In brief

- As the financial landscape faces new challenges, EarlyResolution’sTM innovative cloud-based self-service software has been designed for loan servicing companies to improve the borrower’s experience when they’re dealing with financial difficulties.

- During unexpected crises and changes in the market, EarlyResolutionTM bridges the gap between digital tools and traditional call center support, providing a unified experience for borrowers.

- DXC Luxoft’s EarlyResolutionTM easily integrates with existing systems, maximizes core capabilities, and offers a flexible structure that enhances borrower interactions, boosts contact rates, shortens response times, and streamlines the overall technology setup.

- Built with a keen understanding of the loan servicing industry, DXC Luxoft’s EarlyResolutionTM offers unmatched flexibility, scalability, and security. Its architecture is designed to easily adapt to shifting regulatory and compliance requirements.

There’s an old Mark Twain proverb that runs, "A banker is a fellow who lends you his umbrella when the sun is shining but wants it back the minute it begins to rain." Of course, that may be considered, by some, a rather outdated statement, perhaps creating in mind a scenario reminiscent of old Mr. Potter in Frank Capra’s perennial film, "It’s a Wonderful Life." Nevertheless, it’s one of those sayings which just won’t disappear. And at present, it’s a saying that may ring particularly true for many. These days it’s not just banks which lend people money, and the quote could easily apply to any consumer lender.

With the ever-changing financial climate and times becoming harder for many, the age-old dichotomy of working hard to afford the things you’d like to have against the ever-increasing difficulty to pay back the money borrowed for them, becomes ever more prevalent.

