In brief

- In partnership with IBM, Luxoft’s UmbrellaFraud is reducing the time it takes to score or analyze transactions for fraud, giving clients the chance to check virtually 100% of their transactions and minimize time/cash wastage

- Currently, less than 10% of transactions go through an Al inferencing model in real-time due to the latency incurred as a result of analysis outside the mainframe

- The IBM z16 has a dedicated AI chip, which Umbrella architecture has leveraged as an AI accelerator to allow for fast and straightforward deployment of ML models from Hogan or other Z-based applications, reducing latency and facilitating 100% coverage

- Umbrella might have been built pre-internet, but it’s still relevant today and will be tomorrow. It’s deployed at over 40 tier-1 financial institutions globally, facilitating around 100 applications per bank. That’s thousands of applications in a rapid integrated development environment (IDE)

Fraud is an ugly word

Banks spend massive amounts of money to prevent it, yet, in 2022, criminals still managed to steal £2,300 every minute (£1.2 billion a year) in the UK alone — that’s $161 billion across banking, payments and cards globally. So, banks must spend even more to chase money after the fact, throwing good money after bad.

The problem is that financial institutions are unable to analyze anything like as many transactions as they need to, and the analysis, such as it is, happens off-mainframe.

Inferencing is taking far too long

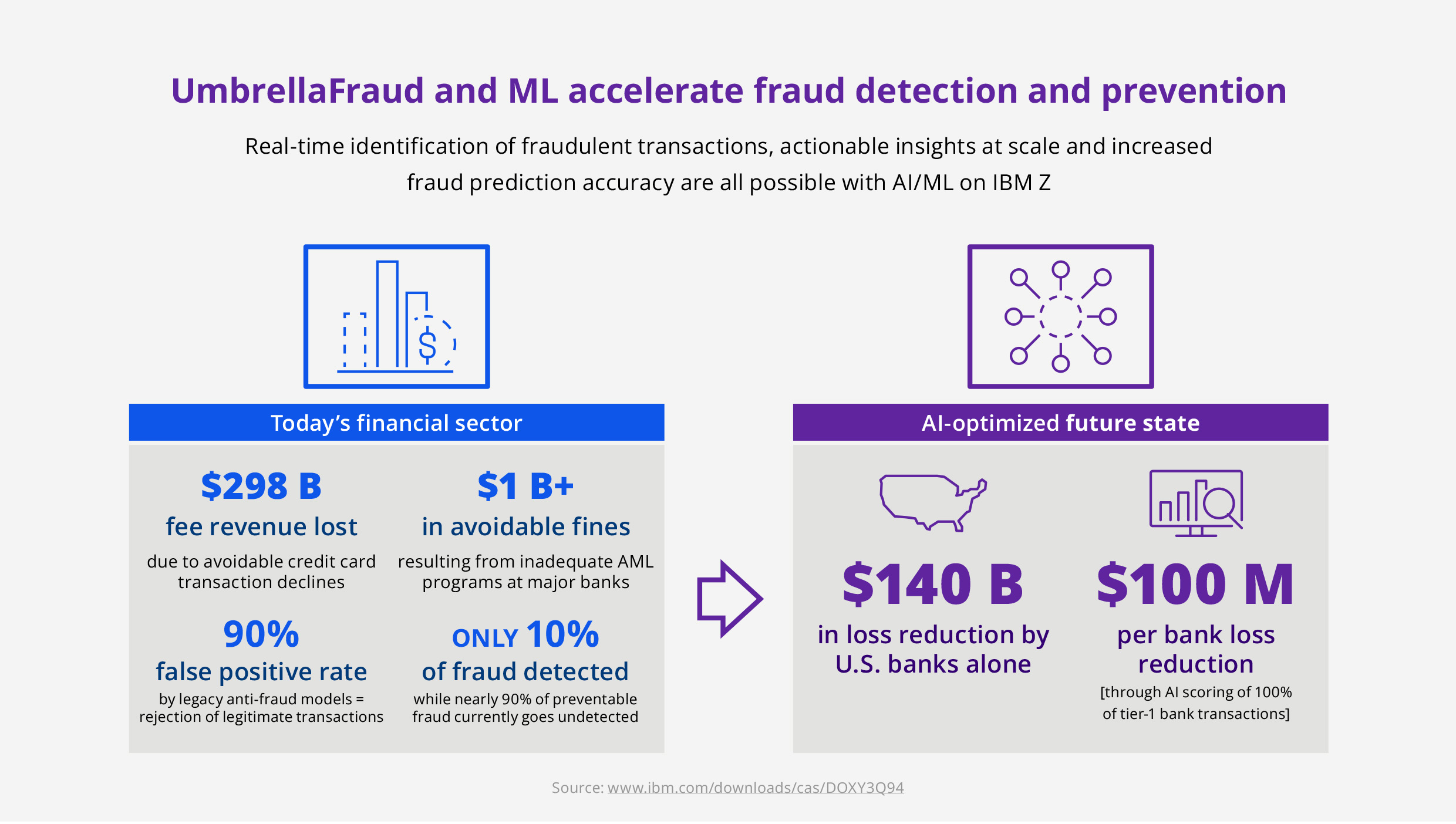

AI is deployed for a variety of use cases, such as credit scoring, fraud and AML. However, while the bulk of banking and payment transactions are executed on mainframe platforms, the AI detection is often off-platform. According to Celent less than 10% of transactions go through an Al inferencing model in real-time due to latency, cost and customer friction issues. This is why so many fraudulent transactions go unmonitored and undetected.

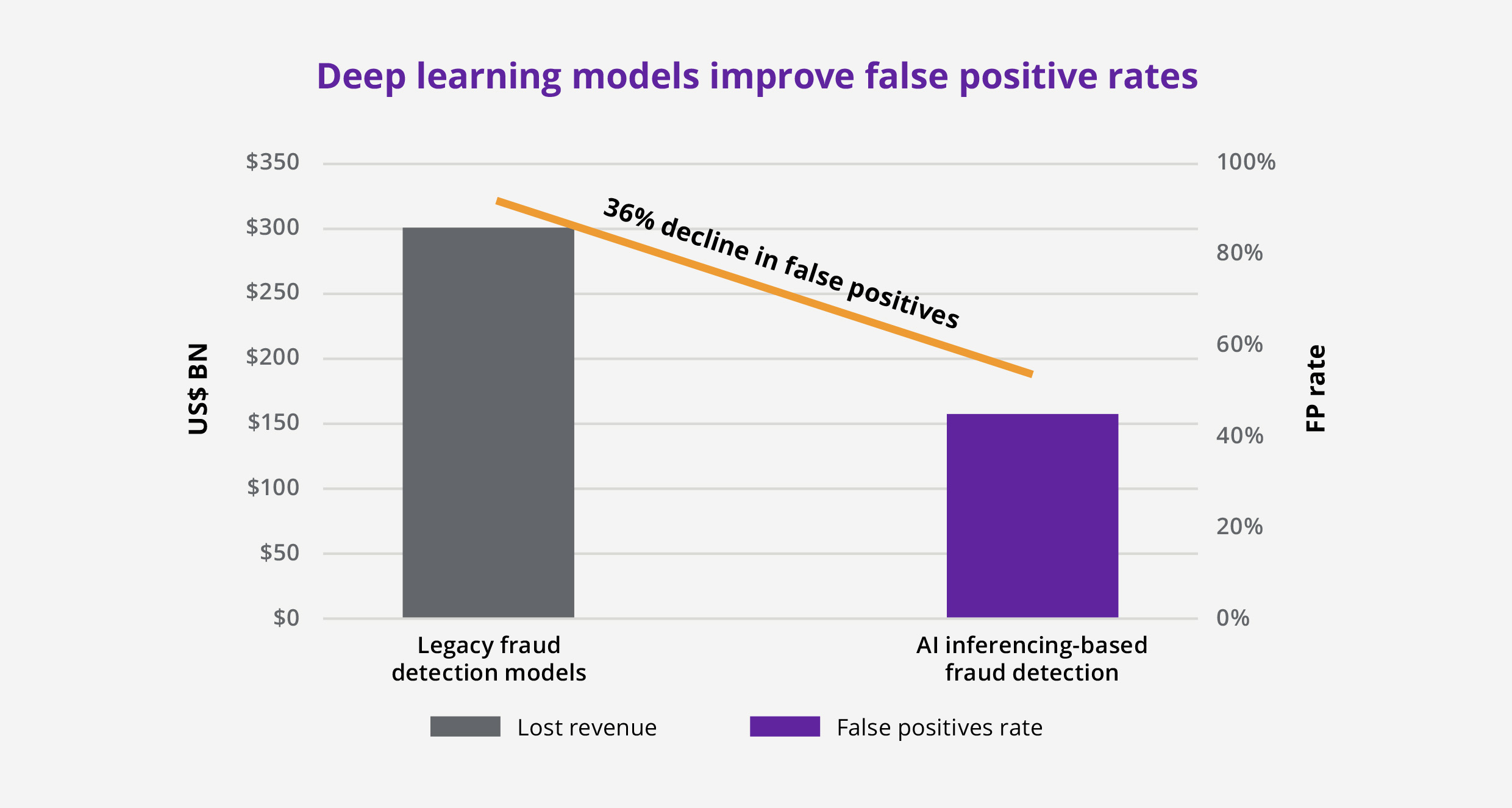

In addition, legacy fraud models can deliver as high as 90% false positives, leading to worldwide revenue losses estimated at $298 billion in credit card transaction fees.

