In brief

- Financial crime represents a significant and ongoing threat to the stability and integrity of the financial services industry and the economy. Each year, trillions of dollars are lost to FinCrime and money laundering globally

- Financial crimes can have severe consequences, including economic losses, regulatory penalties and damage to institutional reputation, and financial institutions are obliged by regulation to have systems and controls in place to mitigate this risk

- However, banks and insurers face a range of challenges, including growing regularity complexity, the sophistication of criminals, rapidly changing technology landscape, and lack of resources and skills in their fight against FinCrime

- With expertise in client lifecycle management (CLM), regulatory technology, enhanced fraud detection, intelligent banking operations and systems integration, DXC Luxoft helps financial institutions detect and prevent financial crime, ensuring compliance and operational efficiency

Financial crime represents a significant and ongoing threat to the stability and integrity of the financial services industry.

The rapid advancement of technology has not only transformed the financial landscape but also given rise to increasingly sophisticated methods of committing financial crimes. These crimes cover a wide range of activities, including fraud, money laundering, terrorist financing, embezzlement and more. Each issue poses a unique challenge to financial institutions and the economy. The United Nations Office on Drugs and Crime estimates annual money laundering volumes range from 2% to 5% of global GDP. For 2024, this translates to between $2.22 trillion and $5.54 trillion.

Financial institutions strive to protect assets, maintain customer trust and adhere to stringent regulatory requirements. So, the need for comprehensive and effective strategies to combat financial crime is paramount. The repercussions of FinCrime are far-reaching, potentially leading to significant financial loss, reputational damage and legal ramifications for the institutions concerned.

DXC Luxoft is a pivotal ally for financial institutions, offering a robust suite of solutions designed to address the challenges posed by financial crime. Leveraging cutting-edge technologies such as AI, ML and advanced data analytics, DXC Luxoft delivers tailored strategies and innovative tools to help financial institutions stay ahead of threats. Our deep domain expertise and commitment to excellence help us detect and prevent financial crime as well as enhance the operational efficiency and regulatory compliance of our clients.

Moreover, DXC Luxoft's comprehensive approach ensures that financial institutions can rapidly adapt to the ever-evolving regulations and threats. By leading technological advancement and industry practices, DXC Luxoft empowers its clients to implement proactive measures against potential risks.

This article provides real-world examples of our successful FinCrime interventions. By understanding the scope of financial crime and advanced solutions available, financial institutions can better safeguard their operations and contribute to a more secure financial ecosystem.

What is financial crime?

According to Section 1H of the Financial Services & Markets Act 2000, financial crime comprises any kind of criminal conduct relating to money or financial services or markets, including any offense involving:

- Fraud or dishonesty

- Misconduct in, or misuse of information relating to, a financial market

- Handling the proceeds of crime

- Financing terrorism

It can be broken down into the following sections:

- Fraud: Deceptive practices such as identity theft, premium fraud and submitting fraudulent claims. Fraudulent activities can lead to significant financial losses and undermine customer trust

- Money laundering: The process of concealing the origins of illegally obtained money. Money laundering schemes can involve complex networks and transactions that make detection problematic

- Financing terrorism: The use of institution services to fund terrorist activities. Identifying and blocking such transactions is critical for national and global security

- Embezzlement: The misappropriation of funds by individuals in positions of trust. This often involves the unauthorized transfer of funds to personal accounts

- Bribery and corruption: Offering or receiving undue advantages to influence actions. These activities compromise the integrity of financial institutions and can lead to regulatory action

- Tax evasion: Engaging in illegal methods to avoid paying taxes. Financial institutions must ensure compliance with tax regulations to prevent such practices

- Insider trading and market abuse: Using non-public information for financial gain and manipulating the market. Institutions must implement robust monitoring systems to detect and prevent these activities, and avoid undermining fair-trading practices

- Forgery and counterfeiting: Creating false documents or money. Advanced detection mechanisms are essential to combat the threat

- Sanctions evasion: Avoiding or undermining international sanctions. Institutions must implement comprehensive screening processes to ensure compliance

Under regulatory guidelines, all financial institutions must have systems and controls to mitigate the risk of being used to commit financial crime.