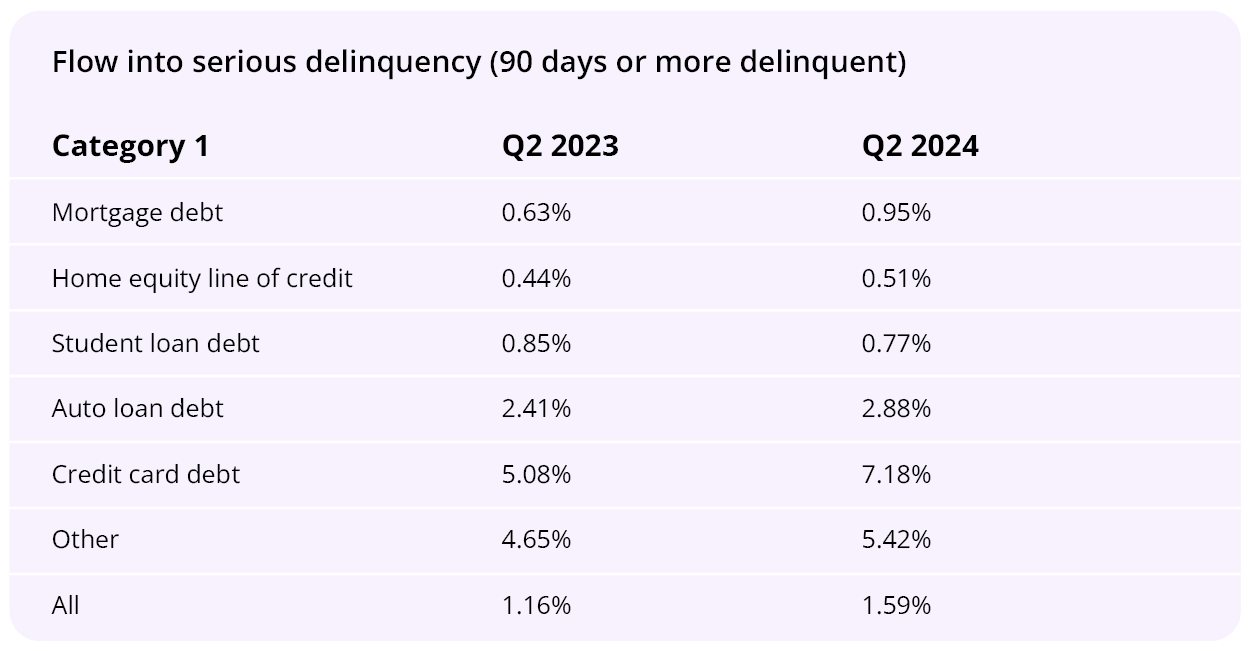

In a recent Wall Street Journal article, "Americans Are Falling Behind on Their Bills. Wall Street Is Alarmed", they laid bare the statistics around the current state of consumer lending as well as the real numbers behind consumers’ ability, or inability, to pay back their loans. The numbers are, quite frankly, staggering. The situation not only affects borrowers, lenders, and the financial markets, but economies as a whole. Still reeling from the pandemic, the global financial situation is constantly in a state of flux, often leading to financial institutes having to constantly try to adjust to new realities. Among them is an upsurge in debt delinquency.

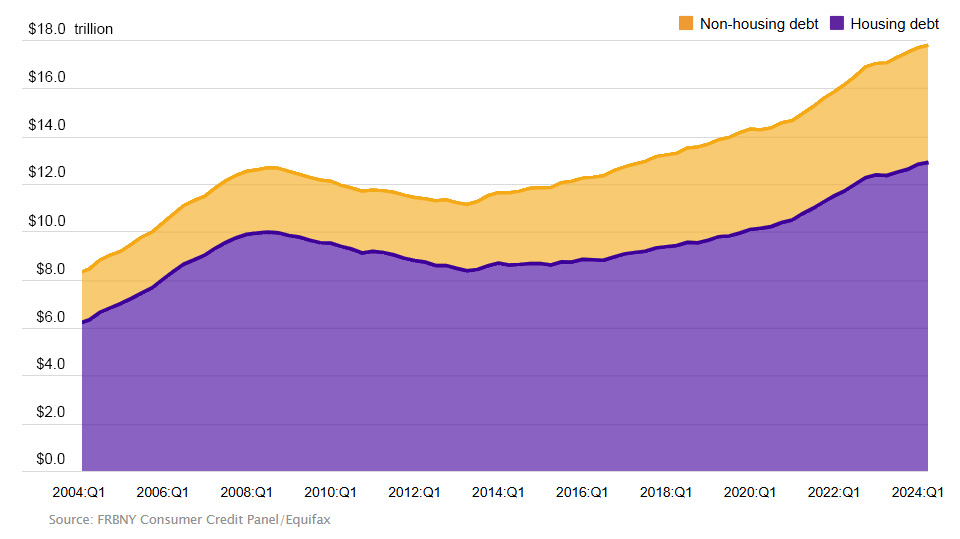

With almost $18 trillion of household debt in the U.S. and aggregate delinquency rates (in some stage of delinquency) at around 3.2 percent of outstanding debt. That’s almost $600 billion of debt which may have to be written off in charge-offs.

When times get tough and people find it harder to keep up with payments, it’s the whole gamut of lending that’s affected: Mortgages, car loans and credit card balances are among them. In the August report from the Federal Reserve Bank of New York noted above, it was stated that a total of around 9.1% of credit-card balances turned delinquent over the past year, the highest rate in over a decade. As well as seeing 8.0% of auto loan balances transition into delinquency.

At a recent Barclays conference, Ally Financial’s Chief Financial Officer, Russell Hutchinson stated that, "Our credit challenges have intensified," with late payments on Ally's auto loans in July and August rising by 20 basis points more than the company expected. And, as more borrowers became seriously delinquent, the company wrote off more loans than it had anticipated. Net charge-offs on auto loans rose by 10 basis points more than Ally had expected.

As a consumer lender what can you do about delinquencies and defaults? Legacy methodologies are time and cost inefficient, and as stated in the WSJ article, obviously not working well enough, evident by the rise in charge-offs.

