In brief

- Luxoft’s certified Temenos experts go beyond implementation to give organizations the full works, ensuring they benefit from everything modernization has to offer. No one knows banking modernization or Temenos better than us

- Our teams modernize legacy platforms by enhancing digital client and advisor experiences (CX/AX) and digitizing back-end manual processes to increase operational efficiency and help reshape the financial landscape

- In addition to enhancing security, streamlining operations, improving compliance, cutting costs and repairing functional cracks, the Temenos upgrade program’s advanced features reduce the rollout time for improved products and services

As a certified Temenos banking software company, Luxoft, the analytics and engineering arm of DXC Technology, provides a full range of turn-key services for new and existing Temenos users.

You can count on our 240+ Temenos experts to set up, configure, upgrade and maintain your Transact core banking system and assess its health.

The banking industry relies on Temenos

Formerly known as the T24 banking system, Temenos Transact is a leading core banking system powering operations for 1,000+ banks in 150+ countries across the globe. Its features include retail, treasury, corporate, payment, and wealth management components. Transact is:

- Modular. You can deploy the full Transact or individual components

- Comprehensive. Transact covers everything from retail and corporate banking to wealth and treasury

- Adaptable. It provides standardized, country-specific functionality

- Cloud-based. It enables core banking SaaS from the Temenos Banking Cloud

It allows you to:

- Cut time to market by as much as 10x

- Resolve adverse market conditions and mutable regulations

- Amplify segmentation for an increasingly personalized, omnichannel customer experience

- Interpret masses of data with advanced analytics

Why you need a health check

A Temenos health check assesses your system, pinpointing issues and building solutions that get the bank to its desired state. A health check allows you to:

- Analyze current and future system performance in light of growth predictions

- Adapt to a new operational environment (e.g., more transactions) while maintaining performance and efficiency levels

- Establish why processing times or data quality are poor

- Trace and remove system patches that impair performance while preserving business continuity

- Optimize the return on your Temenos investment, maximizing profitability

- Enhance your reputation, customer experience and compliance capability

The Luxoft team’s Transact/domain experience gets the most out of your Temenos investment without interrupting day-to-day operations.

Added-value upgrades come as standard

In addition to enhancing security, streamlining operations, improving compliance, cutting costs and repairing functional cracks, the Temenos upgrade program’s advanced features reduce the rollout time for improved products and services.

Being a certified upgrade partner, Luxoft enriches the time-served TIM methodology with value-added processes. Our approach consists of four distinct phases:

Value adds

The following tools have been purpose-built by Luxoft to help deliver a consistently superior upgrade:

Upgrade Analyzer

Ensures accurate scoping and estimation. Our scoping tool extracts and creates a detailed overview of the Transact setup/configuration, local developments, impact on release upgrade, etc.

Data Comparison

This Transact-specific comparison tool compares data between source and target systems, validating data integrity post-upgrade.

GL Comparison

The tool provides insight into financial reporting lines in Transact and identifies transactional-level differences pre- and post-upgrade.

Object Explorer

Object Explorer is a detailed catalog of components implemented in a Transact environment, including parameterization with dependency information. It identifies used/unused components for cleanup/decommissioning or decomposing the core.

That said, upgrading Temenos doesn’t define us

Luxoft’s certified Temenos experts go beyond implementation to give organizations the full works, ensuring they benefit from everything modernization has to offer. From finance workflows through system configuration to security and cloud engineering, no one knows banking modernization or Temenos better than us.

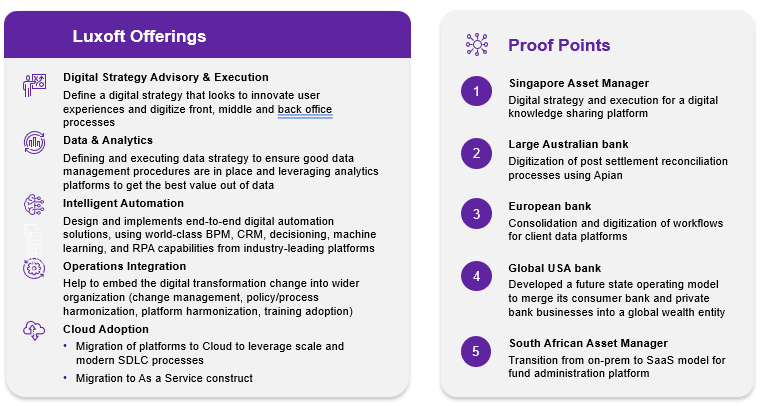

Here are three Luxoft offerings that make our Temenos services a springboard to greater things in banking and capital markets.

