In brief

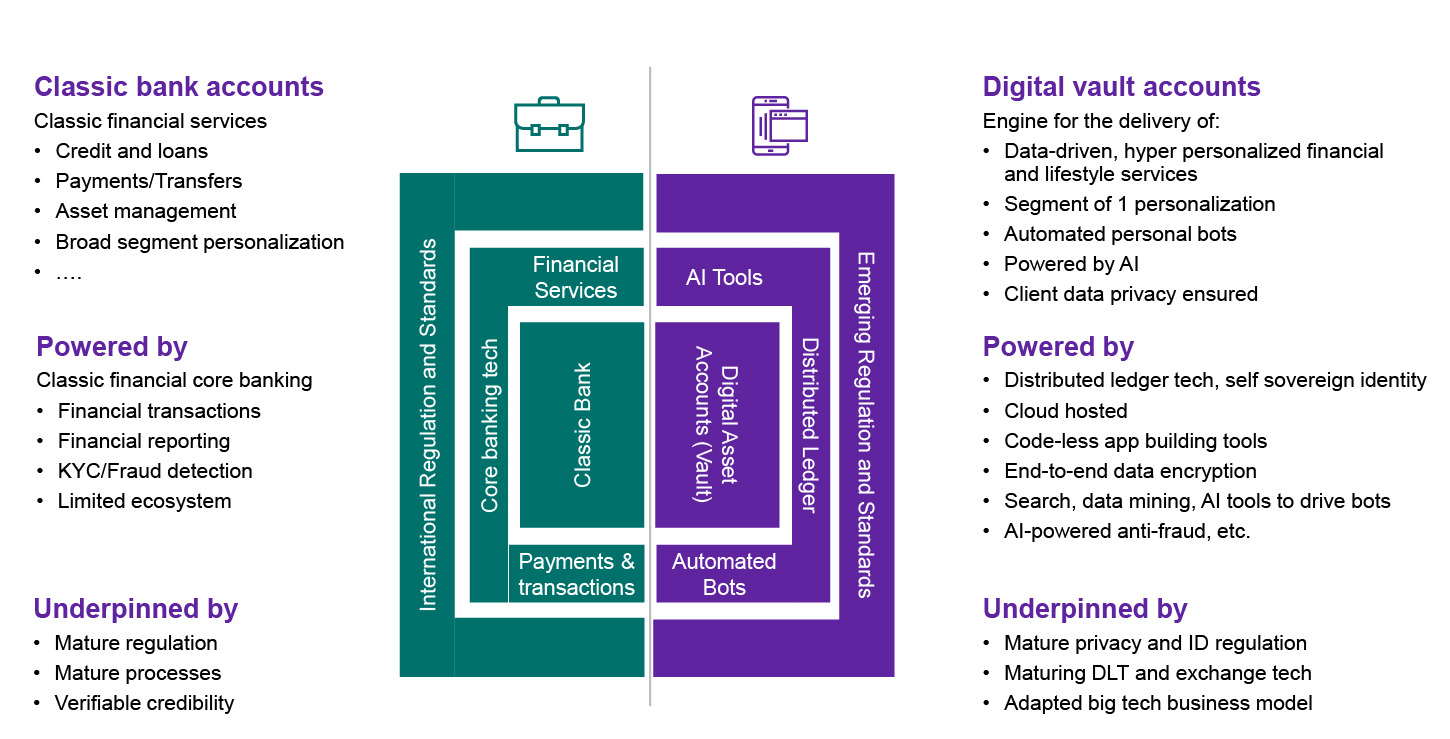

- Digital Asset Banking Services (DABS) is a proposal for the establishment of a digital extension to a bank’s current accounts

- A person’s verified data would be managed as an asset equivalent to their “money” and will reside in an “account” where it can be controlled, managed, exchanged and accounted for. This will comply with existing regulations around data privacy and security

- The data held will be accessible to providers of products and services (e.g., an airline or insurance provider) securely and confidentially with the full approval of the client

- New and emerging technologies like blockchain, distributed file systems (IPFS), real-time data aggregation and AI tools will be leveraged to achieve this

Personal data: Emergence of a new asset class

In 2010, the World Economic Forum launched its Rethinking Personal Data project and the “Personal Data: The Emergence of a New Asset Class” report.