The increased accuracy of deep learning models enables them to cut these excessive false positive rates substantially, which means banks can pass transactions through fraud detection without impacting the customer experience or hemorrhaging money.

But what if your bank could successfully analyze every single transaction it handles instead of just a tiny percentage?

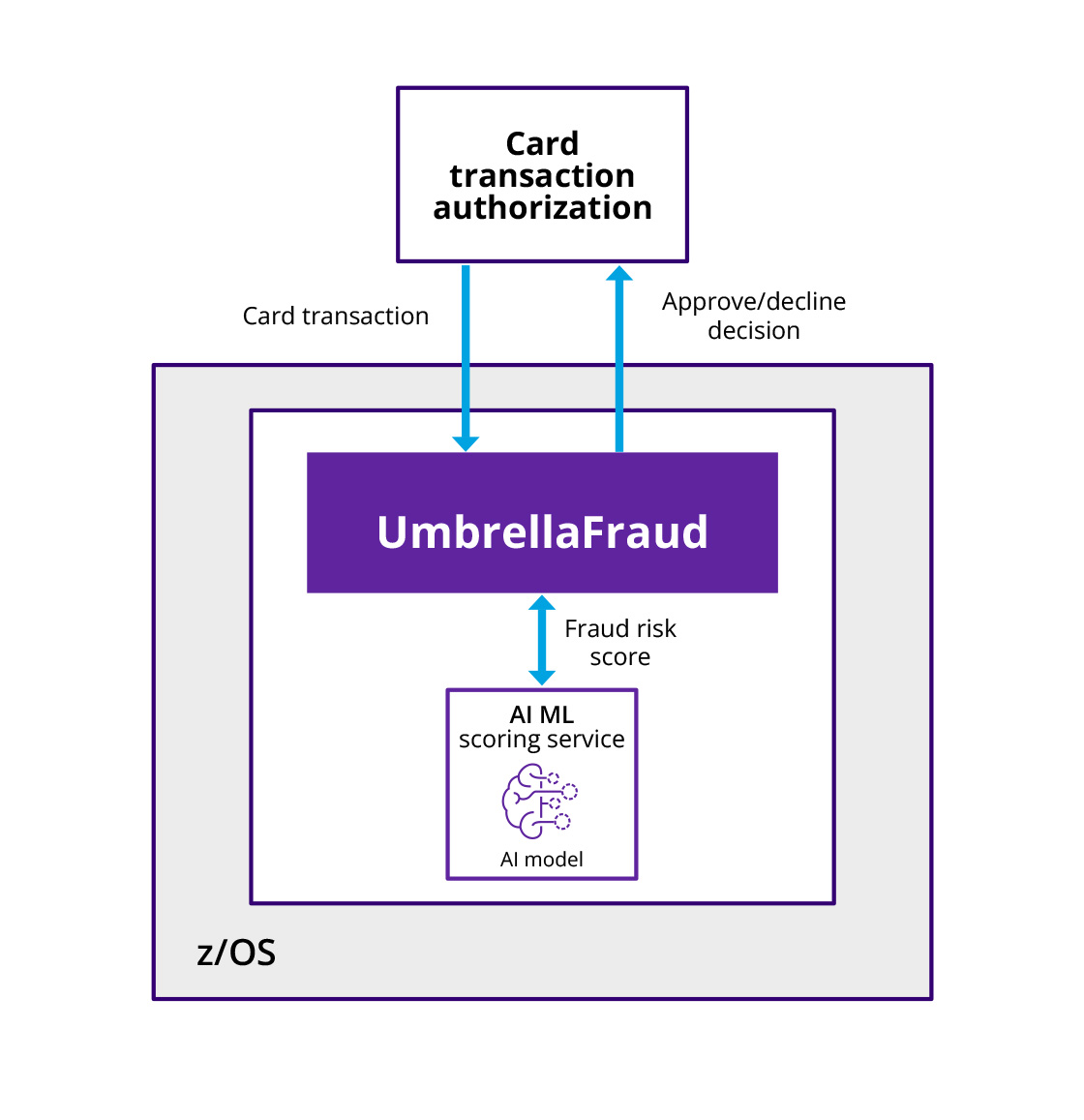

UmbrellaFraud prevents credit card fraud

In partnership with IBM, Luxoft is reducing the time it takes to score or analyze a transaction. This gives clients the chance to check virtually 100% of their transactions and minimize time/cash wastage.