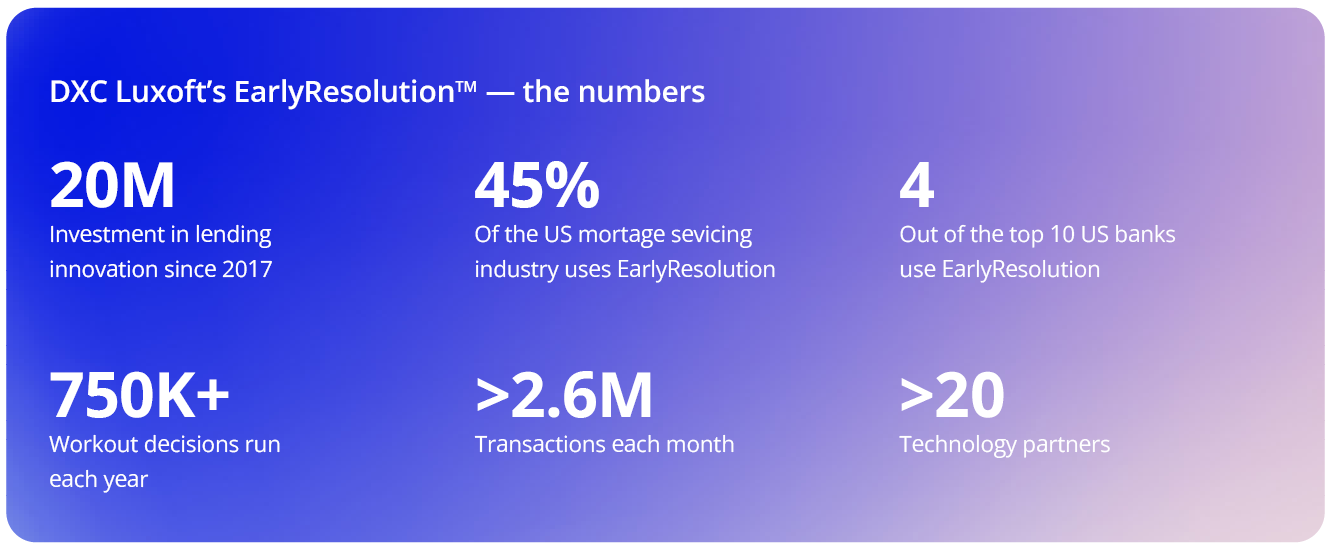

There are ways to alleviate the issues for all concerned. DXC Luxoft’s EarlyResolution™ has been an industry leading light in default management for the last 15 years. Designed and built by prominent industry experts, it is one of the most trusted solutions in the banking industry.

What is EarlyResolutionTM?

EarlyResolutionTM is a cloud-based self-service platform that seeks to transform the way borrowers interact with their servicers during difficult times by providing a focus on improved borrower experience and optimization of default management processes. With the integration into online banking systems and ease of use within the fully featured EarlyResolutionTM suite, the EarlyResoultionTM Borrower Portal significantly improves borrower engagement, increases contact rates, reduces cycle times, and enhances efficiency while adhering to the latest regulations.

By supporting all loan types, be it mortgage, auto, consumer, or personal loans, the platform offers one-stop management of various debt types. The result of this is that it simplifies lenders' technology ecosystems, reduces costs and improves operational efficiency.

Constructed with the explicit purpose of helping servicers meet all the varied regulatory and compliance requirements, EarlyResolutionTM adheres to investor guidelines while minimizing credit risk and providing significant improvements to the borrower experience. By including approved language, process controls, and standardized workflows for compliance, it minimizes the threat of regulatory breaches that may incur fines. EarlyResolutionTM sets a new standard in streamlined, customer-centric operations and greatly reduces the threat of audits and issues dealing with compliance.

Additionally, EarlyResolutionTM offers an end-to-end set of tools to handle defaults, thereby giving operations leaders the ability to manage the entire process, starting from initial contact through underwriting and settlement. The suite includes collections, workflow management, decision-making, and borrower-specific portals, which enables smoother operations and a seamless experience for both servicers and borrowers.

How to keep things together

In a recent article, What to Do if You Fall Behind on Bills - WTOP News, Lamar Brabham, CEO and founder of the Noel Taylor Agency, a financial planning firm in North Myrtle Beach, South Carolina reminded us that, “The primary goal of the company you owe is to get their money. They want to keep you paying in some form or fashion. The last thing they want is to write off your account as uncollectable.”

