In brief

- Technology debt is the accumulated cost of outdated, inefficient, poorly designed IT systems that hinder business performance and innovation. By reducing tech debt, banks can lower their costs and risks and unlock new sources of value and differentiation

- DXC Luxoft can help banks reduce their tech debt and modernize their IT systems and processes using a holistic and comprehensive approach based on our extensive experience and expertise in delivering tech debt reduction projects for banking clients

- DXC Luxoft can help banks achieve multiple benefits and outcomes, such as better IT performance, cost reduction, business relevance and customer satisfaction

Technology debt (a.k.a. technical debt) is the accumulated cost of outdated, inefficient or poorly designed IT systems that hinder business performance and innovation.

Tech debt can arise from various sources, such as legacy systems, siloed applications, lack of standardization, underinvestment or rapid changes in customer expectations and regulatory requirements. It can have significant negative impacts on banks, e.g., high operational costs, slow time-to-market, low customer satisfaction, reduced agility, increased security and compliance risks and lost competitive advantage.

A major barrier to progress

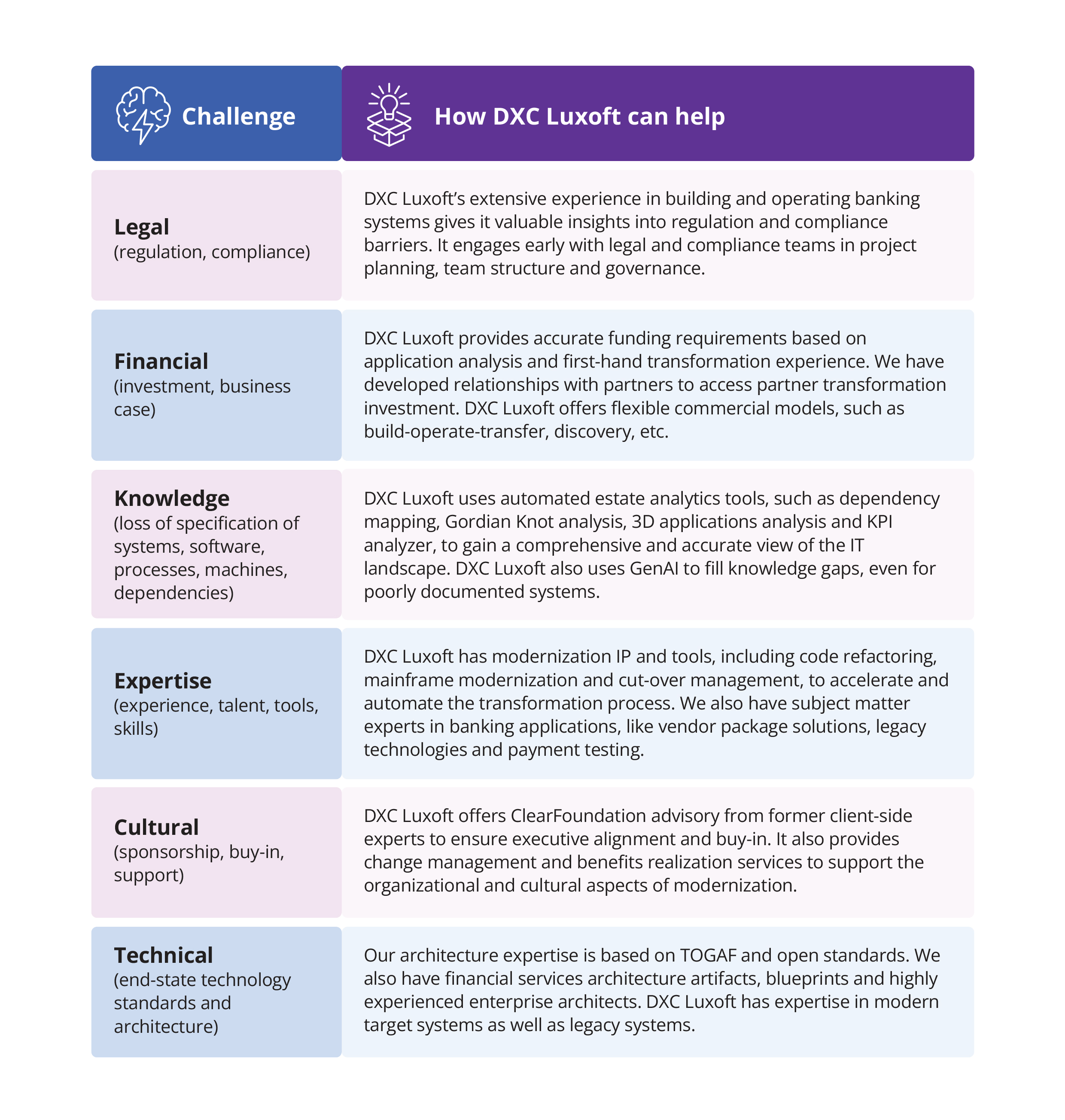

According to a recent DXC Luxoft Tech Debt Pulse Survey, 89% of financial services IT executives see tech debt as a significant barrier to digital transformation and growth. This is higher than in any other industry. Moreover, the survey revealed that banks face multiple obstacles to modernization projects, like legal, financial, knowledge, expertise, cultural and technical challenges. These challenges prevent many banks from addressing their tech debt effectively and in time, leaving them vulnerable to disruption and stagnation.

However, tech debt can also be seen as an opportunity to transform and grow. By reducing tech debt, banks can lower their costs and risks and unlock new sources of value and differentiation. Banks can improve their agility, scalability and innovation by modernizing their IT systems. They can enhance their customer experience, operational efficiency and business relevance by adopting industry-standard solutions, cloud platforms and data-driven insights. Also, they can increase loyalty, retention and revenue by redesigning and refreshing their customer and colleague journeys.

This article presents DXC Luxoft's point of view on technology debt in banking, based on our extensive experience in helping banks modernize their IT systems and processes. It will explain why tech debt is such a pressing issue for banks, how DXC Luxoft can help them solve tech debt challenges and what benefits and outcomes banks can expect from reducing their tech debt. The article will also share banking success stories and best practices developed while delivering tech-debt reduction projects.

Why tech debt is a pressing issue for banks

Tech debt is not a new phenomenon for banks. They have been dealing with legacy systems and applications for decades while growing organically or through mergers and acquisitions, diversifying products and services and expanding their market reach. However, in recent years, tech debt has become a more pressing and urgent issue for banks due to several factors, including:

- The increasing pace and complexity of digital transformation and innovation are driven by changing customer expectations, new technologies and competitors. Banks must deliver fast, seamless and personalized omnichannel customer experiences while leveraging emerging technologies such as AI, blockchain, cloud and data analytics to create new products, services and business models. But many banks are hampered by tech debt that limits transformation and innovation

- The rising cost and risk of maintaining and operating legacy systems and applications that consume a large portion of IT budgets and resources. According to a McKinsey report, high-performing European banks spend significantly more on technology than low performers. Top performers have shifted the balance of their IT spend from paying down tech debt to investing in a growth platform. That said, banks having to deal with the complexity, inefficiency and vulnerability of legacy systems and applications still struggle to free up investment for modernization

- Heightened regulatory and compliance pressure that requires banks to ensure the resilience, security and transparency of their IT systems and processes. Banks have to comply with various rules and regulations, e.g., Basel III, PSD2, GDPR, MiFID II and others, that impose stringent standards on data quality, privacy, protection, reporting and governance. However, many have trouble meeting these requirements, thanks to tech debt impeding their data management, integration and accessibility

These factors compel banks to reduce tech debt and modernize their IT systems and processes. However, modernization is rarely straightforward. It requires a clear vision, robust strategy, detailed roadmap, strong business case, skilled and experienced team and a proven methodology and tools. Moreover, it requires a holistic and comprehensive approach, covering not only technical considerations but also the business, cultural and organizational aspects of modernization.

How DXC Luxoft helps banks solve their tech debt challenges

DXC Luxoft is a leading global provider of IT services and solutions with deep domain expertise and experience helping banks modernize their IT systems and processes. DXC Luxoft has a holistic approach to modernization that encompasses the following:

DXC Luxoft's approach to modernization is based on a set of proven methodologies and tools that help us deliver quality modernization projects on time and within budget. This approach covers the following:

- Assessing modernization opportunity: DXC Luxoft analyses the IT landscape to quantify opportunities and define a tech-debt-reduction plan using KPIs, industry benchmarks and discovery tools

- Setting direction: DXC Luxoft defines the strategy, business case and roadmap for modernization, taking into account the client's objectives, constraints and risks

- Implementing: DXC Luxoft executes the modernization plan, using a combination of tech-debt plays, such as moving to the cloud, adopting industry-standard solutions, modernizing legacy, consolidating and simplifying, redesigning the customer/colleague experience, decommissioning, archiving and running to kill

- Realizing benefits: DXC Luxoft measures and reports the outcomes and benefits of modernization: Reduced cost, improved performance, enhanced business relevance and greater customer satisfaction