Challenges of financial crime in banking and the FSI

The banking and financial services industry (FSI) faces numerous challenges in combating financial crime. These challenges stem from the diverse and sophisticated nature of illegal activities that exploit the financial system. Here are some of the primary challenges that institutions must address:

- Complex regulatory requirement: Financial institutions must comply with stringent regulatory requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations. These requirements necessitate extensive data collection, monitoring and reporting

- Increasing sophistication of criminals: Criminals continually develop tactics and leverage advanced technologies to help them conduct financial crimes. Financial institutions must adopt innovative technologies for detection and prevention to stay ahead

- Slow adoption of technology: Slow adoption of advanced technologies hampers the ability of financial institutions to detect and prevent financial crimes effectively. Lagging behind the technological curve leaves institutions vulnerable to increasingly sophisticated criminal tactics

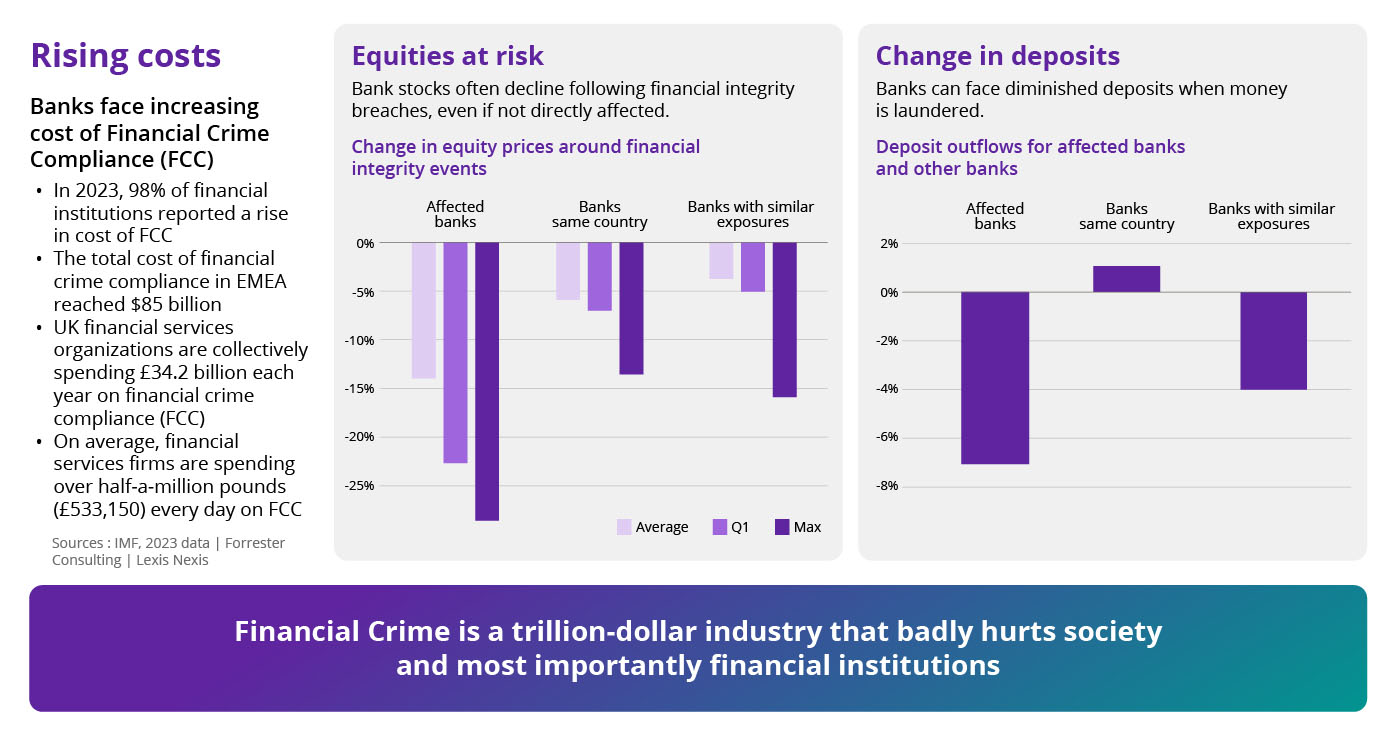

- Mounting costs and available budget: Increasing the financial burden. The rising costs associated with implementing and maintaining advanced detection systems, compliance measures and skilled personnel, exert significant financial strain. Skillful budget balancing is critical to ensure robust defenses against financial crime without compromising other operational areas

- Skills availability: Combating financial crime demands significant resources, including skilled personnel and advanced technologies

- Operational silos preventing an integrated approach: FinCrime detection requires the comprehensive data management of various silos, including data integration, cleansing and real-time analysis

- Information sharing across the industry: Collaboration between financial institutions is essential for fighting financial crime. Sharing intelligence on emerging threats, suspicious activities and best practices enhances crime detection and prevention

- Training and culture: Top management support. Providing training programs and expert consultancy to help institutions and their workforces stay ahead of changing criminal tactics

Fostering a culture of compliance and vigilance backed by unwavering support from top management is equally important. This creates an environment where employees are encouraged to stay informed and proactive in combatting financial crime.