This is exactly where EarlyResolutionTM excels. EarlyResolutionTM can help predict payment behaviour to determine if a borrower is about to become delinquent and default on their loan. This allows the servicer, through EarlyResolutionTM, to intervene. But EarlyResolutionTM goes further than that.

What can EarlyResolutionTM do?

EarlyResolutionTM is recognized for advancements in:

Collections

Drives consistent results and efficient workout plans by guiding collections counsellors through calls. Borrower needs and viable workouts are constructively addressed upfront, saving over 20% in time and resources while reducing the need for future mitigation efforts.

Workflow

Through process automation, eliminating paper and providing instant file access, workflow typically generates a 20–25% lift through productivity gains. Staff are provided with at-a-glance dashboards and customized reporting, allowing for rapid and informed decision-making.

Decisioning

Automated rules engines, integrated applications and a single platform for sharing documentation makes the decisioning process seamless while reducing errors. Underwriters see a 25–30% improvement in number of loans serviced while reducing decisioning times by 20%.

Borrower self-service

The borrower portal provides secure online account access and management. Required documents can be easily uploaded, and the system automatically provides users with an account status and progress towards resolution – reducing inbound call volume by as much as 30%.

New capabilities

Recently added capabilities include:

Real estate agent portal:

Allows the servicer to manage the entire short sale process with the real estate agent, improving the interaction while reducing the cycle time. The real estate agent portal allows servicers to manage critical documentation, property listings, offers and all communication in real time.

Financial calculator:

When clients have to manage financial data across different applications and spreadsheets, they increase time, effort and risk. The financial calculator simplifies the gathering and calculation of income and expenses, integrating with the underwriting decision engine for faster determination of loan workouts. When changes are made at the enterprise level, the tool ensures all users are working from the same rules to reach consistent decisions.

EarlyResolutionTM Borrower Portal

Central to EarlyResolutionTM is the EarlyResolutionTM Borrower Portal, a modern tool built to make life easier for loan servicing companies and their customers. Its entire scope is about improving the borrower experience and simplifying how servicers manage loans when people hit tough times. The portal easily connects with existing online banking sites and offers a simple, intuitive interface that puts borrowers in control. It helps boost engagement, speeds up processes, and ultimately makes things run more smoothly for everyone involved.

Imagine the scenario that Lisa Whitley, an accredited financial counsellor and chartered retirement planning counsellor points out in a recent article, “If you are at risk of falling behind on your car payment, then you are at risk of losing your car, perhaps more quickly than you imagine, if you rely on your car to earn a living, this can cause a cascade of financial problems.”