Personal data is becoming a new economic asset class, a valuable resource that will touch all aspects of society. A balanced ecosystem with increased trust between individuals, government and the private sector is necessary to unlock its' full potential.

The report focused on the rapid growth of personal data from all sources and the opportunity to develop a global digital economy and, ultimately, world economic growth. The main thrust of the report was to promote a user-centric data ecosystem built on trust and the control individuals have in sharing their data. This vision includes a future where:

- Individuals can have greater control over their data, digital identity and online privacy. They would be better compensated for providing others access to their personal data

- Disparate silos of personal data held in corporations and government agencies will more easily be exchanged to increase utility and trust among people, private firms and the public sector

- The government’s need to maintain stability, security and individual rights will be met in a more flexible, holistic and adaptive manner

The WEF report was clear about the challenges and the actions required to succeed. It defined a complex set of business, policy and technological issues that would require coordinated leadership from firms and the public sector. Specifically, they identified five imperatives requiring action:

- Innovate around user-centricity and trust

- Define global principles for using and sharing personal data

- Strengthen the dialog between regulators and the private sector

- Focus on interoperability and open standards

- Continually share knowledge

Why is it relevant?

In practical terms, a person’s data would be managed as an asset equivalent to their money. It would sit in an account where it would be controlled, managed, exchanged and accounted for, like money and personal banking services are today. These services would be interoperable so data could be exchanged with other institutions and individuals globally. The services would operate over a trusted and highly secure technical and legal infrastructure. Maintaining confidence in the integrity, confidentiality, transparency and security of the entire system would require intense monitoring.

End-user centricity is critical for building the personal data ecosystem and is vital for aligning stakeholder interests and realizing the vision of the personal data ecosystem. This holistic approach recognizes end users as vital and independent stakeholders in the co-creation and value exchange of services and experiences. Designed for the information economy, the concept breaks from the industrial-age model of the “consumer”, where relationships are captured, developed and owned.

Instead, end-user centricity represents transformation, integrating diverse types of personal data in a way previously impossible. This can only be done by putting the end user at the center of four fundamental principles:

- Transparency: Individuals expect to know what data is being captured about them, how the data is captured or interpreted, what it will be used for and who has access to it

- Trust: Individuals’ confidence that the attributes of availability, reliability, integrity and security are embraced in the applications, systems and providers that have access to their personal data

- Control: The ability of individuals to manage how their data is shared

- Value: Individuals’ understanding of the value created by the use of their data and how they derive value from it