1. Wealth management

A new generation of extremely wealthy investors that experienced the last financial crisis and crested the recent tech and digital media tidal surge has emerged. They recognize the value of digital wealth management and new asset classes prompted by cultural and environmental considerations (e.g., sustainability).

Unfortunately, with a highly volatile investment climate, increasing regulatory demands, growing uncertainty, new competitive patterns and the rising cost of risk, established advisors are struggling to achieve the exceptional results clients routinely expect. Naturally, this state of affairs is damaging advisor/investor relations and allowing fresh business models to gain an extra foothold and extend their market reach. Traditional wealth managers must reassess and remodel their services to take advantage of this upscale opportunity and deliver credible advice.

Luxoft is transforming wealth management

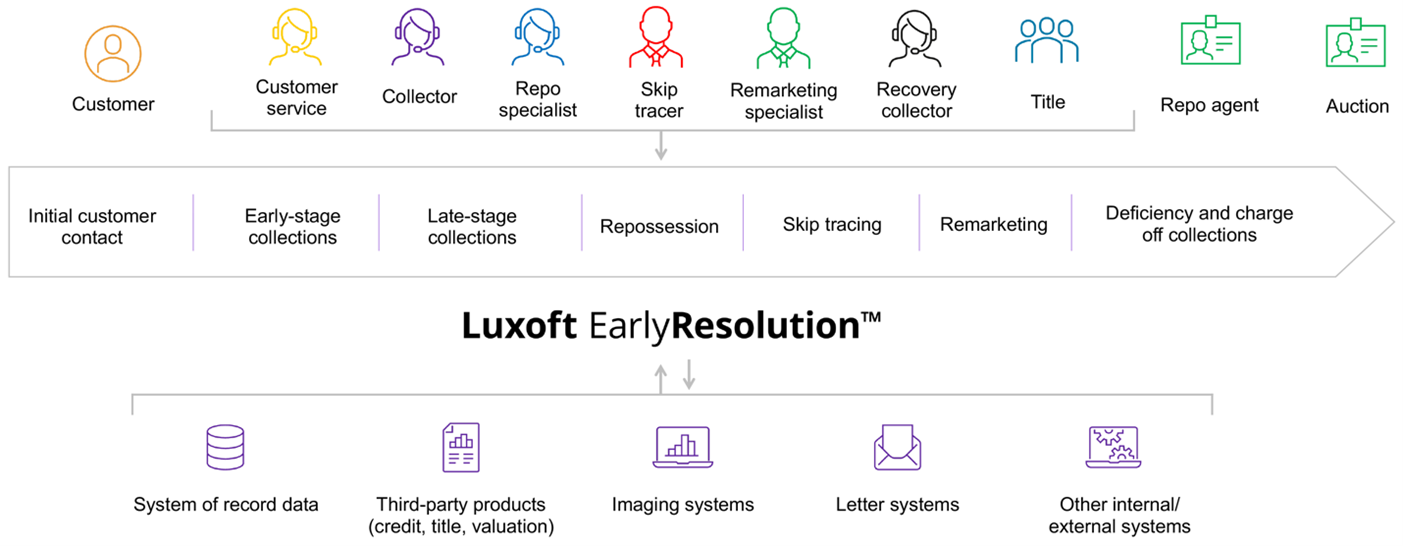

2. Default management and collections

Luxoft’s EarlyResolutionTM is fast becoming the central pillar of default management for the loan servicing industry. Borrowers, servicers and third parties work on the same seamlessly automated platform from initial contact to repossession, simplifying the complex process, ensuring consistent service and guaranteeing an exceptional customer experience. EarlyResolution’s suite of features includes core collection scripting, customer service and workflow capabilities, providing a robust and comprehensive approach to default management.

EarlyResolution solution overview

- Reduced technology footprint by over 50%. Implementing EarlyResolution collections and decisioning modules helped retire legacy systems, leading to significant cost savings and efficiency gains for a leading U.S. bank

- Borrower portal cut inbound calls. Using the EarlyResolution Borrower Portal, a major U.S. bank diverts 50,000+ calls each week away from the call center, improving customer satisfaction

- Over 25% reduction in servicing costs and processing times. Usage of the platform helped dramatically reduce servicing costs and processing times for a global bank while improving compliance and audit requirements

3. Digital transformation

Luxoft provides bespoke, end-to-end technology solutions for mission-critical systems. We modernize legacy platforms by enhancing digital client and advisor experiences (CX/AX) and digitizing back-end manual processes to increase operational efficiency. In reshaping the financial landscape, digital transformation delivers both opportunities and challenges:

Opportunities

- Operational efficiency: Technologies like artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA) provide real-time insights for a greater understanding of risk and improved decision-making

