In brief

- With the convenience of being accessible from any connected device, Luxoft's EarlyResolution Borrower Portal is always there for borrowers and loan servicers

- Servicers and banks have a direct source of communication and assistance options for their borrowers

- Seamless integration and a customizable interface help streamline operations to significantly enhance operations

- 15+ year proven track record

- Dynamic, adaptable and technologically advanced

We all aspire to enhance our quality of life — whether it's securing our dream home, upgrading our car, or simply ensuring our household runs smoothly.

Yet, despite our best-laid plans, unforeseen circumstances can disrupt our trajectory, leaving us feeling overwhelmed and uncertain about what lies ahead. It’s not always easy to keep our heads above water, and life’s challenges can catch us off guard, testing our resilience to recover.

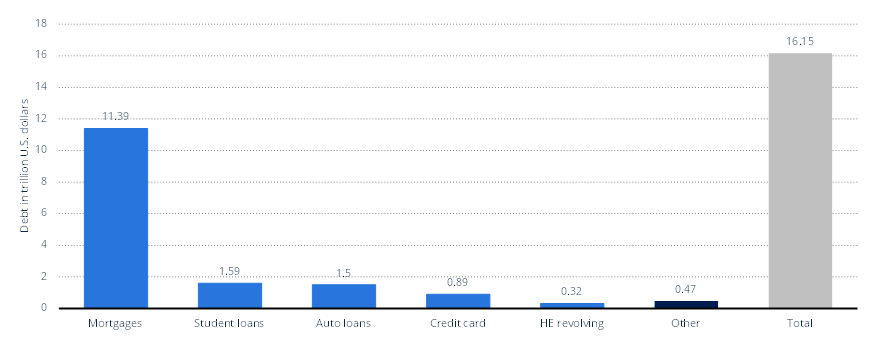

The reality is, the amount of household debt accrued by a typical US family places a significant amount of pressure on finances when life takes an unexpected turn.

Value of household debt in the United States as of 2nd quarter 2022, by type (in trillion U.S. dollars)

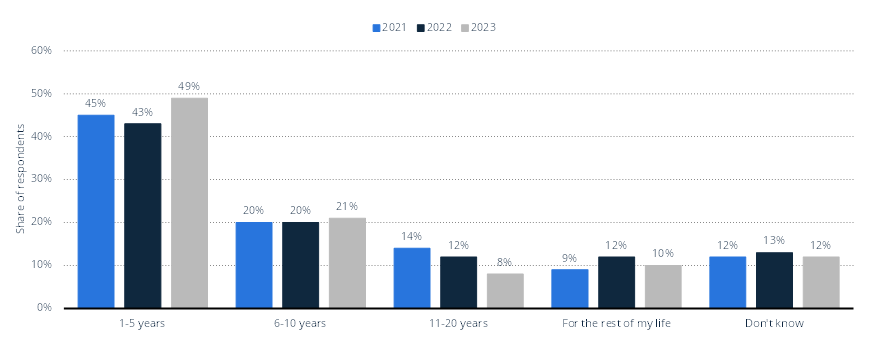

If we delve a little deeper, we can see both the amount and the duration of non-mortgage debt is significant for average families, spanning years for some.

Number of years consumers expect to remain in non-mortgage debt in the United States from 2021 to 2023

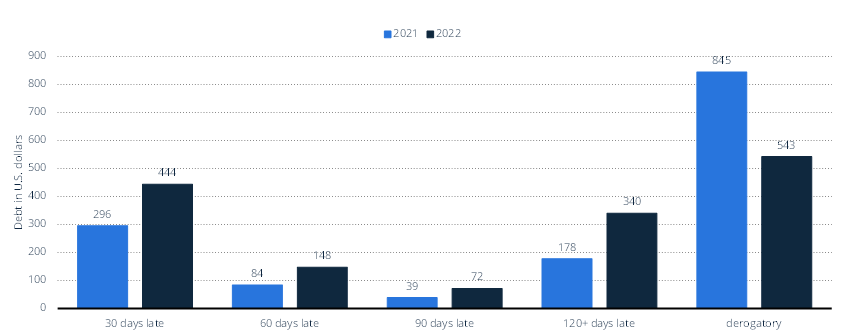

When borrowers lose a job, suffer costly medical illness, or incur other significant expenses, loan servicers need a solution to get their borrowers assistance immediately. Luxoft's EarlyResolution Borrower Portal can serve a dependable lifeline, extending a reassuring hand of stability and support when it's needed most. Accessible around-the-clock, it's ready to offer guidance and assistance whenever a borrower needs help. Whether borrowers are grappling with unexpected expenses, striving to make ends meet, or simply seeking counsel on assistance options, the portal is meticulously crafted to streamline processes and alleviate the burden of stress. The truth of the matter is that the issue of rising debt isn’t going to disappear any time soon, and borrowers will always need a straightforward way to get back on track.

Value of delinquent debt balance per capita in the United Staes from 2021 to 2022, by stage (in U.S. dollars)

The EarlyResolution Borrower Portal incorporates robust business rules and workout decisioning to offer unique assistance options to the borrower directly. Seamlessly integrating with servicers’ online banking sites, letter generation vendors, text/email systems, imaging systems, and e-Sign vendors, it offers a myriad of advantages. The Borrower Portal is optimized for mobile devices and can be customized to adhere to corporate branding standards to provide a consistent omnichannel experience across various channels.

Built-in Google Analytics provides analytical insights into user interaction, patterns, borrower engagement, usage trends, and key metrics, enabling data-driven decisions and continuous optimization of the borrower experience. The EarlyResolution Borrower Portal helps reduce the technology footprint for loan servicing companies, streamlining operations, enhancing efficiency and lowering costs. It also addresses many of the issues that cause the highest number of complaints about the debt collection process.

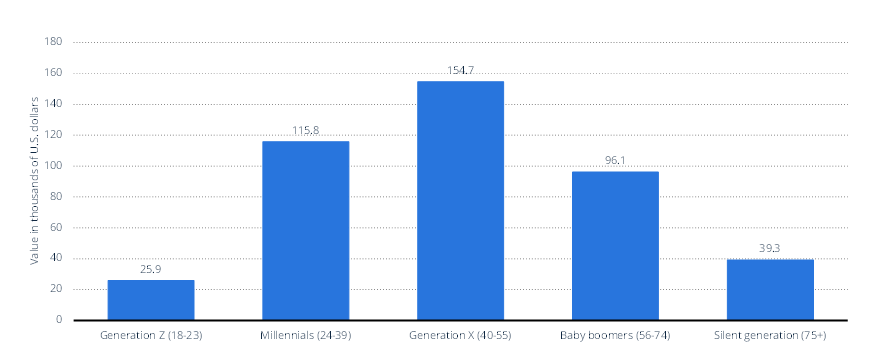

Total average debt in the United States in 2022, by generation (in 1,000 U.S. dollars)

In today's fast-paced world, where efficiency and reliability reign supreme, Luxoft's EarlyResolution Borrower Portal shines as a beacon of efficacy, empowering individuals and institutions alike to navigate life's uncertainties with confidence. Please reach out to Luxoft's team today and explore firsthand how the EarlyResolution Borrower Portal can help your borrowers get back on their feet!