In brief

- With advanced analytics and machine learning, you can start to predict the claims that are likely to be litigated, those that won’t and cases likely to have higher costs

- DXC Luxoft can help you estimate the size of the prize before you end up implementing loads of unfit-for-purpose technology, standing up unlikely processes and so on

- Something like 90% of insurance companies are looking for a fraud analytics engine that they can build into an existing process and “fix” fraud. DXC Luxoft tells clients whether a tool will work before they buy it

This is the second of two articles on fraud and building security in insurance. Missed the first? You can read it here.

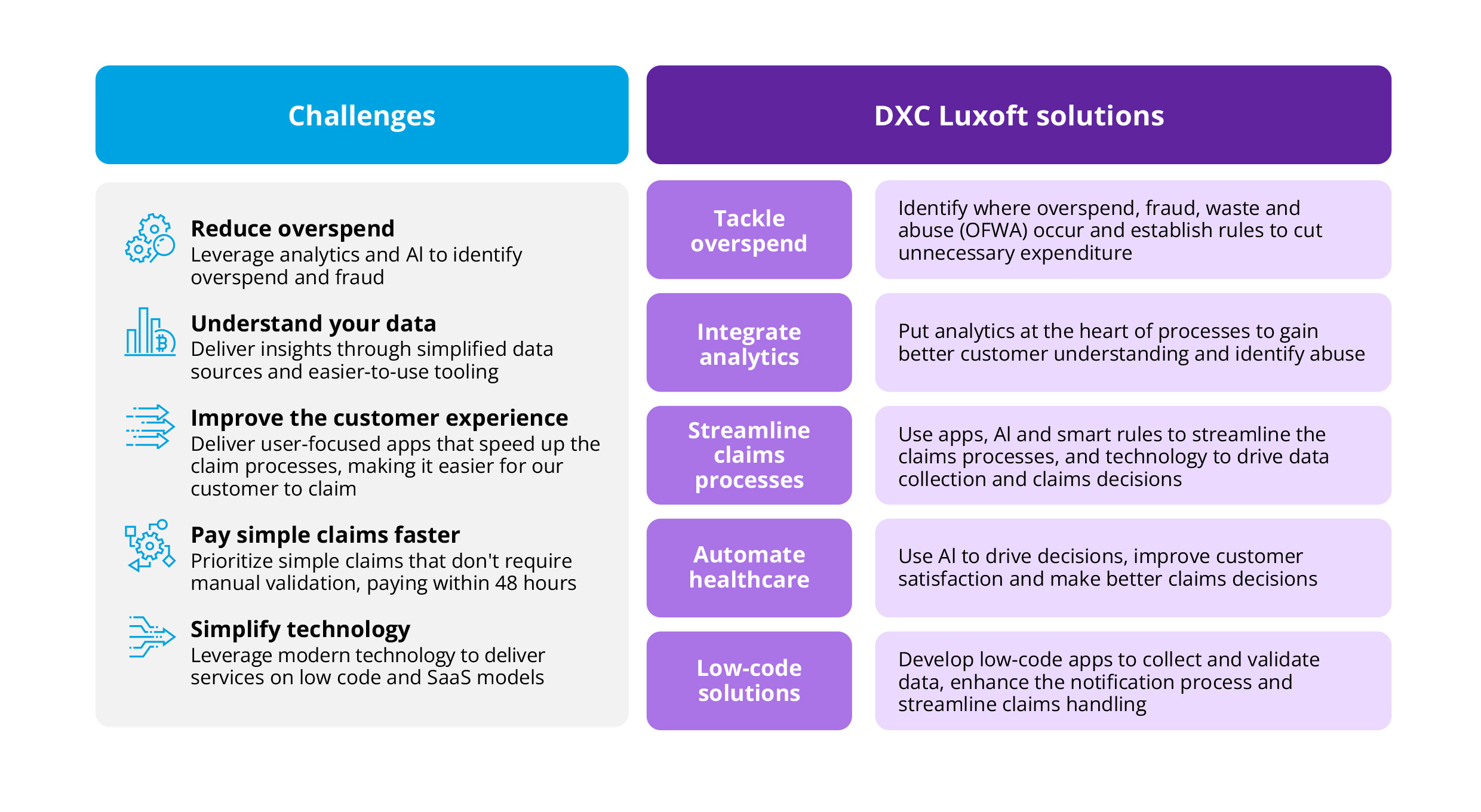

In the first article, we looked at how advanced data analytics helps us know the unknown or why people deviate from expected behaviors. We pointed out that, unlike standard fraud tools, DXC Luxoft’s four-stage fraud methodology goes deeper, using data science, advanced analytics, and machine learning to identify cases of OFWA (overspend, fraud, waste and abuse), including unearthing things like invoices that should never have been paid.

Now, we’re going to expand on the subject, delving into areas such as, if you’re determined to buy a fraud tool, how do you know if it will be any good in your IT and business environments?

Do the business case first

The trouble is, when you buy a piece of software, you have to spend 3 months installing and training it before you know how good or bad it is (as soon as you switch it on). You might do a proof of concept, and it might turn something up. Then again, it might not.