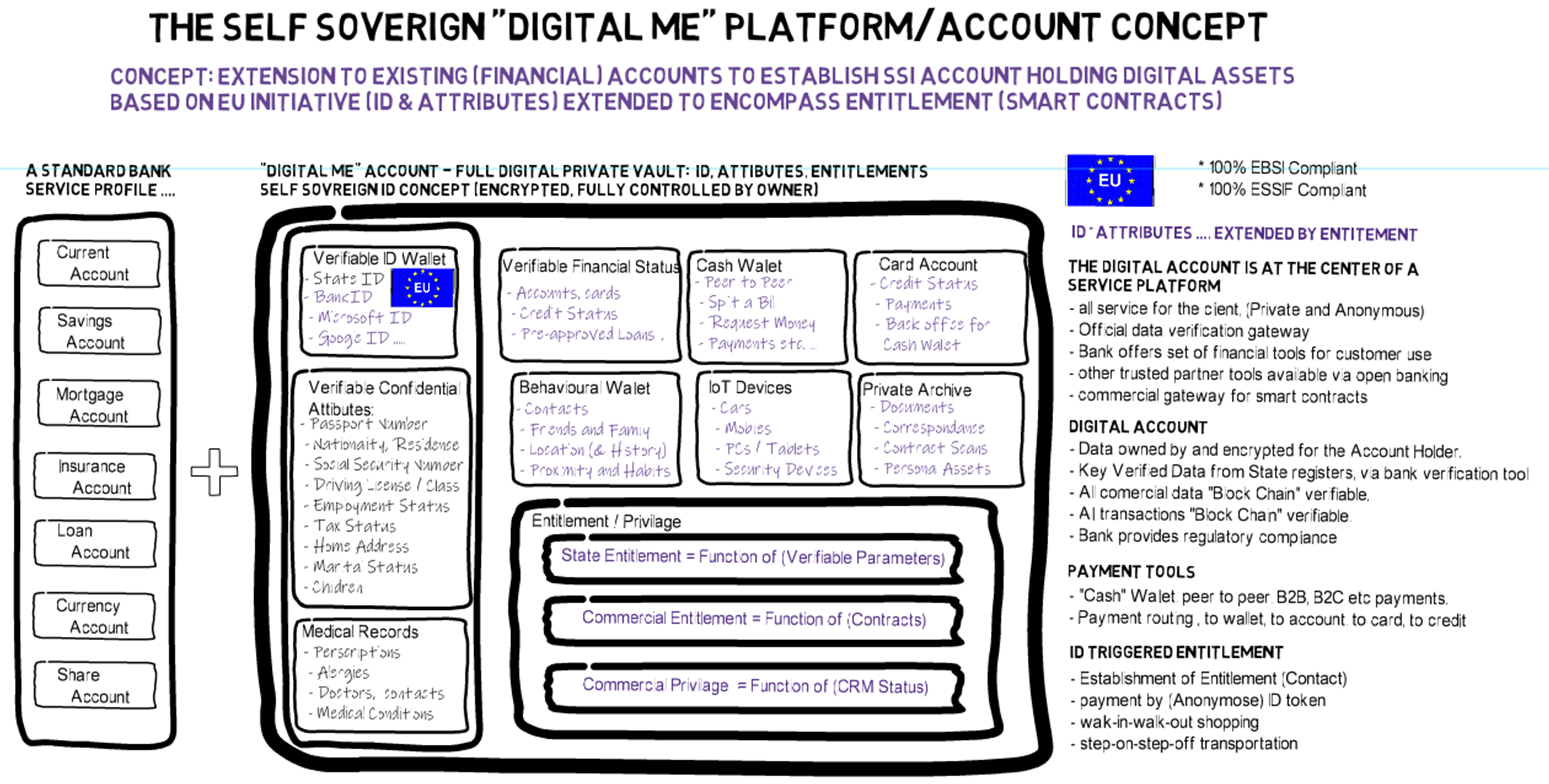

Digital Asset Banking Services: The concept

Digital Asset Banking Services (DABS) enables banks to monetize data through a trusted bank-powered platform for accounts hosting verified personal data, traded by account holders toward value services from third parties, thus building a local self-perpetuating services ecosystem. Data and digital are the “new economic oil”, and DXC Luxoft believes banks can develop a significant role in the new economy:

- Banks’ trusted status means they’re uniquely placed to hold personal digital assets

- Digital assets are verifiable attributes attached to a user’s unique ID

- Digital bank accounts are made up of verifiable digital data pods, with data acting as the input to a range of personalized services

- Ensuring the provision of innovative and secure instant digital solutions from an ecosystem of data participants

- Enabling hyper-personalization in a trusted ecosystem of service providers hosted by banks and supported by large-scale, distributed data ledgers

- Creating a large, anonymized data lake from accumulated data ponds to power automated and AI services