- New markets: Digital products, personalized services, on-demand access and real-time support meet changing customer preferences

- Customer-centricity: Mobile apps and digital portals give consumers control through convenient and transparent transactions. These benefits rely on designing an ultra-clear, user-friendly interface and exceptional user experience

- More diverse strategies: Modernization moves beyond the traditional one-size-fits-all business and operational strategy. Micro, on-demand and peer-to-peer models attract and inspire new digital-savvy customers

- Fresh culture: Virtual, agile working and a flatter organizational model require fresh cultural thinking. Employees need to understand the benefits and implications of greater agility, innovation and continuous learning. And driving home a clear digital vision calls for engaging upskilling programs to accelerate change management

- Exceptional CX: A personalized customer experience will go a long way to increasing upsell and reducing churn

Challenges

- Significant early investment: Transforming legacy systems, upskilling the workforce and implementing new technologies is expensive

- Customer expectations: Modern customers want smooth, coherent and consistent digital-first engagement

- Cybersecurity: More complex platforms increase potential vulnerability and the threat of cyber-attacks

- The cost of compliance: Navigating fresh digital territories and regulatory environments might mean the cost of remaining compliant could rise significantly

As you can see, digital transformation is more than a technical readjustment; it’s a companywide cultural shift driven by enterprise leaders and decision-makers.

What makes the Luxoft-Temenos link-up so valuable?

Thanks to our unique Temenos expertise, Luxoft enables:

- Low-risk digital transformation with increased performance, minimal disruption and an exceptional user experience

- Faster time to market for your current system and subsequent releases

- Minimized TCO and maximized ROI

- A fully hosted and managed solution, transparent costs and no surprises

- A leading-edge core banking system with a proven track record

- Expert maintenance and upgrades, freeing up vital resources for innovation and growth

Luxoft’s banking capabilities routinely outstrip the competition in volatile financial markets. This dominance led to Luxoft signing a global strategic agreement for an expanded partnership with Temenos in 2020 (certification being achieved in record time thanks to our wealth of banking and capital markets experience and deep understanding of the upgrade process).

Now, as a leading member of a select group of Temenos Transact certified partners, Luxoft prides itself on delivering exemplary Temenos service implementation and run capabilities (we hold four different global certifications):

Cream rises to the top

We work with the world's largest, most prestigious, highly valued banks. These institutions hold the future of finance (and global stability) in their hands. And they count on Luxoft to resolve their most complex digital, technical and operational challenges.

Key challenges

- AI, ML and advanced analytics

- Cost, change and vendor management

- Data quality, security and management

- Legacy system modernization and technical debt

- Complex system integration, upgrades and business continuity

- Data architecture, scalability and performance optimization

- Risk management, cybersecurity threats and disaster recovery

- Regulatory compliance and data governance

- Customization and flexibility

To compete effectively, Transact banks must optimize the efficiency of their systems and processes and place less emphasis on local customization. Shifting customer preferences and the proliferation of banking channels have compromised heritage IT infrastructures by increasing the complex nature of digital commerce. Upgrading the core banking system enables banks to claw back lost ground and take a leading market position.

Why Luxoft

Luxoft ‘s Transact upgrade experience is second to none. Our dedicated and dynamic team has developed a unique insight into the upgrade process by performing complex transformations and upgrade projects while maximizing performance and minimizing downtime.

The Luxoft Temenos Academy expands our talent pool, helping next-generation experts develop exceptional Temenos capabilities, including holistic system maintenance.

Here’s a quick overview of our team’s expertise:

Free scoping exercise

An upgrade can take anything from a few months to a couple of years to complete. Understandably, prospects need an idea of the cost and timescales involved. So, we undertake a free scoping exercise to get to grips with client and system requirements.

Clients complete a questionnaire, providing a detailed description of their current and desired end-state architecture. Then, Luxoft prepares a client-specific upgrade analyzer tool designed and executed in the client’s environment to provide the required transformation data and insights.

To sum up

As a trusted Temenos Global Certified Partner, Luxoft tailors solutions to each client’s core banking requirements. With a proven track record of successful implementations, we help financial institutions resolve complex challenges, improve regulatory compliance and modernize data management, ensuring a resilient and future-ready banking environment.

Considering modernizing your bank? Then, your choice of partner could not be clearer. Luxoft's certified Temenos teams have a flawless track record for inspiring confidence and ensuring a seamless transition.

As they say, working with leaders helps you become an even greater leader.

Want to know more?

To learn more about what upgrading the world’s #1 core banking system could do for your organization, visit Temenos | Luxoft. Or, if you’d like to arrange a Transact demonstration, a full system health check or to discuss any particular pain points, contact us.