The outcomes and benefits banks can expect from reducing tech debt

By reducing their tech debt and modernizing their IT systems and processes, banks can expect to achieve multiple benefits and outcomes, including:

- Better IT performance: Increase speed, scalability, reliability and security to improve results. By reducing tech debt, banks can accelerate their time-to-market, deliver faster and more frequent updates, handle higher volumes of transactions and data, ensure higher availability and resilience of their systems and protect systems from cyberattacks and data breaches

- Cost reduction: Optimize IT operations, maintenance and licensing. Reducing tech debt enables banks to cut infrastructure and software costs, automate and standardize IT processes, rationalize and retire redundant applications and shift from CapEx to OpEx

- Business relevance: Align IT systems and processes with your business strategy, goals and priorities. Reduce tech debt and enable your IT systems and processes to support business transformation, innovation and growth and to respond to changing customer expectations, market conditions and regulatory requirements

- Customer satisfaction: Improve customer experience, loyalty and retention. Less tech debt allows banks to deliver seamless, personalized and omnichannel customer experiences while leveraging data and analytics to gain insights into customer behavior, preferences and needs and to offer tailored products, services and recommendations

DXC Luxoft's success stories and best practices for delivering tech-debt reduction banking projects

DXC Luxoft has a strong track record and credentials in delivering tech debt reduction projects for global banking clients. We have helped banks reduce tech debt and achieve business outcomes in various areas, such as mainframe modernization, cloud migration, application rationalization, data management and customer experience. Success stories include:

- Large UK-based insurer: DXC Luxoft performed an extensive IT transformation, enhancing application stability, reliability, availability and performance while reducing IT operating expenses. We eliminated the company’s reliance on end-of-service-life IT infrastructure for mainframe, Wintel and Oracle platforms. This improved provisioning speed, streamlined the application management processes and allowed scalability for business growth. Notably, minimal application outages occurred during migration, preserving functionality

- Large Swiss-based bank: DXC Luxoft delivered several major transformation programs over a decade, moving the bank's core banking solution from the mainframe to a modern modular and virtualized platform, using an evolutionary step-wise migration approach. For subsequent transformations, we focused on digitalization, optimizing processes and application enhancement to eliminate further tech debt on the application layer and the middleware stack. Finally, DXC Luxoft moved most platform operation elements to a hyper-converged-system-based private cloud to avoid infrastructure- and data-center-related technology debt

- Large global bank: Under an outcome-based, agile transformation program, DXC Luxoft delivered 37% efficiency savings, migrating the platform to MS Azure cloud, introducing DevOps and QA Automation and reducing application architecture complexity. The customer was facing a high TCO and a long time-to-market for their strategic platform to calculate credit risk built on a legacy technology stack

We‘ve developed best practices and recommendations for delivering tech-debt-reduction projects for banking clients, such as:

- Start with a clear vision and a strong business case: Banks must have a clear vision of the desired end-state and the expected benefits and outcomes. The business case should be based on a thorough analysis of the current state: Opportunities, costs, risks and value proposition of the project

- Adopt a holistic and comprehensive approach: An approach must cover the technical, business, cultural and organizational aspects of modernization. It must be aligned with the business strategy, goals and priorities and should involve all relevant stakeholders

- Use proven methodologies and tools: Follow proven methods and use appropriate tools to automate and accelerate modernization. Include assessment, planning, implementation and realization stages, and support with tools like automated discovery, analysis, migration, testing and reporting

- Leverage industry-standard solutions and cloud platforms: Leverage industry-standard solutions and cloud platforms to simplify and standardize the IT landscape, enabling flexibility, scalability and innovation. The solutions and platforms should be selected based on the client's needs, preferences and constraints and should be integrated with existing systems and applications

- Redesign and refresh the customer and colleague experience: Redesign the customer experience by improving the UI/UX, customer journeys and business processes. The omnichannel experience should be personalized and seamless, leveraging data and analytics to provide insight and recommendations

Conclusion

Technology debt is a pressing and urgent issue for banks. However, reducing it through modernizing IT systems and processes can provide the chance to transform and grow. By doing so, banks gain multiple benefits, e.g., better IT performance, cost reduction, business relevance and customer satisfaction.

DXC Luxoft helps banks address and solve tech-debt challenges by following a holistic and comprehensive approach based on our extensive experience and domain expertise. We help banks assess their modernization potential, set and implement their plan, and realize the benefits, using a combination of tech-debt plays (e.g., cloud migration, adopting industry standard solutions, modernizing legacy systems, redesigning the customer/colleague experience and decommissioning and archiving.

Get in touch

To learn more about how DXC Luxoft can help you reduce your tech debt, visit our website or contact us.