In brief

- Cutting-edge self-service software for loan servicing companies, enhancing the borrower’s experience during challenging financial situations

- The portal's crucial role during unexpected crises is to merge contrasting digital solutions with a traditional call center approach

- Seamless integration, core capabilities utilization, flexible architecture, analytics optimization, and positive impacts on borrower experience, contact rates, cycle times, and technology footprint reduction

It’s simply not possible to look into the future and see what’s around the corner. And in turbulent times, it’s hard to find the certainty needed to offer a feeling of stability and of being in control.

According to Joseph Wilkin’s article in Business Insider, “America's consumer-debt stress is mounting — as mortgage rates top 7%, credit-card liabilities hit $1 trillion, and now auto-loan defaults are on the rise”. It makes a rather clear case that the issue of debt and defaults is something that is not going to disappear.

When it comes to a mortgage, auto or consumer loan, even a small change in circumstances can mean it’s necessary to adjust one’s situation. An already difficult situation can be exasperated by customers being left feeling even more powerless by their inability to connect with the responsible party for their loan.

Empowering customers to log on to a portal which allows them to both safely and securely communicate their needs, not only gives them a sense of confidence and control, and improves their relationship with their lender or loan servicer, but also alleviates much of the burden from those very institutions. Customers using the self-serve borrower portal means less wait time for them, reduced intake for the servicer and eliminates the need to hire temporary staff to deal with volume spikes. It provides the convenience of having customers contact their lender or loan servicer at a time that suits them. You may not be able to predict what’s around the corner, but the EarlyResolution borrower portal gives you and your team the confidence of knowing that even when things do change, you’re ready for those transitions.

So just what exactly is Luxoft’s EarlyResolution Borrower Portal?

The EarlyResolution Borrower Portal is a cutting-edge multi-channel self-service software solution designed specifically for loan servicing companies. It is the most trusted tool available on the market for financial institution borrowers to manage their debts and is a vital part of Luxoft’s EarlyResolution offering. Here’s a few facts and figures around the EarlyResolution offering:

The numbers:

45% of the U.S. mortgage servicing industry uses EarlyResolution

750k workout decisions annually

2.6 million transactions each month

20 % faster decisioning

< 30 % call-management and productivity savings

< 50 % workflow improvement

> 20 technology partners

EarlyResolution overview

With a focus on enhancing the borrower experience and streamlining default management operations, this self-service platform revolutionizes the way borrowers engage with their servicer when facing difficult times. By integrating with online banking sites and providing a user-friendly interface, as a part of the whole EarlyResolution offering, the EarlyResolution Borrower Portal empowers borrowers, increases contact rates, reduces cycle times, and optimizes overall efficiency within the latest regulations.

Designed to assist all loan types, it offers a single platform that can deal with all types of debt (e.g., mortgage, auto, consumer, personal etc.), all in the same place, simplifying a lenders technology platform which, in turn, makes it much more cost effective.

EarlyResolution is purpose-built to help servicers regulatory and compliance requirements, stay aligned with investor guidelines, and reducing credit risk all while markedly improving the borrower experience. To meet regulation standards, EarlyResolution provides approved language, process controls and the consistency with rules thus preventing regulatory breaches that would often lead to fines. It introduces an era where streamlined, customer-centric approaches are the norm, and avoiding undesirable audits and compliance issues is a must.

EarlyResolution offers a comprehensive toolset for default management, giving your operations leaders the ability to manage and ensuring they have ample coverage over the entire process from initial contact through underwriting and settlement. It incorporates collections, workflow management, underwriting and decisioning, dedicated borrower portals, streamlining operations and making life easier for both servicers and customers.

EarlyResolution highlights

- Industry leading default management solution for 15+ years

- Built and maintained by industry

- Usable from initial customer contact to loss mitigation and through settlement

- Open SaaS architecture for complex operating environments

- Large partner ecosystem, giving clients flexibility and choice

The EarlyResolution advantage

- Innovation focus — transformational capabilities delivered regularly

- Servicing expertise — deep industry experience across the team

- Industry best practices — industry approved processes and templates implemented from day one

- Established integrations — scalable integrations maintained with major industry systems

Why do you need the EarlyResolution Borrower Portal Solution?

If we take a moment to focus on the EarlyResolution Borrower Portal and what makes it the essential tool for loan banks, service companies and credit unions perhaps we can answer that question.

It’s easy to understand why in prosperous economic times, banks, mortgage lenders, loan service companies often prioritize lending and loan origination over managing default situations. However, neglecting the servicing default space can quickly evolve into a higher risk situation when unforeseen downturns, such as the unexpected COVID-19 pandemic in 2020, catch organizations off guard.

One might consider the actions of a major U.S. servicer that had embarked on a digital transformation journey years before the pandemic, included in their transformation was the incorporation of a customer-facing self-service portal. As the pandemic unfolded and customers faced financial challenges, the utilization of the self-service portal skyrocketed, experiencing an unprecedented 600% daily increase in transactions. This surge pushed customers to seek assistance independently, alleviating additional strain on the call center.