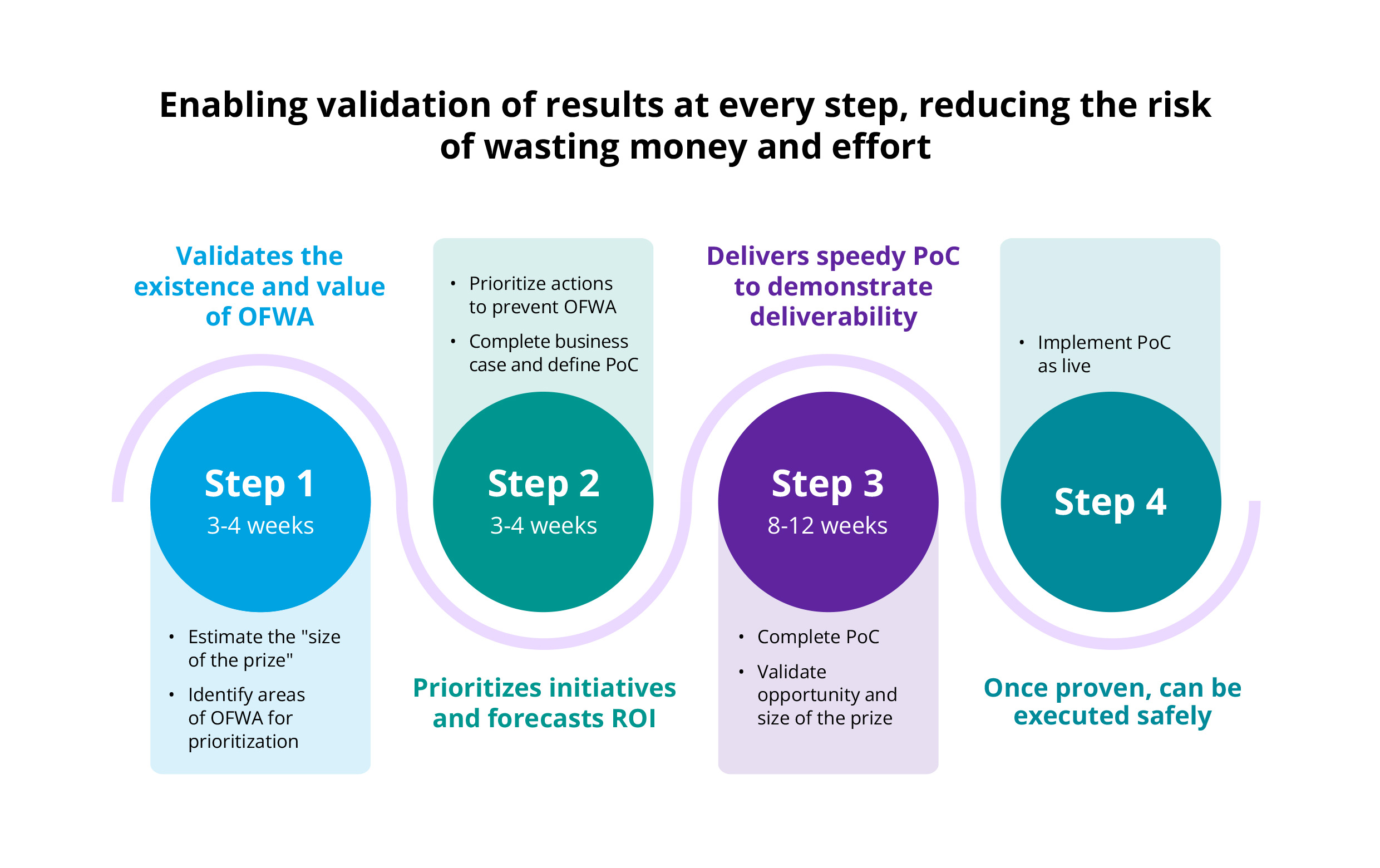

To get around this problem, DXC Luxoft’s methodology takes a series of short steps to validate the benefits of implementing a software tool in the first place.

Step one

In 3-4 weeks, you should be able to estimate the size of the prize. When an EU insurer approached us, we said we'd do a short sample. We reported that probably 5%-10% of their cases were overpaid, or paid without sufficient evidence. We asked them, “If you go down your preferred route and try to come up with something, how do you know if it will save you money?”

On the other hand, DXC Luxoft might determine the size of the prize and find that the company is the world's best anti-fraud insurer, so it's not worth bringing us in. Or that their current software is working just fine.

The point is you need to estimate the size of the prize right off the bat before you end up implementing loads of unfit-for-purpose technology, standing up unlikely things, etc. So, step one is nice and quick: evaluate the scope of the opportunity.

Step two

Now you know the size of the prize, what steps can you take to address the situation? You could take the time to implement a full-blown analytics solution, of course. But what if you could make two or three quick changes to your system and prevent fraud right now? The point of prioritizing the initiatives is about taking the quick wins, not waiting 6 months to implement a piece of software that might not make any savings at all.

The “size of the prize” is your potential cost saving. “Prioritize the initiatives” tells you the quickest way to plug fraud holes, which might lead to process changes or, if you’re lucky, just starts building up the database for future fraud developments.

Step three

Do the proof of concept. If you're buying a new piece of software to identify fraud, do a proof of concept to determine how valuable it’s likely to be. That's a 2-3-month project, and with our current methodology, you already know the size of the prize and the business case before you start doing the proof of concept. So, why spend 3 months waiting to see if an off-the-shelf tool's going to work if, within a month, DXC Luxoft can tell you that you that what you’re planning may not be cost effective? Or, within another month, you’ll have some quick wins that are a significantly better option than deploying a massive piece of software over a substantial period.

Step four

Go-live. As you can see, we're not claiming that the solution is to buy our fraud tool. We're saying we can help you build the business case before deciding whether you need to buy a tool at all.

Machine learning

The key thing with machine learning is a data scientist explores, spots and labels trends and items causing the trends. AI then looks for similar trends that might not be in the exact same space. As you will remember, in one case, we found that claims were passed from father to son or mother to daughter. Insurance cover allowed the father 10 physiotherapy sessions, but when he’d used up his allocation, another family member picked up the ailment and effectively, the claim shifted. Clearly, the father had found a way to continue the physio treatment beyond his allocation.

Having identified this particular data curve as anomalous and interesting, machine learning can look at where it might occur elsewhere, flashing other types of claims back to the analyst.

