- Industry:

-

Banking

- Project Type:

-

Temenos T24 cloud uplift DevOps CI/CD automation Temenos upgrade services

Challenge

A long-established Australian retail bank with multiple brands engaged DXC Luxoft to help it reduce operating costs, accelerate innovation and keep up with changing customer behaviors. The bank had both an on-premise Temenos Transact R22 system supporting its relationship bank and a Temenos-managed Banking-as-a-Service (BaaS) solution supporting its digital brands.

The bank’s fundamental challenge was running older versions of Temenos on older technologies, on-premise. Their internal teams, with their deep expertise in legacy technologies, have been instrumental in keeping operations running smoothly. However, their reliance on older deployment methods has made it challenging to adapt quickly to newer practices. While their experience is invaluable, this focus on traditional approaches has slowed progress and made it tougher to embrace the innovations needed to stay competitive in a changing landscape.

At the same time, staff were using obsolete technologies to maintain the bank’s systems and applications. They didn’t have the necessary knowledge and experience to work on the latest applications, so our team were charged with “training the trainers” and educating them on the job.

The bank’s biggest challenge on the ground was moving to the cloud and adopting all the new changes while ensuring that, business-wise, everything remained intact with minimum disruption of their existing live production and operations.

Uplifting the bank to the future

To better balance CAPEX and OPEX costs, our client created an ambitious cloud-only strategy to uplift all its applications from multiple datacenters to an upgraded Azure cloud platform. Put simply, the bank is building a strategic platform for the future on Azure cloud infrastructure.

Migration of the first non-strategic apps began in August 2023, with the Transact on-premise app being the first strategic app migrating to the new purpose-built Azure strategic landing zone.

Creating consensus in the business

In June 2023, one of our specialist consultants interviewed 27 key line-of-business and digital transformation stakeholders over a five-week engagement to determine precisely what the bank was trying to achieve. He:

- Conducted an “as-is” cloud operating model maturity assessment, advising on target-state requirements

- Provided a Transact ecosystem Azure high-level design (target-state architecture)

- Assessed the Temenos bespoke code functionality

- Drew up a migration roadmap

- Completed a business case — “What are your datacenters costing you, and what would that look like in the cloud?”

This task helped decision-makers fully grasp the value and challenges of moving from Temenos on-prem to an advanced Azure AKS container-based environment with a DevOps pipeline.

Project

- Build a strategic cloud platform to run Temenos on an Azure Kubernetes environment

- Upgrade Temenos to the latest technology stack with automation, AI and new features

- Develop a DevOps CI/CD capability

- Use the solution as a blueprint for bringing other, older core banking installations up to speed

- Critical skills uplift for internal teams

Solution

Having accepted the statement of work, the bank approved a fixed-price 15-month project to move the Temenos on-prem virtual machines (VM) from the datacenters onto this new containerized platform. While a typical application might require several hundred containers, the Temenos R24 solution operates efficiently with only three.

Our work started with the creation of detailed design documents, migration strategies, and other critical materials to ensure a smooth transition. This initial phase set the foundation for successfully moving to the latest Temenos technologies and cloud operations, leveraging our deep understanding of both the platform and the operational requirements needed to make this shift seamless. Meanwhile, our agile engineering team successfully moved the entire banking estate to the cloud using a range of Azure cloud services and technologies.

The two teams worked closely together on the estate transition and transformation to give the bank more agility, quicker upgrades and the ability to execute safer deployments with best practices. The aim was to bring IP and knowledge back in-house and deploy DevOps CI/CD automation to improve efficiencies by minimizing human error (most processes were manual to that point). And that’s the bottom line, to maximize the benefits of cloud working to create high availability, flexibility and scalability.

