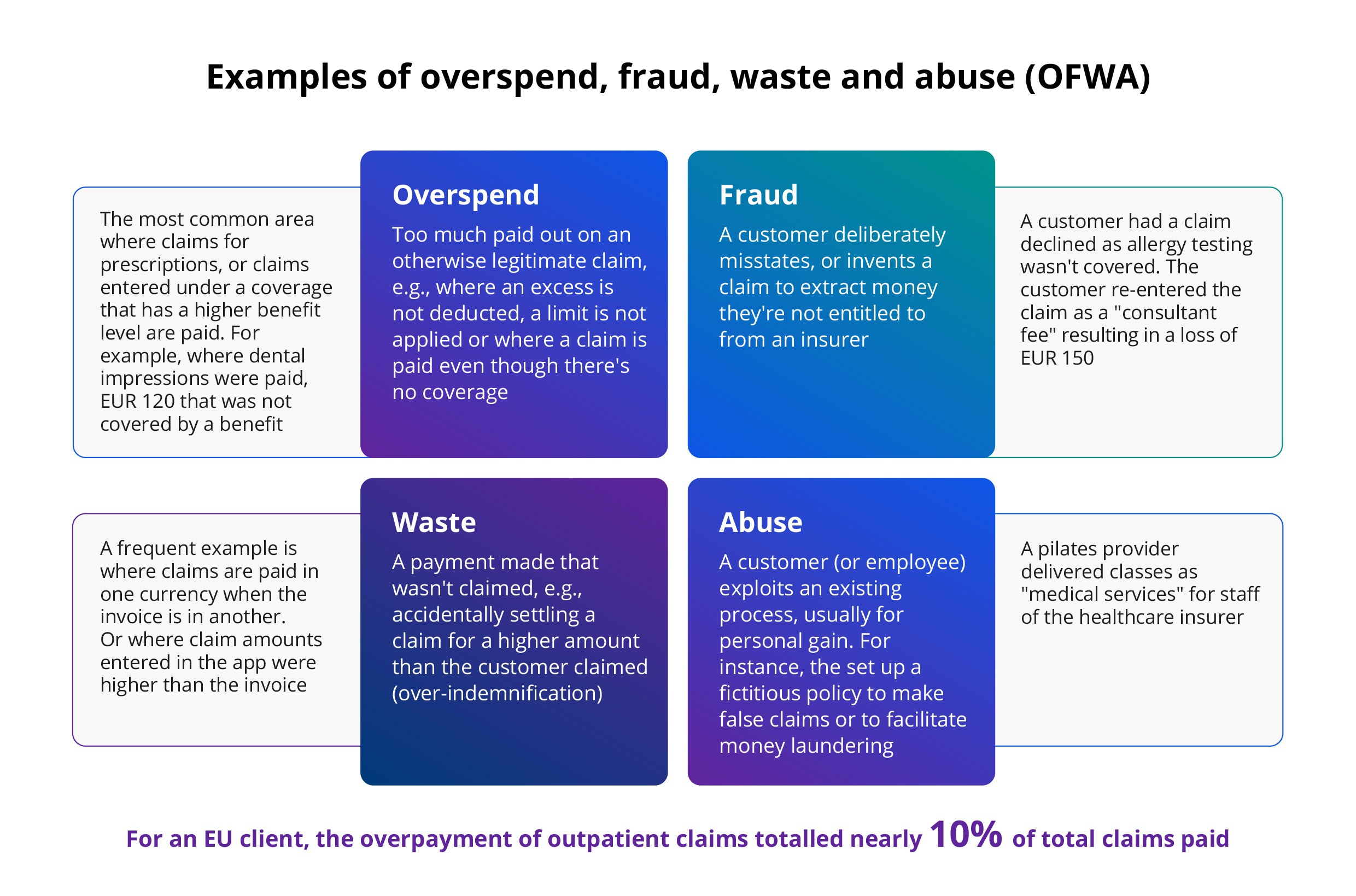

Our methodology runs deeper than standard fraud tools to uncover OFWA — overspend, fraud, waste, and abuse. In addition to picking up fraudulent or potentially fraudulent claims, we use advanced analytics to identify things like invoices that shouldn't have been paid (even if paid quite innocently.)

The above chart states our definition of overspend and gives an example of where it occurs. The waste example shows a claim paid in one currency for an invoice raised in another. So, if the invoice was in dollars and settled in sterling, the insurer has wasted £x by overpaying on the exchange rate.