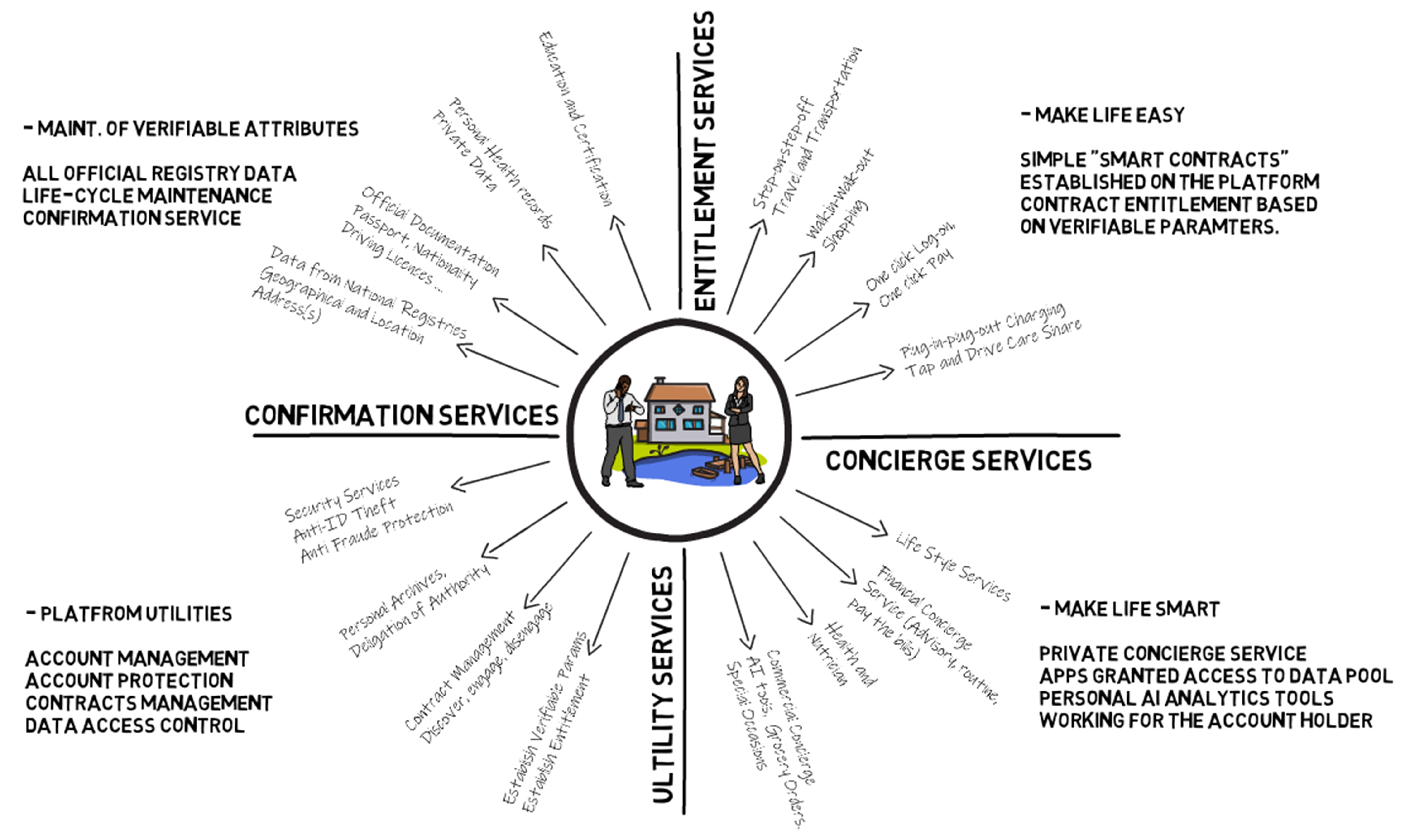

The concept allows account holders to use verified, digitally signed bank applications to capture and hold encrypted personal data on a single, digital-data account platform. It may be temporary data such as location or online activity, calendars, contacts, web activity, accounts or transactional details (itemized receipts), or records of state such as holdings of cash, frequent flyer/loyalty points or other digital assets.

The data will be accessible to platform-hosted concierge applications that allow individuals who want the service to grant confidential access to their private data. For example, a bank might offer financial organizer concierge applications that use platform data to advise the individual. The bank might supply the branded concierge application. Still, the nature of platform rules says the data provided to the platform cannot be shared outside of the individual’s data account domain.

Accordingly, a user might ask the concierge financial advisor if they could realistically afford to buy the car of their dreams and receive a fully data-informed reply without leakage. The application would only work on behalf of the individual. However, based on feedback, the application could promote bank products to the user and place an application for a bank service on behalf of the user with that individual’s permission.