UmbrellaFraud’s goals include:

- Scoring 100% of incoming transactions while meeting existing SLAs

- Leveraging existing fraud models or deploying custom models

- Reducing scoring latency by deploying fraud prevention natively on z/OS alongside card authorization systems

- Leveraging the MLz COBOL scoring service to:

- Greatly simplify scoring call-out

- Reduce overheads to invoke the scoring service

Celent estimates that applying advanced inferencing models to all banking, card and payment transactions running on IBM zSystems mainframes could potentially reduce global fraud losses by $140 billion (banking) and $21 billion (cards and payments).

The pace-setting Hogan/Umbrella/IBM partnership

IBM z16 has a dedicated AI chip, which Umbrella leverages as an AI accelerator to allow for fast and straightforward deployment of ML models from Hogan or other Z-based applications, reducing latency and facilitating 100% coverage. Combining ML with Hogan’s transaction-processing capabilities offers banks twice the advantage. Hogan’s system (acknowledged transactional integrity and scalability) provides a solid foundation for ML models analyzing patterns in real-time.

Revolutionary fraud detection and risk management

One of ML’s key plus points is the escalation of fraud detection. Traditional rule-based systems are inflexible and unable to adapt quickly to developing fraud patterns. Meanwhile, ML algorithms continuously learn from transactional data, identifying fraudulent activities faster and more accurately.

IBM’s v16 chip helps score the transaction within the mainframe itself, so you don’t have to go outside to find fraud algorithms and implementation to score a transaction. Everything is local. That way, you manage the latency issue and secure the data.

By implementing fraud analysis on the mainframe using UmbrellaFraud and IBM’s Telum chip, 100% of your transactions can be run across deep learning models in real-time, reducing fraud at the average tier1 bank by $120m a year.

Luxoft’s UmbrellaFraud can save you millions in fraud detection with on-mainframe inferencing. The key component to this, Umbrella, has certainly stood its 35-year test of time.

Wherever you are, whatever you do

In the home and office, online global transactions are growing at an incredible rate — anyone in Singapore can use a card to buy something from the United States, if necessary. But while point-of-sale fraud detection measures are effective, online merchant fraud is escalating.

That’s why UmbrellaFraud is industry and geography agnostic. It works at the foundation level, employing and deploying models that learn and grow as usage changes. It’s a case of “a transaction is a transaction” as long as our model can learn the behavior.

Why did we choose Umbrella architecture for UmbrellaFraud?