Then there’s abuse, systematic abuse of the system. Let’s look at patients prescribed Pilates for a specific medical condition. In one case, we found staff members attending Pilates classes and putting it through their insurance. So, it's not fraud — they had the Pilates classes — it's an abuse of the system.

This was picked up through DXC Luxoft’s LXA tool. The tool enables data scientists and claims experts to understand claims better so they can identify more cases. We found 10% of this client’s claims displayed elements of unusual payment. Only 3% turned out to be fraudulent, and although the other 7% might or might not have been legitimate, the exercise demonstrated that claims should be examined in forensic detail throughout their lifecycle.

Process changes

As you can see, we’re not just promoting a point solution that says, “Install this, and we'll flag up all your frauds going forward.” We’re offering insights into how your processes can be upgraded, if necessary, because although analytics identifies fraud, it's up to your processes to prevent it.

And speaking of upgrading processes, one of our healthcare clients’ most beneficial process changes was initiating the storage of invoice data because the interpretation of invoices can prove/disprove fraud, waste, abuse, etc.

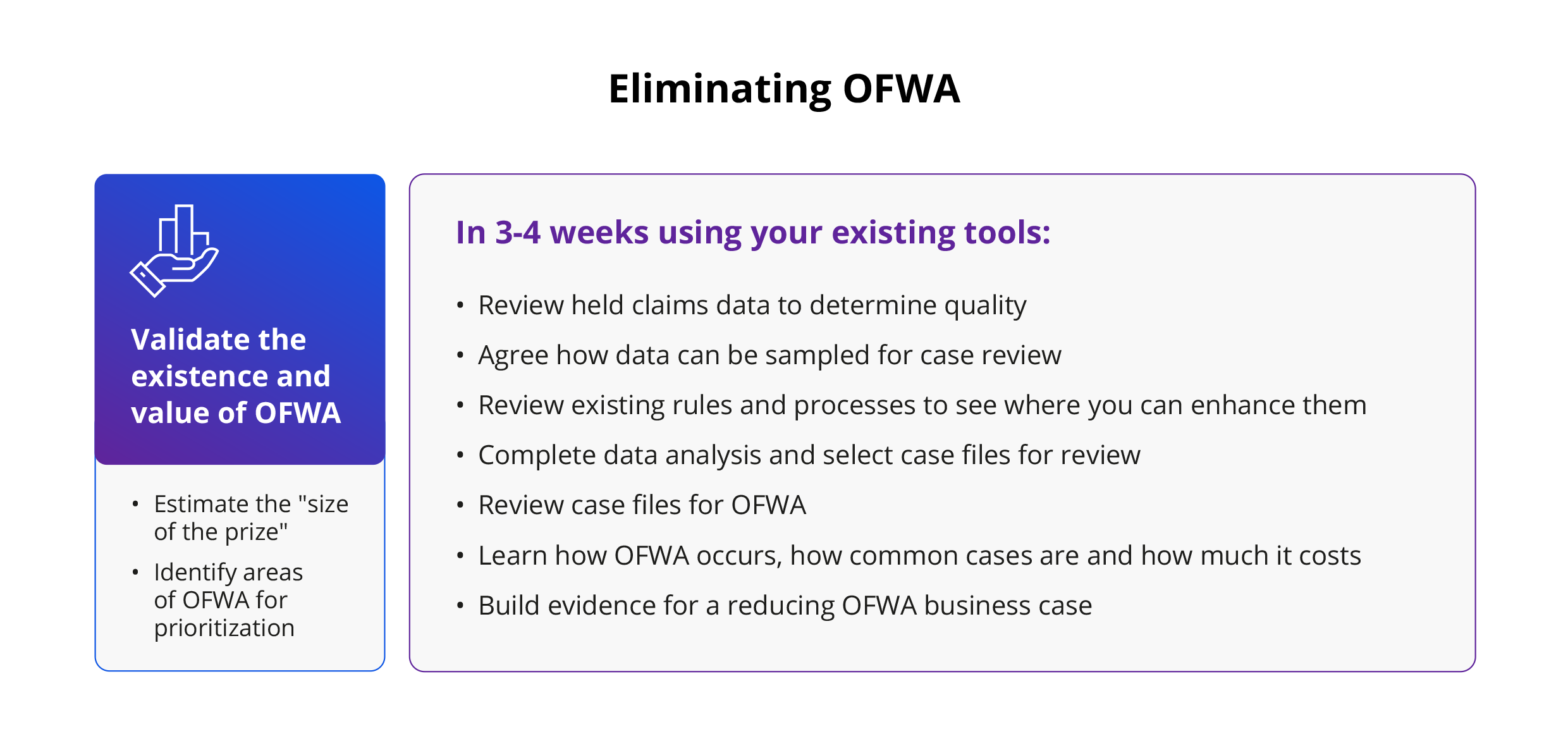

DXC Luxoft’s OFWA methodology

DXC Luxoft domain experts deliver technology-agnostic analytics. Here’s how they go about helping you uncover and eliminate OFWA.

All four-step OFWA projects begin with data and “understanding business” sessions.

1. Understanding the business

Initially, our consultants work with clients to determine precisely what they want to accomplish and what success would look like. Armed with these baseline insights, we plan our approach and adapt DXC Luxoft analytics and data science methodologies accordingly.

Once that's established, we can take a deep dive into the client’s systems and operations. This process kicks off with a series of onsite workshops to get to grips with how the business works in practice and, specifically, how claims are processed.

2. Evaluating the data

That intelligence drives the second step, data understanding. What’s available? What should we look for? What’s captured in the data? How can we reach the declared and approved business goals? We begin exploring the data to gain further insights into the best way to tackle the steady stream of second-step questions.

With one client, we noticed a family submitting claims for a particular treatment on the same policy. Analytics-wise, it was a defined bimodal distribution (i.e., two peaks.) One person was in their 50s and another in their early years: clearly, a parent-child policy. But we saw that, initially, the parent claimed for a particular treatment (physiotherapy). In due course, the child began claiming for that same treatment. In fact, the parent had reached the treatment threshold (number of claims allowed) and pretended their child needed the physio so they could continue the treatment.

Uncovering these sorts of anomalies as part of this data understanding phase flags up where to start looking when we introduce AI, machine learning or any type of advanced analytics.

3. Preparing the data