So, we see that in physiotherapy, but is it starting to appear in dentistry, for example? Are there similar claim circumstances with similar attributes picked up by machine learning but not by the data scientist? Or are you seeing particular trends within particular segments that allow you to run more scenarios with machine learning rather than a simple data scientist?

We can use your tools

Fraud is a perennial topic that concerns the whole industry. In terms of a broader context, fraud is the perfect canvas for insurance technology solutions and the astonishing abilities of advanced analytics in particular. When an organization moves to a data warehouse, deploys a new analytics engine, or looks for the next area their data scientists should investigate, we say, “Why not look at our OFWA methodology? It demonstrates business cases incredibly quickly.”

This is the next step for companies with Dataiku, Snowflake or whatever. If clients want us to do something quick, clean, and exploratory, we can use their existing tools and teams to give them a feel for the size of the prize. That way, there’s minimal impact. They do have to commit a certain amount of time, and there is some cost involved, but it's not something they need to get approvals or GDPR agreements for.

Once you’ve got it, you can use ML for virtually anything

Once you've got the analytics in place, machine learning can be used for a multitude of tasks: Motor claims litigation where there have been injuries, for example. You can start to predict the claims that are likely to be litigated, those that won’t and cases that are likely to have higher costs.

So, where people are disclosing early symptoms, you can effectively use machine learning to confirm that they align with people who have longer recovery periods, complications and so on. Therefore, you can use machine learning to predict legal costs and injury complexities; the list is virtually endless. Similarly, you can determine which supplier is best based on previous performance.

A U.S. company asked us to look at the validation of medical reports. Were treatments aligned to medical conditions? And in the case of people in long-term care, were they receiving bills for care actions solely related to the medical symptoms or paying for other things as well? In some cases, long-term care certificates don’t cover maintenance costs. So, what if someone has a celiac diet (they’ve never been able to eat gluten) and ends up in a care home?

Is gluten-free food part of their long-term care cost, or is it a personal expense to be borne by the individual? If they've always been gluten intolerant, that's a personal expense. However, if they became gluten intolerant because of the treatment, then that's a treatment cost and should be honored as part of the policy.

Improving healthcare claims

The point of the example is to recognize how you assess medical bills. Using machine learning to understand what the treatments comprise. It means reading a bill and checking a particular medical treatment against the medical database to confirm that it aligns with the medical presentation. If there’s no match, it raises a warning flag for the handler regarding that medical presentation.

Holistic approach

We advise clients on how to close loopholes by changing processes. One such client is an EU insurer. It had been receiving receipts from medical service providers but not recording them. For instance, is receipt A from Dr. Bones and receipt B from Dr. Bones from the same provider? The heading and layout look the same. Machine learning examines the receipts and decides that both are definitely from Dr. Bones, but A looks different and shows an additional amount.

So, this holistic approach says you need to change your process to start recording those receipts so you can compare them in the future. A standard fraud tool wouldn't be able to advise you, from an analytics perspective, how to improve your current process and understand things better. We can.

DXC Luxoft’s service is beyond pure software and data analytics. It's an insight into improving your claims processes to maximize analytical capabilities in fighting fraud.

Talk to DXC Luxoft before you buy a fraud tool. After could be too late

Our challenge is that, as “the software guys,” we’re not engaged early enough. One company that approached us recently was clearly looking to buy a fraud tool that would tell them which claims were fraudulent, and it was the wrong thing for them to be doing. In fact, 90% of insurance companies are looking for a fraud analytics engine to build into an existing process and “fix” fraud.

We say talk to DXC Luxoft before you even think about buying a fraud tool because we'll tell you what tool would best fix your fraud process. And, more importantly, if it won't, we'll give you a steer on how you can best organize your analytics to solve the particular problem rather than just buying a piece of redundant software.

And that’s our key takeaway.

Looking for more?

If you’d like to learn how DXC Luxoft can help you avoid making the wrong fraud choices, visit our websit or contact us.