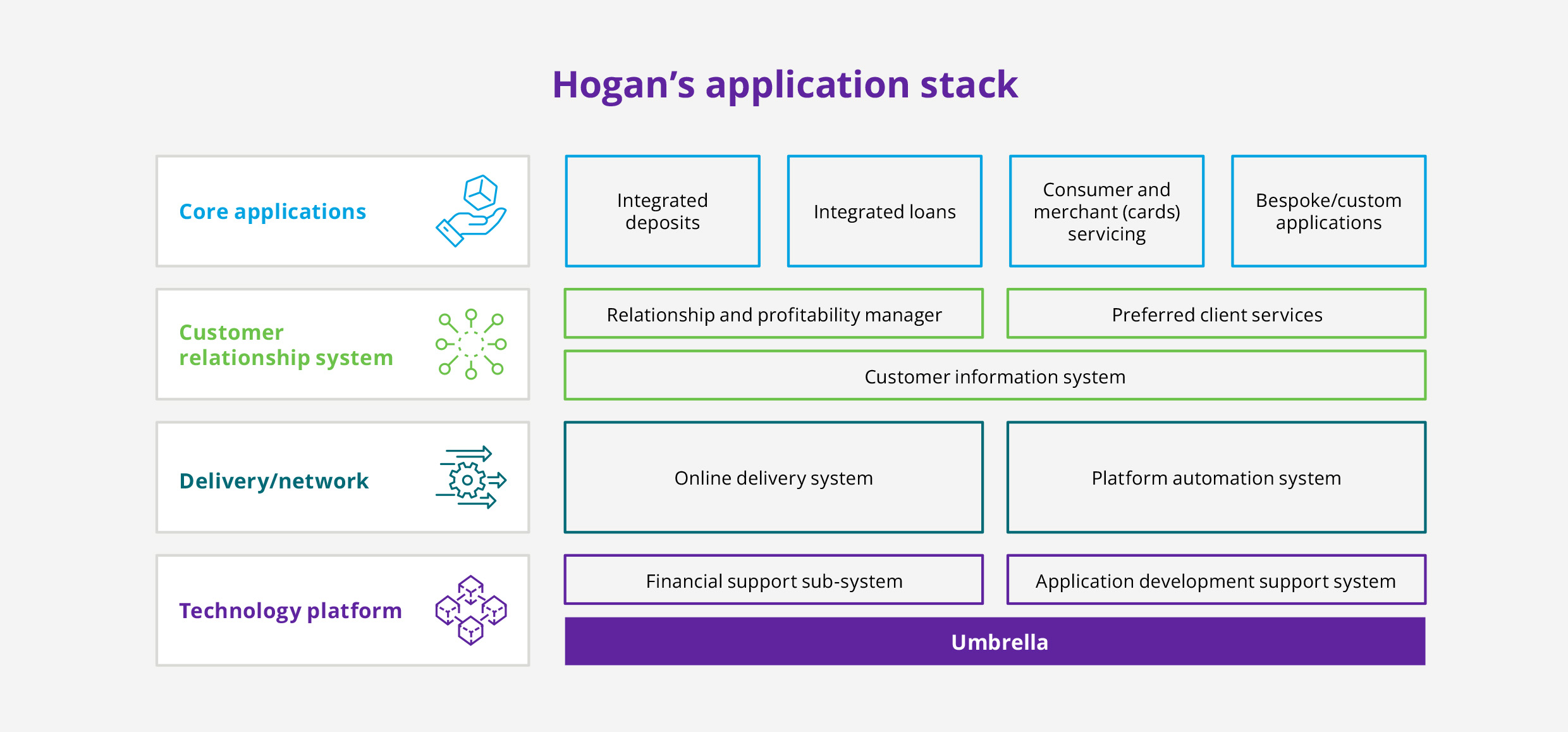

Over 35 years, the Umbrella application architecture has become a proven technical foundation designed to provide a rapid integrated development environment (IDE) on z/OS. Umbrella is currently used by more than 40 tier-1 financial institutions globally, facilitating around 100 applications per bank. That’s thousands of applications on mainframe development.

We already have the software foundation at the lowest plane, talking to the mainframe and splitting applications from low-level hardware and networking needs. Umbrella is the best place to implement any scoring AI solution because every application that comes in already has access.