Data preparation is the central pillar of any use case (not just OFRA-related.) We make sure we have the correct data, that it's clean and of sufficient quality (garbage in, garbage out) and confirm whether we need to treat it because if we do, that could affect the outcomes. For example, if we have a missing value for a claim-event field, do we just drop it or add an average value for that type of claim?

After that essential process, we construct new data and features. So, in the case of our previous example, where one treatment type switched from parent to child, we could build a new field that indicates those policies. This could be looked at when it comes to using predictive analytics because it would be a good indicator of fraud or OFWA.

Then we put it all together, harvesting claims, policy and individual information and attending to any formatting issues. Now we can introduce predictive analytics, advanced analytics and so on.

4. Methodology

We approach OFWA in one of two ways:

- Traditional statistics. In the previous claims case, our team used sampling because they couldn’t confirm the OFWA rate as many claims followed straight through processing (STP). With object character recognition (OCR), the client was able to differentiate claims, matching content from the uploaded claim against information the claimant previously entered in the app for their submission. But their process might have ignored all manner of suspicious items. So, the team used traditional statistics to get an idea of what was going on and sampled a precise number of claims. We used stratification, sampling from a particular group to ensure we didn’t get any unbalanced samples.

In other words, we captured important subgroups in the claims population. The claims team reviewed these data manually, looking for OFWA cases and attempting to determine the associated costs. A study of this first tranche gave us the confidence to extrapolate across the total population. Given time and resource constraints, manually reviewing several thousands of claims each month is not practical. - Machine learning. OFWA instances are not always labeled in the data set, so we use predictive analytics and machine learning to create a supervised learning model. This is where we take both claims labeled and not labeled as having OFWA and use machine learning algorithms to learn the patterns and trends that separate the two types of claims.

A parent submitting for a particular treatment, reaching the threshold, then switching to a child claimant could be an excellent OFWA indicator. That (or demographic information, etc.) is something that machine learning picks out easily. Therefore, it's best to use the more traditional machine-learning approach to resolve OFWA issues.

Next time

In the second part of this article, Jeremy will demonstrate how to estimate the size of the prize, check out the invoices you’ve overpaid, and work out whether you really need to buy that fraud tool you’re on the brink of commissioning. Look very carefully before you leap — register here, and we’ll make sure you don’t miss a thing.

In the meantime, if you’d like to learn how DXC Luxoft can help your insurance organization clear up OFWA, visit our website or contact us.