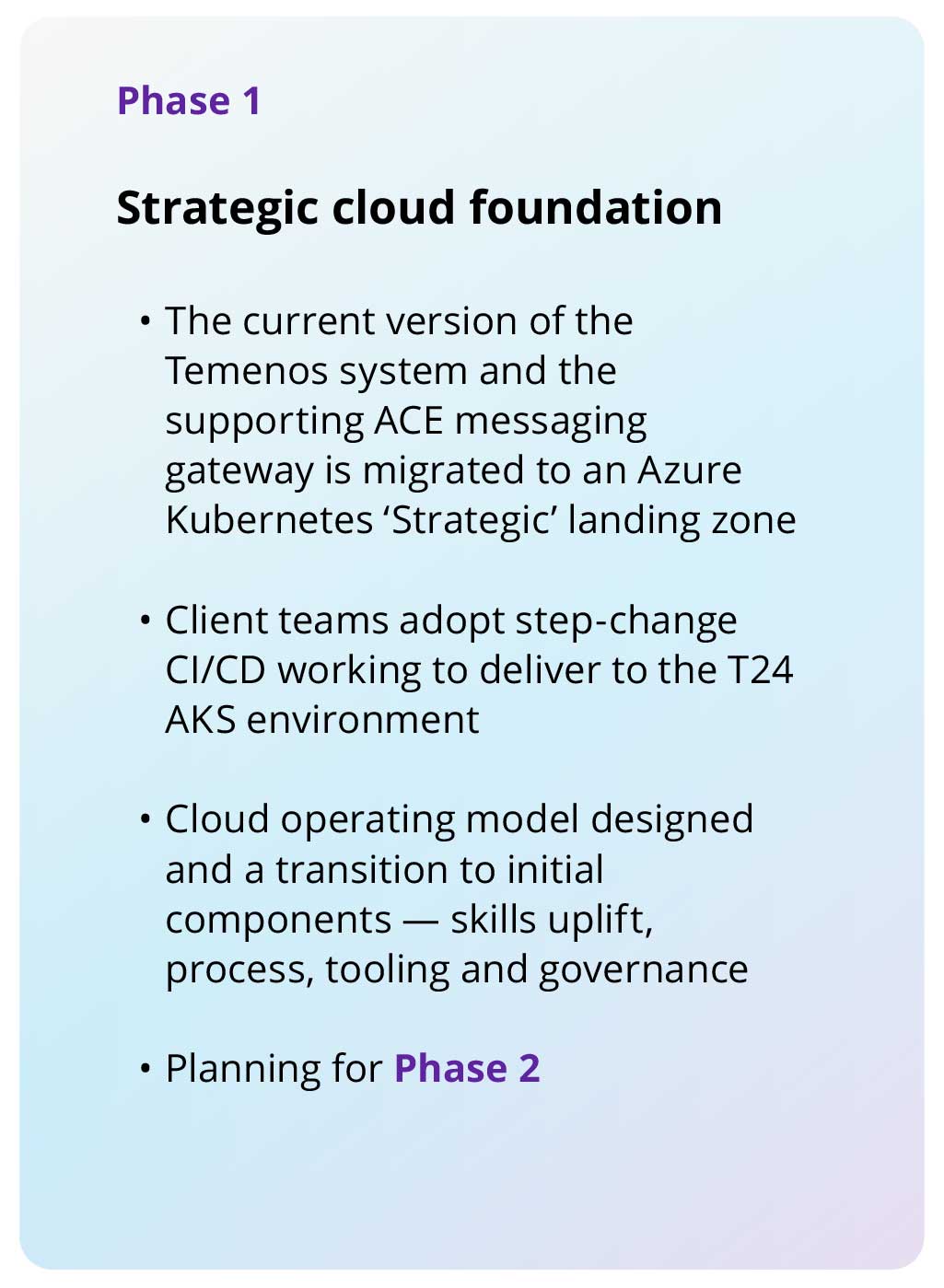

Temenos cloud enablement — three-phase execution

The bank can now easily scale environments up and down as needed, with the build nearing completion. The DevOps component is functioning smoothly, and automation has driven significant progress. DXC Luxoft employs AI automation to reduce the cost of end-to-end testing, optimizing processes and improving efficiency. By utilizing AI-assisted Microsoft Copilot, DXC Luxoft has further enhanced automation in development, resulting in a notable improvement in productivity of up to 50%.

Result

Outcomes

With multiple retail banking brands and core banking systems, regulatory demands have been a problem area for the client. The strategic direction for the bank is to reduce the number of core banking systems with automated evergreen, self-upgrading applications to make compliance easier to monitor and maintain.

Talk to us

Want to learn how DXC Luxoft’s advanced engineering, core banking and operations optimization capabilities could take your business to the next level? Then, how about talking it over with one of our experts?

3 min read

3 min read