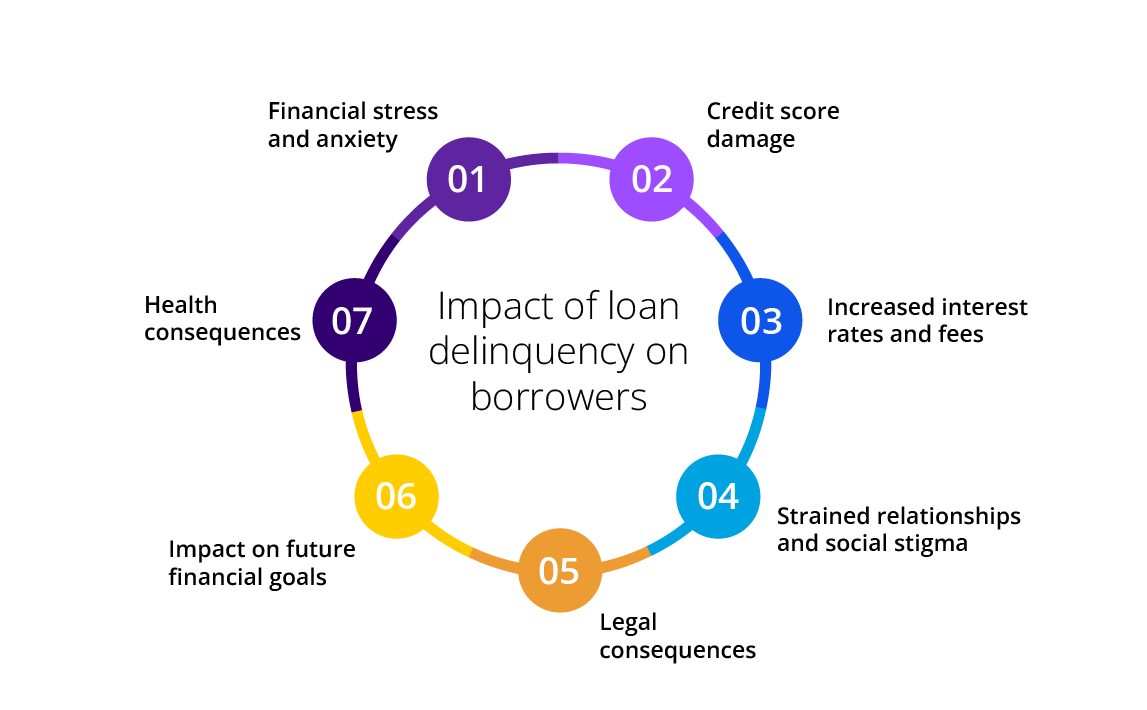

Most consumers would never choose to be in delinquency, the impact is significant:

EarlyResolutionTM was created to help alleviate the impact on both parties and offers a unified view across all management and digital channels, ensuring borrowers receive the same level of service no matter how they reach out. This helps servicers quickly identify customers who might be affected and provide support faster. For instance, if a natural disaster hits, EarlyResolutionTM clients can implement special business rules to direct impacted customers to a payment relief program within minutes — without waiting for them to be routed to a specialized team.

It’s a more responsive and efficient way to leverage existing processes, showcasing the flexibility and scalability of the EarlyResolutionTM platform.

In our experience, consumer loan servicers face significant challenges when major events like the 2008 financial crisis or COVID-19 occur. New mandates from various national, regional, and local regulatory agencies often require quick adoption, sometimes within just weeks. But with many servicers relying on outdated and rigid technology systems, they struggle to keep up with both process and technology changes. The current financial climate is no different.

That’s where EarlyResolutionTM comes in. Our SaaS-based default management platform is designed for maximum flexibility and ease of use. And because it’s built in the cloud and powered by a business-rules engine that clients can configure themselves, servicers can respond to new requirements quickly—often within days or weeks—without waiting for a vendor to rework the code.

We’ve also seen a growing interest in our managed services model, where Luxoft takes on the management of these business rules for our clients. This approach lets them scale resources up or down as needed.

A great example of EarlyResolution’sTM adaptability was during COVID-19. One of our clients rolled out new assistance options through our customer portal in just a few weeks, allowing them to support hundreds of thousands of customers every month. Meanwhile, other servicers in the industry had to rely on their internal IT teams, taking months to build and implement new systems to handle the surge.

What’s next for EarlyResolutionTM?

Even though we’ve been successfully helping clients and their customers with loan management for over 15 years now, we’ve never rested on our laurels; DXC Luxoft is making significant progress in identifying, building, and delivering new capabilities across the default management process to create a more profitable future state:

- Chatbots, SMS: Omnichannel capabilities to resolve delinquencies immediately

- Self-serve portals: Borrower direct, integrated e-sign

- Decision service: DXC Luxoft-managed workout plans extended to various front ends, reducing upkeep costs

- Data over docs: Partnerships with leading data providers to gather critical customer data

- AI processing: Utilizing automation, AI, and RPA within workflow tools to reduce manual steps

- Increased profit margins

- Lower operating costs plus increased revenue driven by higher customer satisfaction equals higher profit margins

It’s not often that you get to prove Mark Twain wrong, but what if EarlyResolutionTM really is the umbrella that puts the best interest of everyone involved to the fore? What if the consumer lender and their customers can both be under the same umbrella? Managing delinquencies and defaults benefits more than just the lender and the borrower, helping customers avoid them is better for the whole economy.

To learn more or to schedule a demonstration of the EarlyResolutionTM platform, please contact us at earlyresolution@dxc.com.