In stark contrast, servicers, relying primarily on phone calls and printed letters, found themselves unprepared when the pandemic struck. Faced with the need to hire and train new staff for their call centers, these companies incurred substantial expenses and introduced significant risks by thrusting new personnel into complex situations without adequate preparation.

Due to the absence of any kind of digital interaction, a must in this day and age; customers found themselves increasingly frustrated, often enduring long waits in hold queues. Even now, three years later, these servicers grapple with the repercussions of hastily implemented measures during the crisis peak. Moreover, the heightened focus on reputational damage in recent years underscores the importance of avoiding suboptimal service during times of crisis.

Still not convinced?

Perhaps it would help if we highlighted some of the benefits that the EarlyResolution Borrower Portal brings:

Borrower experience focus: It is seamlessly integrated with the servicer’s online banking site — the Borrower Portal offers a user-friendly and intuitive interface. It can be customized to meet corporate branding standards and is optimized for mobile devices, providing a consistent experience across many platforms.

Utilization of EarlyResolution core capabilities: By leveraging the power of EarlyResolution, the Borrower Portal incorporates the business rules and a decisioning engine for automated workout generation, calculations, and business rules execution. It seamlessly integrates with key systems such as core systems of record, letters, text/email systems, imaging systems and e-Sign vendors.

Flexible architecture: Loan servicing companies have increased control over branding and messaging throughout the platform, delivering a personalized and cohesive borrower experience.

Analytics optimization: Gain valuable insight into user interaction and patterns with built-in Google Analytics. Monitor borrower engagement, usage trends and key metrics to make data-driven decisions and continuously optimize the borrower experience.

The solution includes:

Enhanced customer experience: The EarlyResolution Borrower Portal offers a self-service channel for borrowers that enables them to take control of their financial situation and find the best workout solution. This improves customer satisfaction and builds trust.

Increased borrower contact rates: The Borrower Portal facilitates effective communication and collaboration by seamlessly integrating with online banking sites, which results in higher borrower contact rates and improved responsiveness.

Reduced cycle times: The direct interaction with the customer eliminates manual handling and expedites the overall process. This streamlines operations, reduces processing delays and accelerates cycle times.

Real-time status updates: Borrowers have instant access to real-time updates on the status of their assistance program. This transparency empowers borrowers with the information they need to make informed decisions and stay engaged throughout the process while reducing the servicers call volumes.

Technology footprint reduction: By consolidating various functionalities into a single platform, the Borrower Portal reduces the technology footprint for loan servicing companies. This simplifies operations, improves efficiency, and lowers costs.

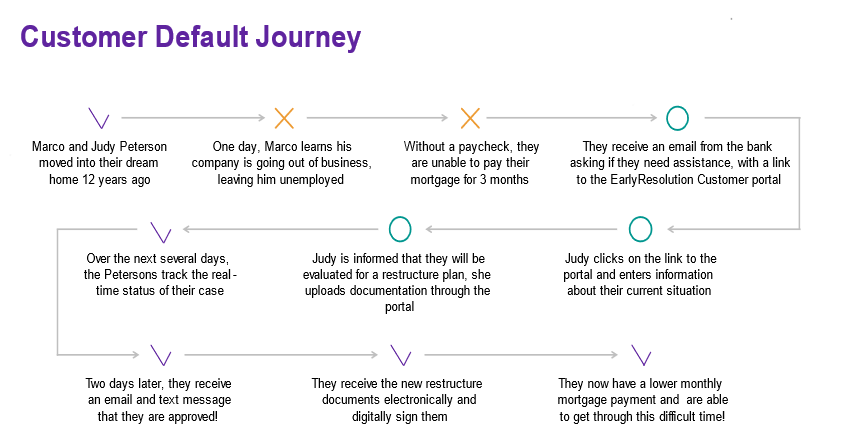

If all of these actions are happening in the background, you might ask, what would it look like for a customer? Here is a typical journey to demonstrate what ERBP can do:

As we inferred at the beginning, we don’t have a crystal ball that can help see into the future, we do however have a solution that can make the future just that little bit brighter for banks, loan service companies and credit unions and, of course, their customers.

Conclusion

The EarlyResolution Borrower Portal is a powerful software solution that gives the borrowers what they want and the servicers the operations control they need to manage their assets. By offering a self-service channel, encouraging borrower engagement, and leveraging core capabilities, the EarlyResolution Borrower Portal drives higher contact rates, improves promises and repayment plans, reduces cycle times, and optimizes efficiency. With its flexible architecture and analytics optimization, this innovative solution ensures a seamless and personalized borrower experience while delivering tangible business benefits. Experience the future of self-service workout solutions with the EarlyResolution Borrower Portal.

If you’d like to find out more, visit our website or contact us.