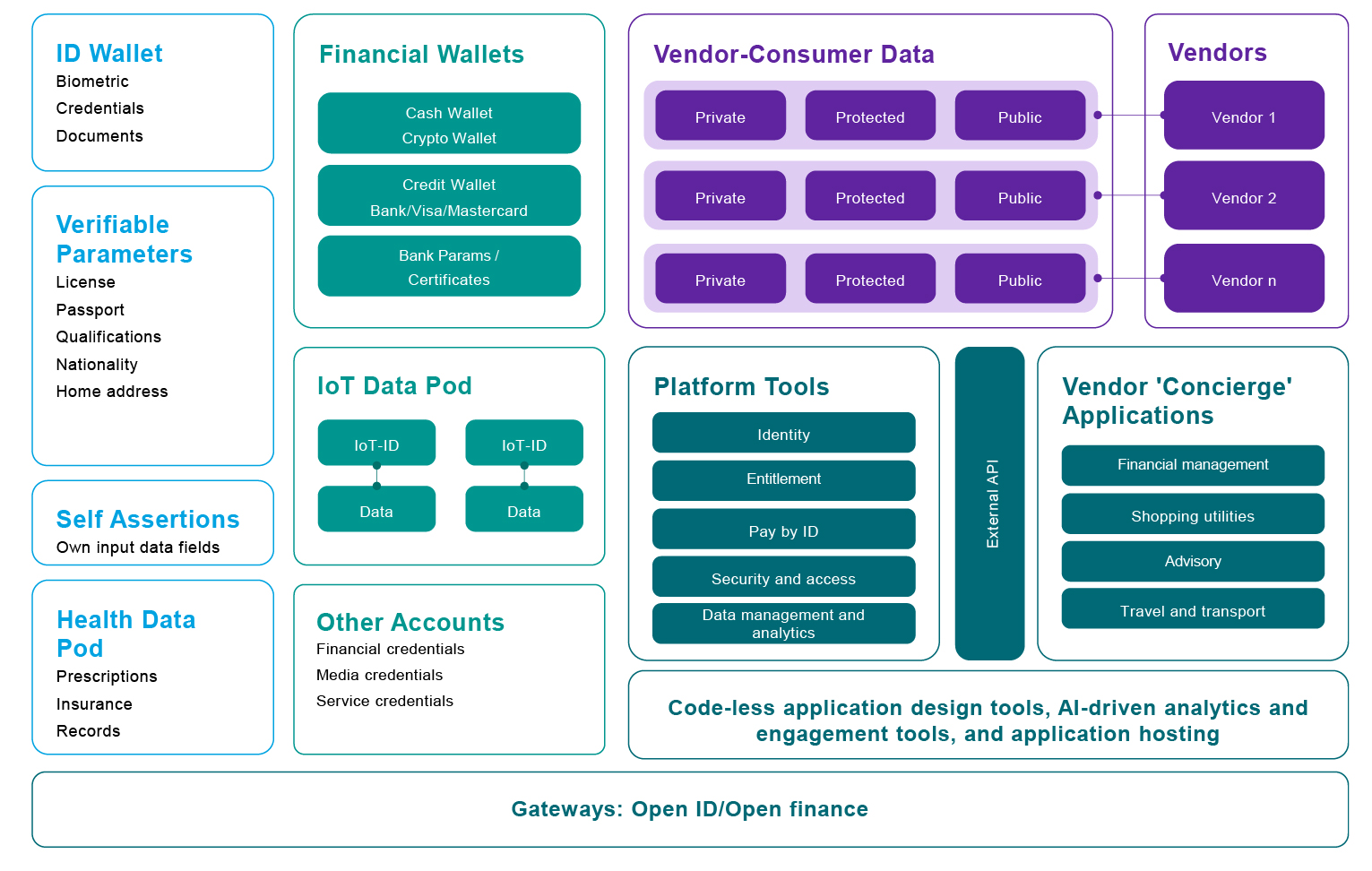

The concept and chosen technology allow for account holders, natural citizens, legal entities, and, via the state engine, the definition of roles and role-based access to the services made available on the platform. A simplified conceptual, functional block architecture is shown below:

How can DXC Luxoft help?

According to the WEF report, “A person’s data would be equivalent to their money. It would reside in an account where it would be controlled, managed, exchanged and accounted for like personal banking services operate today”.

DXC Luxoft supports this concept but with one significant extension. We believe that the value of the data will not be realized in simple “price/kg of data” models, but holders of their own data will be able to translate that data into a greatly expanded set of very high-quality services.