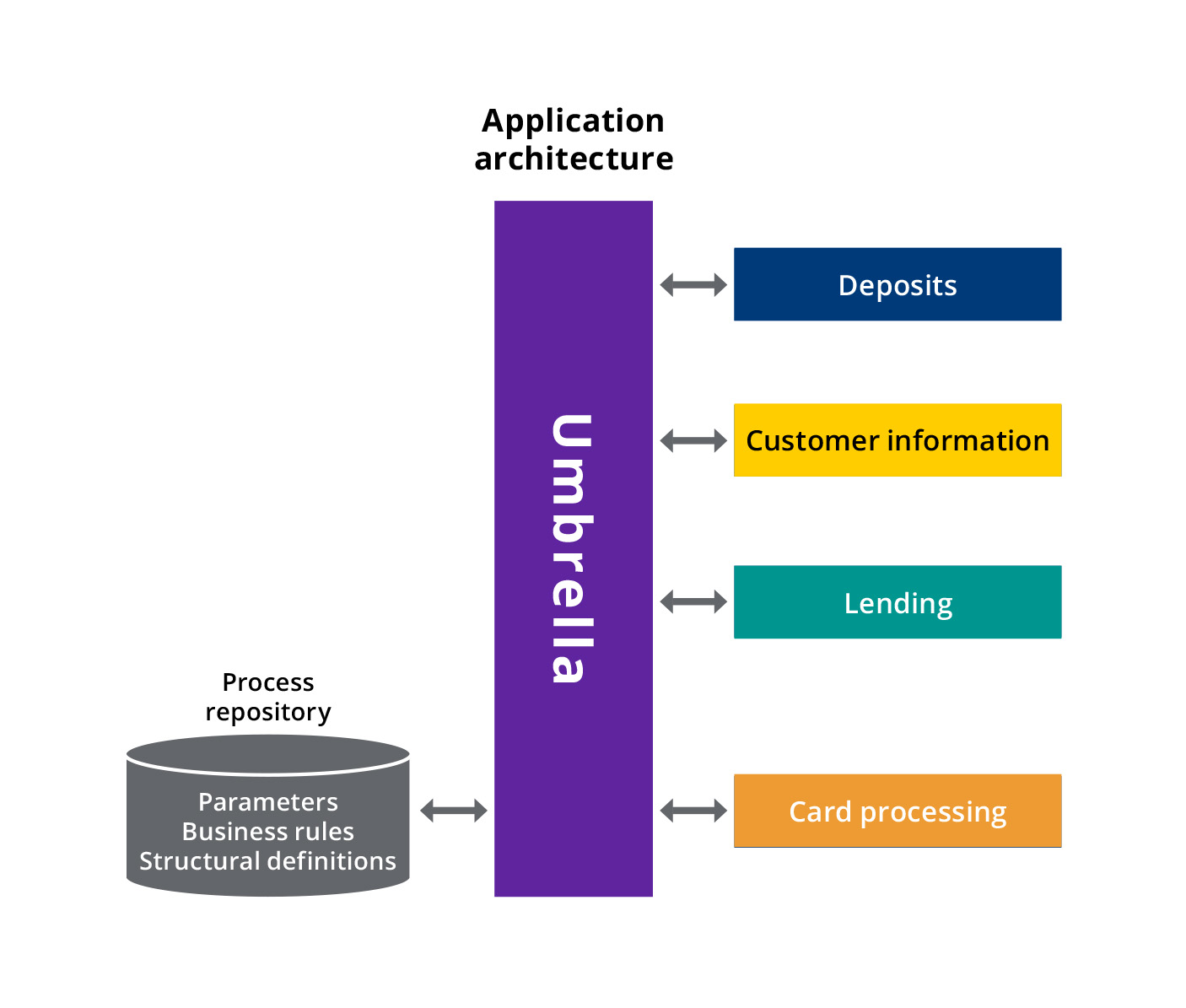

Characteristics of solid application architecture value

- Return on investment: Business applications can be independent of technological change while leveraging advances in hardware and software

- Effective change management: A repository houses parameters and rules that govern processing options and logic flows, delivering flexibility by organization or product

- Stability and reliability of service delivery: The exploitation of shared services across business applications (reusability) to foster quality

Built pre-internet; still relevant today (and will be tomorrow)

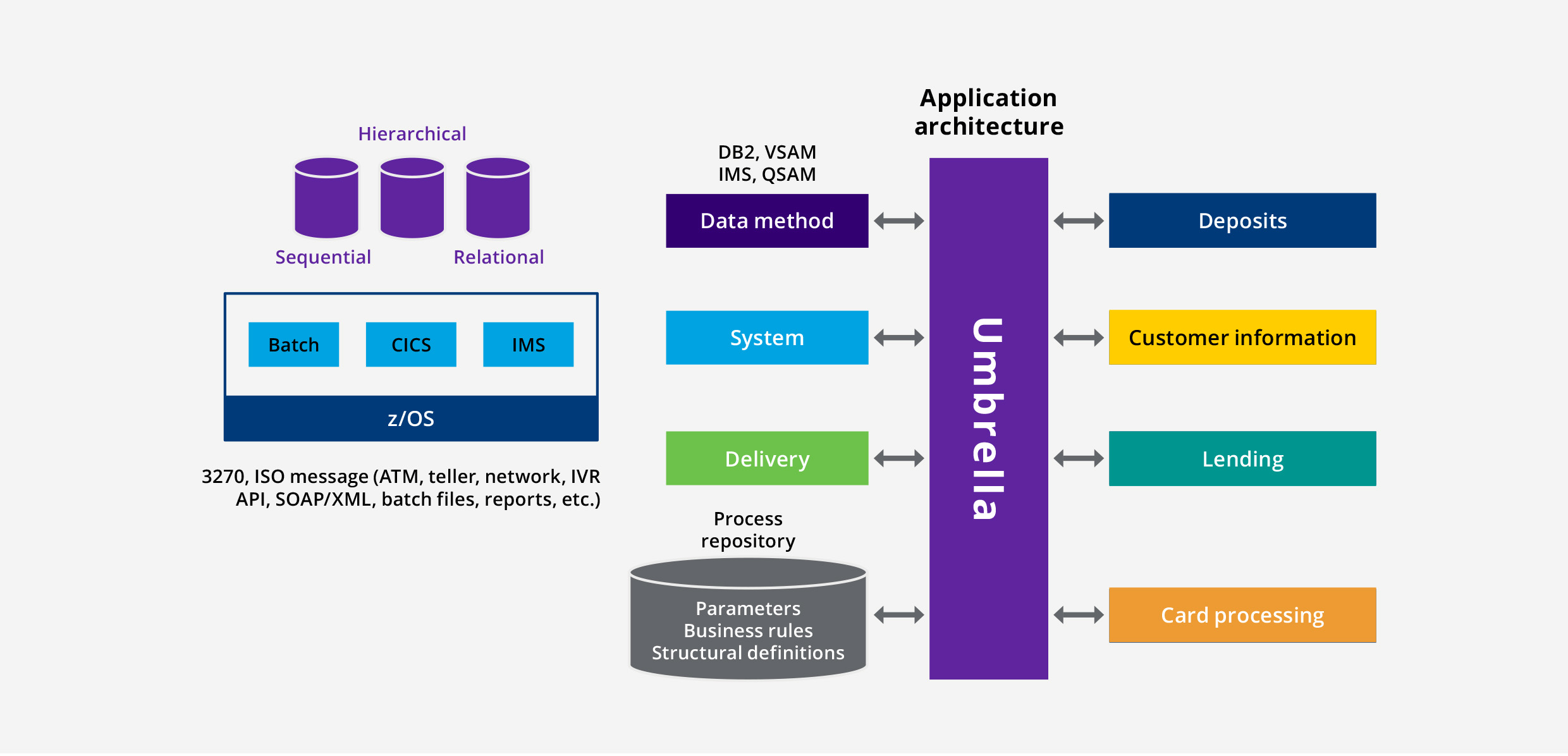

Umbrella architecture is designed to insulate the applications from the traditional sources of change. The programs under Umbrella have no physical definitions for technology/infrastructure, business logic or data specified in their code. The Umbrella system provides a logical/virtual view of the applications.