Forms of fraud

Fraud takes many forms, each presenting unique challenges requiring specific solutions. The table below outlines some common types of fraud:

|

Form of fraud |

Description |

|

Identity theft |

Stealing personal information to commit fraud. This can include using someone else's identity to open accounts, make purchases or obtain loans. |

| Premium fraud |

Providing false information to obtain insurance benefits, involving inflating the value of claims or staging incidents to receive payouts. |

|

Fraudulent claims |

Submitting false claims to receive payouts from insurance or other financial services. This fraud strains resources and increases costs for legitimate customers. |

|

Phishing |

Deceptive attempts to acquire sensitive information by email, such as usernames, passwords and credit card details, by masquerading as trustworthy. |

|

Account takeover |

Unauthorized access to a bank account by obtaining the account holder's login. Fraudsters then make unauthorized transactions or steal funds. |

|

Loan fraud |

Providing false information to obtain loan approvals. This can include falsifying income details or using stolen identities to secure loans. |

|

Card not present (CNP) fraud |

Using stolen card information to purchase online or over the phone without the physical card. This fraud bypasses traditional card security measures. |

|

Check fraud |

Using counterfeit checks or altering legitimate checks to withdraw funds fraudulently (e.g., forging signatures or modifying check amounts). |

|

Wire transfer fraud |

Manipulating wire transfer instructions to redirect funds to fraudulent accounts. This often involves social engineering tactics to deceive bank employees or customers. |

|

Money mule schemes |

Recruiting individuals to transfer illegally obtained money on behalf of criminals. Money mules may be unaware of their involvement in illegal activities. |

How DXC Luxoft helps institutions address financial crime

DXC Luxoft offers a suite of solutions specifically tailored to beat financial crime. We combine advanced technologies with deep industry expertise to deliver effective and efficient solutions. Below are some of our key capabilities:

- Client Lifecycle Management (CLM): DXC Luxoft provides end-to-end services for CLM, encompassing onboarding, KYC, Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD), risk profiling, entity resolution and sanctions screening. This includes consulting, solution delivery, program management, post-implementation support and managed services. These services ensure that financial institutions accurately assess and manage client risk throughout the client relationship

- Regulatory technology and reporting services: DXC Luxoft delivers Reporting as-a-Service and implements regulatory solutions to help institutions comply with ever-changing regulations. Our services include automated reporting, regulatory analytics and compliance management, ensuring institutions are always one step ahead. We partner with a range of regtech and reporting solution providers to achieve this

- Enhanced fraud detection: Utilizing AI, ML and data analytics for advanced fraud detection in various use cases, including insurance, banking and real estate. Our solutions enable institutions to identify and prevent fraudulent activities in real-time, reducing financial losses and nurturing customer trust

- Intelligent banking operations: Embedding fraud prevention controls into banking processes and providing AML, KYC and Fraud as-a-Service as part of intelligent banking operations. This approach ensures that fraud prevention is integrated into the core operations of financial institutions, enhancing overall security and efficiency

- Systems implementation and integration: Extensive experience in implementing and integrating financial crime management systems, ensuring seamless data flow and improved operational efficiency

Impact of AI on FinCrime

According to research by IDC Financial Insights, one of the top areas of AI investment is in security and fraud prevention. DXC Luxoft is working with clients on several use cases to augment the efficacy of anti-FinCrime processes using GenAI. Some examples are shown in the figure below:

How DXC Luxoft helps institutions fight financial crime

The table below details how DXC Luxoft supports financial institutions in fighting financial crime:

|

Problem/challenge |

DXC Luxoft's capabilities |

How DXC Luxoft helps |

|

Identity verification |

AI- and ML-based solutions for accurate identity verification |

Implement automated processes to reduce fraud and improve customer experience |

|

Sanctions screening |

Dynamic entity resolution and network analytics |

Implement dynamic entity resolution and network to ensure compliance with regulatory requirements and prevent sanctions evasion |

|

Enhanced fraud detection |

Advanced analytics and ML techniques |

Identify fraudulent activities and mitigate financial and reputational risks |

|

Manual and inconsistent onboarding processes |

CLM. Full end-to-end services for onboarding, KYC, CDD/EDD |

Automate and streamline onboarding processes to enhance efficiency and compliance |

|

Need for centralized customer due-diligence process |

Implementation of tools like Fenergo, BAE Systems and Quantexa for CLM and screening |