This is significant because it’s not enough to provide a data store, data-trading capacity and a platform to provide the services. Naturally, this leads to a need to collect private data, keep it secure and provide controlled access according to the wishes of the individual account holder. To achieve this, DXC Luxoft is working with four key technologies:

- Blockchains supporting distributed computing, smart applications, accounts, state data, transactional data and hosted oracles for data extraction to external applications

- Distributed file systems (IPFS), using BitTorrent technology to replicate data over multiple solid pods to secure private data

- Real-time data aggregation tools

- AI toolkits to underpin data-driven concierge tools

DXC Luxoft has explored extending personal bank accounts to hold digital assets of all kinds, and creating defined mechanisms through which identity wallets (as defined by EU/EIDAS and hosted on a blockchain backbone) can act as a gateway to multiple data pods containing encrypted data collected from multiple (private) sources. The collective data map represents an individual, historical and current digital record.

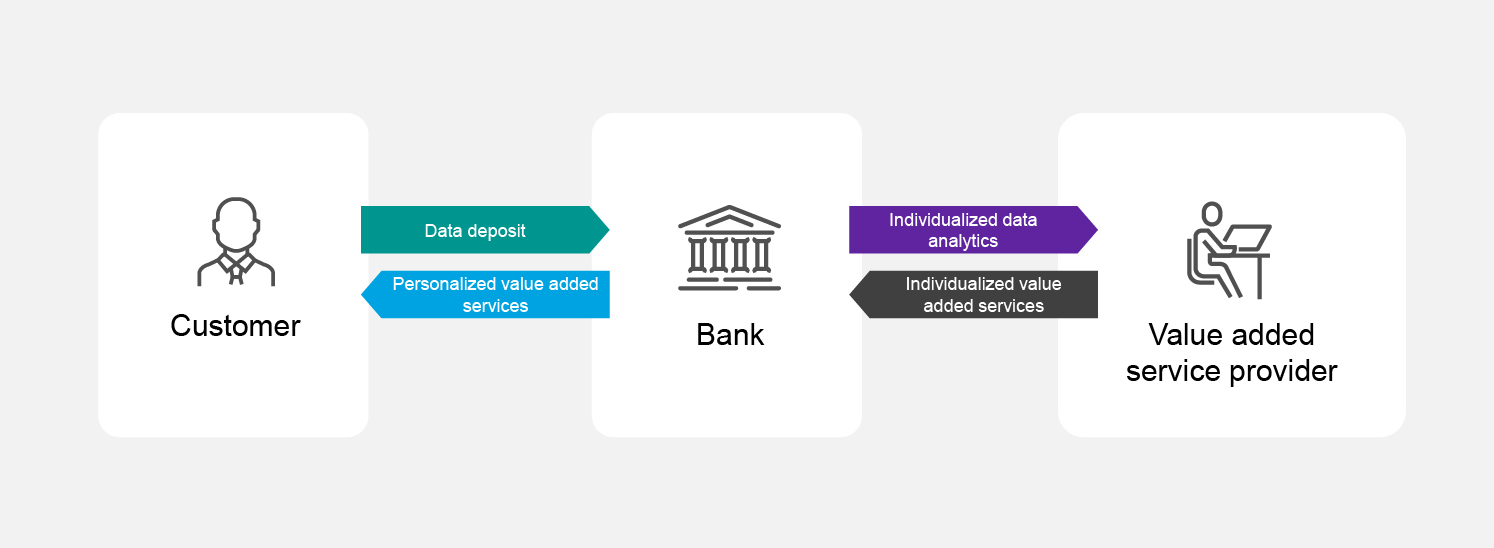