Umbrella provides the following processing environment support

- Isolate applications from the “real” environment

- Virtual run-time environment

- CICS, IMS, z/OS, VSAM

- Database isolation: DB2, VSAM, IMS/DB

- Protective layers of security and encryption

- Standardized and simplified integration of distributed applications and other host-based applications

- Multichannel support

- REST API support

Whenever the application needs a technical service related to technology/infrastructure, business logic or data, it calls the Umbrella system. The system is configured to reflect its processing environment, using parameter values, rules and definitions stored in a run-time process repository to satisfy the request.

In addition to the structural descriptions for operating system components and data definitions, the repository stores different parameters and rules affecting the processing logic within the business applications.

Umbrella architecture, IBM z16 and AI agility

The partnership of Umbrella with AI and the IBM z16 delivers impressive business insights (no need for data science skills).

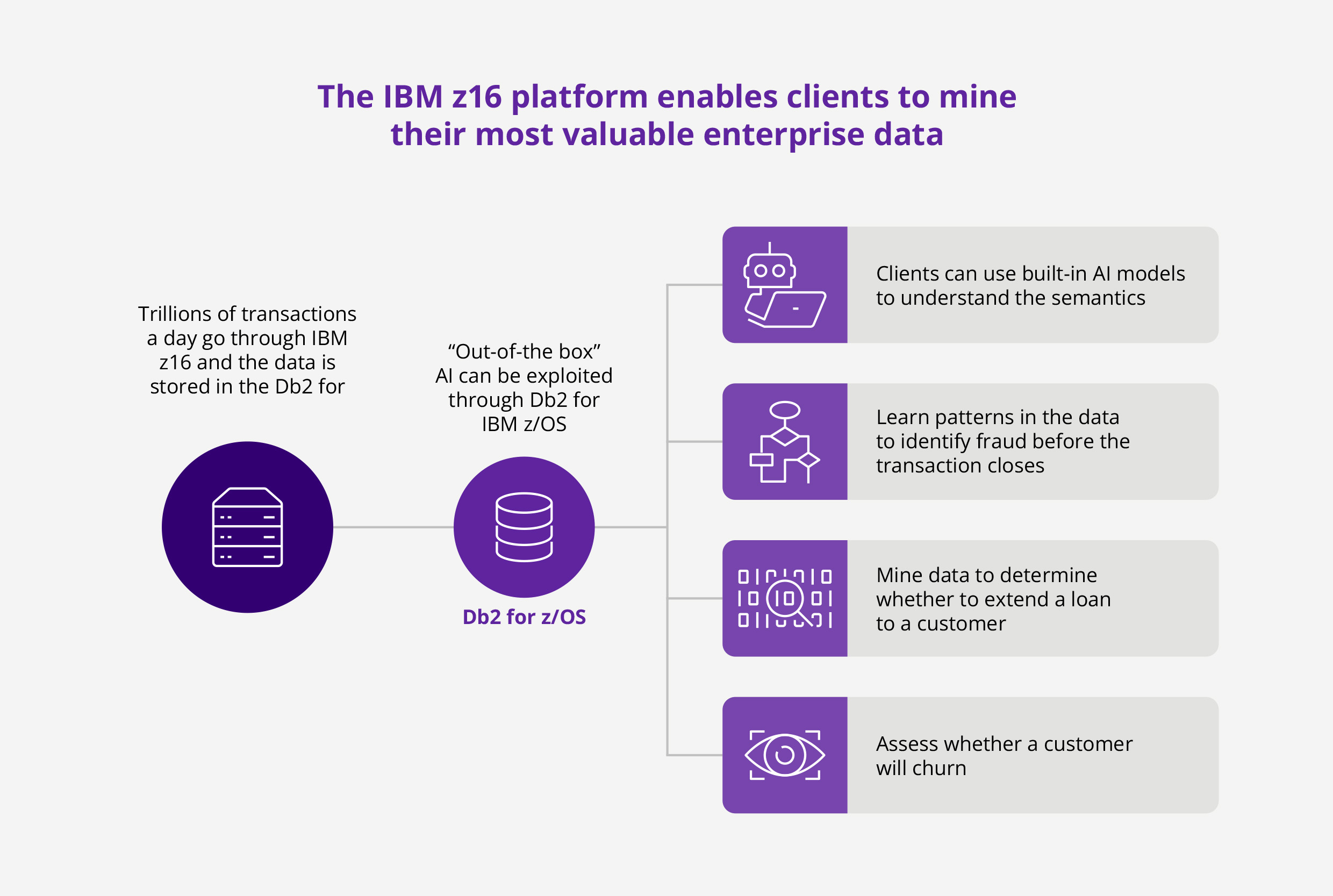

Around 70% of financial transactions are run on IBM zSystems, and that’s also great news from an ESG standpoint — 40% less energy is consumed during inferencing on the mainframe than running on some kind of server farm.