Provide a 360-degree view of customers and automate risk-based CLM |

|

Fraud detection and risk mitigation |

Enhanced fraud detection using AI and ML |

Utilize ML models to identify and mitigate fraud, improving overall security |

|

Operational inefficiencies and regulatory compliance |

Workflow management and automation |

Transform processes to reduce fraud, mitigate risk and boost compliance |

|

Need for improved data management and reporting |

Data, analytics, MI and reporting |

Analyze data to detect anomalies and provide insightful reporting capabilities |

|

Legacy systems integration and modernization |

Systems implementation and integration |

Integrate and modernize systems for seamless data exchange and operational efficiency |

|

Increasing complexity of regulatory requirements |

Regulatory compliance solutions |

Stay ahead of regulatory changes with automated compliance updates and reporting |

|

Growing threat of cybercrime |

Cybersecurity services |

Protect sensitive financial data through advanced cybersecurity measures and continuous monitoring |

|

Need for real-time transaction monitoring |

Real-time transaction monitoring systems |

Identify suspicious activities swiftly with real-time analytics and monitoring tools |

|

Demand for scalable and flexible infrastructure |

Cloud services and infrastructure management |

Ensure scalability and flexibility with robust cloud solutions tailored to your specific needs |

|

Client Lifecycle Management (CLM) |

End-to-end services for onboarding, KYC, CDD/EDD, risk profiling and sanctions screening, including consulting, program management and managed services |

Comprehensive services for managing the client's lifecycle. Streamlines onboarding and compliance processes, ensuring thorough risk assessments and adherence to regulatory requirements |

|

Intelligent banking operations |

Embedding fraud prevention controls into banking processes and providing AML, KYC and Fraud as-a-Service |

Enhancing security measures within banking processes, ensuring robust protection against financial crime |

Examples and references

DXC Luxoft has helped several clients tackle financial crime through tailored solutions and strategic partnerships. Here are a few notable examples:

- Large European bank: Faced with increasingly stringent AML/KYC regulations, this bank struggled with disparate systems and fragmented data. DXC Luxoft implemented a new data-centric operating model that centralized and standardized AML/KYC processes. Our actions resulted in streamlined procedures, reduced compliance costs and improved regulatory adherence

- Global investment bank: This institution needed to enhance its AML capabilities to cope with evolving regulatory requirements and sophisticated financial crimes. DXC Luxoft’s comprehensive CLM solution integrated with existing systems to improve the enforcement of financial crime policies, increase detection and prevention capabilities and ensure compliance with global standards

- Large Australian bank: Confronted with outdated FinCrime technology and CLM inefficiencies, this bank asked DXC Luxoft for help with modernization. We implemented cutting-edge tools for CLM, screening and investigative analytics. The new centralized, risk-based CLM approach enhanced the bank's ability to identify and mitigate risks, streamline processes and bolster compliance measures

- Japanese investment bank: Our client faced challenges related to inefficient Client Due Diligence (CDD) processes and poor systems integration. Our team established a universal CLM infrastructure, optimizing CDD processes to improve processing times, accuracy and overall system performance

- Global money transfer agent: Struggling with rapid regulatory changes and speed of adaptation, this agent needed a robust AML and sanctions policy validation solution. DXC Luxoft quickly implemented a comprehensive solution that ensured compliance with industry standards and regulatory requirements. This rapid deployment enabled the agent to maintain regulatory compliance, minimize risks and continue operations without interruption

To sum up

Financial crime remains a significant challenge for the banking and financial services industry. However, DXC Luxoft can help financial institutions mitigate these risks. We enable clients to win their battles against financial crime by leveraging AI, ML and robust regulatory frameworks and processes. Our proven track record and tailored solutions ensure institutions can protect their assets, customers and reputations.

The strategies and technologies to combat financial crime must keep pace with its evolution. DXC Luxoft remains committed to providing cutting-edge solutions that empower financial institutions to detect, prevent and respond efficiently. We help institutions enhance their security measures, comply with regulatory requirements and foster a culture of integrity and trust. Our holistic approach addresses the root causes of financial crime, offering sustainable solutions that adapt to changing threats and regulatory environments.

DXC Luxoft is an acknowledged FinCrime partner for firms wanting to fortify their defenses. Through innovation, broad expertise and a relentless commitment to excellence, we help clients navigate the complexities of financial crime and achieve lasting success.

Get in touch

To learn more about how to detect and reduce your financial crime vulnerabilities, contact our expert.