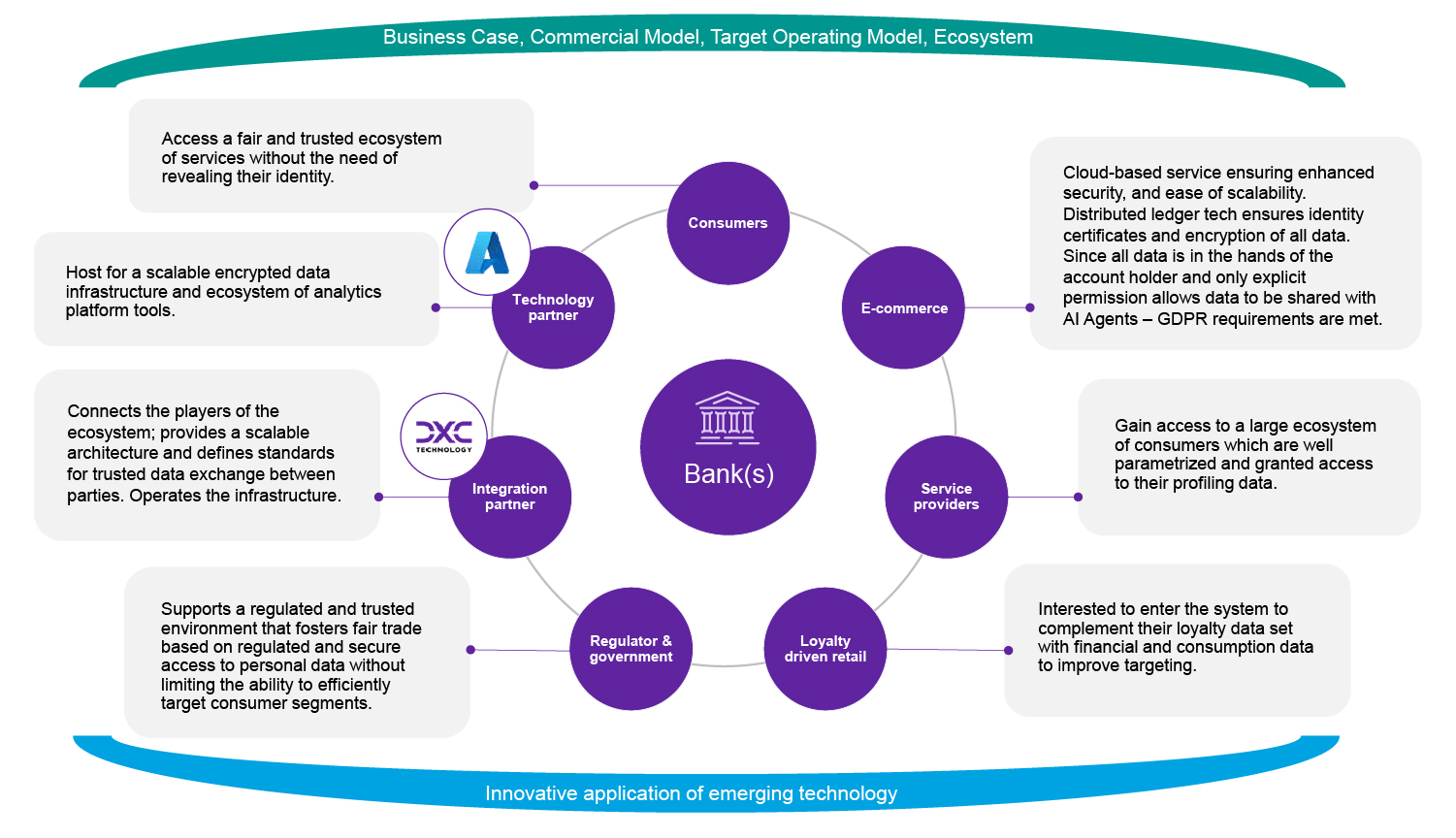

DXC Luxoft proposes a trusted bank-powered platform for hosting verified personal data, traded by account holders toward third-party value services, building a local self-perpetuating service ecosystem.

The business ecosystem consists of several players bound by the bank DABS platform:

The emergence of AI is particularly significant for the concept. AI depends on the data quality it receives and the associated training. AI processes that use traditional data sources will be just as dependent on high-quality sources as any other analytic process.

However, the technology is also using a wide range of new data sources and types. AI can sometimes improve quality by evaluating and identifying additional datasets that can expand on the original data. It’s particularly effective at identifying patterns and building connections between data points. Under DXC Luxoft’s concept, multiple high-quality datasets are collected and data connected, pivoting around the individual.

Find out more

If you’d like to learn more about how DXC Luxoft can help you embark on a DABS proof of concept, contact Dhritiman.mukherjee@dxc.com and Anthony.fullam@dxc.com.