- Power any IBM z/OS application with Al-enhanced SQL and UmbrellaFraud

- Uncover and monetize insights hidden in your data

- Identify similarities, differences and correlations

- Interpretability out of the box

- Apply a single model across multiple questions

- Minimize Al deployment complexity

- Improve false negatives with deep learning models

The IBM z16 supports the most popular ML algorithms, providing clients with an Al cloak to help them improve processes and drive greater business value from their existing investments.

IBM zSystems integrated accelerator for AI

IBM z16 has a dedicated AI chip which Umbrella uses as an AI accelerator. This allows for quick and simple deployment of ML models from Hogan or other Z-based applications, reducing latency and facilitating 100% coverage.

This industry-first, integrated, on-chip AI accelerator is designed for high-speed, latency-optimized inferencing with sustainability as a core principle:

- Green AI and AI-powered sustainability: Reduces the energy consumption for inference operation processing by 41x using the integrated accelerator for AI against running inference operations remotely on a comparable x86 server using an NVIDIA GPU

- Accelerated AI at scale: Processes up to 300 billion deep learning inference requests a day with a 1ms response time

- Real-time insights when you need them: Injects AI into every transaction while still meeting the most stringent SLAs

- Speed to scale with transaction volume: Delivers up to 19x higher throughput and 20x lower response time co-locating applications and inferencing

The box with everything

The IBM z16 will be the first secure box with everything embedded, ensuring that the processing, analysis and data stay within the bank. Latency is minimal, and the entire toolset can be used to train the model or perform ML operations in a box / hybrid box environment.

Looking forward

We’re evolving and developing UmbrellaFraud for many other use cases that set up scoring models using ML and other tools. For instance, putting money into an account: “What’s that?”, “Who are you?”, “Is it all valid?” or paying off loans, etc. We picked the card transactions use case to open with because fraud is still a huge problem, particularly in North America.

Since we’re implementing scoring so close to the data source, we’re in an ideal position compared to other use cases where the model needs to be corrected as soon as possible.

For example, let’s say we’re analyzing transactions today and the behavior of some high-value client changes. They get flagged, but we can rapidly introduce the new behavior back into the model. So, the next day, they don’t have to go through the same pain again, or they’re flagged as, “These are normal changed transaction behaviors.

”Deploying and training close to the actual source (system of record) is a great advantage. Third-party systems ship this data outside for the model to be trained, tested and sent back.

Why partner with Luxoft?

Luxoft and IBM help banks support millions of customers, processing and protecting trillion-dollar assets. Achieving business success in an increasingly competitive market requires a tight alignment between business and IT strategies and the effective use of partners.

Successfully adopting an UmbrellaFraud mainframe inferencing strategy isn’t just about the technology; it’s about achieving business goals enabled through a technology partnership. It also relies on the collaboration and guidance we provide throughout the journey. Here are five prime elements that make a strategy effective:

- Customized solution: By partnering with banks individually, we can tailor UmbrellaFraud and Hogan to their unique needs, ensuring a seamless fit with their existing infrastructure and future goals

- Expert guidance: We act more like a trusted advisor than a simple vendor. Luxoft and IBM experts guide banks through the complexities of AI implementation, platform selection and system integration, helping them make better-informed decisions

- End-to-end support: Luxoft offers comprehensive assistance from pre-implementation consultation to post-implementation support. We guide clients through each transformational journey

- Relationship building: Building long-term relationships with our banking partners fosters trust and confidence. This approach aligns with our portfolio’s core purpose, emphasizing partnership and empowerment

- Value-driven results: Solution-centric partnering ensures that banks buy into our technology and derive maximum value from it. We focus on delivering results that positively impact our clients’ operational efficiency, agility and competitiveness

Let’s talk

To learn more about how the partnership of AI, Umbrella architecture and IBM z16 delivers exceptional cost savings, business insights and fraud prevention (without the need for data science skills), visit luxoft.com. However, if you’d like to double down and discover what UmbrellaFraud and on-mainframe inferencing could do for your bank’s profitability and sustainability, contact us.