In brief

- The insurance industry is facing sluggish growth projections, undercut by the inflation-cooling monetary policy, pressure from climate and cyber risks, plus tightening capital and solvency regulations. Navigating these challenges imposes the digital transformation imperative on traditional insurers

- The most notable 2024 insurance technology trends include GenAI, responsible AI use, omnichannel customer experiences, automation and virtualization, predictive analytics, insurance chatbots and low-code/no-code development tools

- Other insurtech trends to watch in 2024 involve IoT, cloud adoption, computer vision, new business models, embedded insurance distribution and parametric insurance

Do you feel like the whole world’s cracking up, or is it just me?

Macroeconomic, political and geopolitical uncertainty and emerging climate and cyber risks are putting pressure on insurers worldwide. However, “survival of the fittest” still rules. For many businesses, especially those slower to innovate, it’s a simple choice: Leverage technology or wither away.

2024 was the year of AI in the insurance industry. Computer vision, GenAI, predictive analytics, you name it. The technology is fast becoming ubiquitous across the insurance value chain.

But AI isn’t the only tech trend. IoT, automation, omnichannel CX, cloud adoption, embedded insurance and new insurance products continue to reshape the industry.

The state of the insurance industry in 2024

The insurance industry continues to grapple with macroeconomic uncertainty fueled by inflation, interest rates, supply chain disruptions and geopolitical tensions. The monetary policy to cool inflation saw sluggish growth across most insurance sectors and markets.

Insurance companies are not optimistic about future growth opportunities and the insurance landscape. For example, most chief risk officers (CROs) surveyed by McKinsey expect a slight economic downturn in the next two years.

Emerging risks — climate and cyber risks in particular — continue to dominate strategic discussions.

The annual number of severe natural disasters in the United States rose from five (1980-2010) to 28 (2023). In 2023, losses from natural disasters reached a staggering $80 billion, driving up premiums across the country and prompting some carriers to stop offering coverage.

Cybercrime is also on the rise. In the United States, IC3 complaints almost doubled, and losses nearly quadrupled between 2019 and 2023. However, cyber insurance premiums have fallen as insured businesses ramp up their cybersecurity measures to mitigate risk.

As regulators tighten capital and solvency requirements, capital management also emerges as a critical risk, pushing insurance companies to rethink their ideal balance sheet composition.

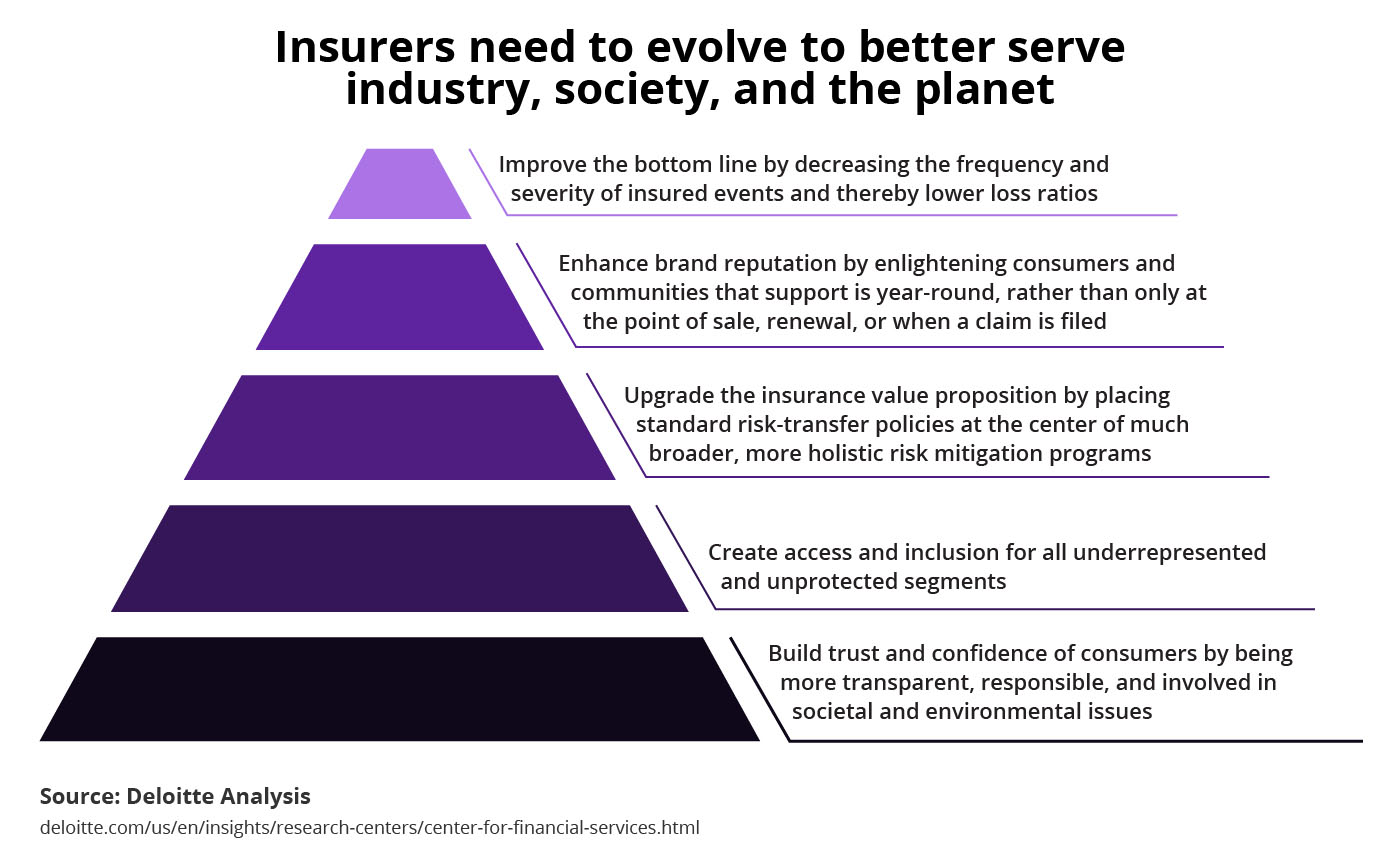

These and other trends impose an imperative on insurance companies: Ace digital transformation or lose out to tech-savvy insurtech challengers. Deloitte outlines the transformation path based on five tenets:

- Build trust and confidence among customers

- Expand coverage to underinsured segments

- Adopt more holistic risk mitigation programs

- Provide year-round support to policyholders

- Reduce the frequency and severity of insured events

Such profound transformation means harnessing established and emerging technologies to capitalize on troves of data and streamline processes, secure a competitive advantage and improve customer satisfaction.

1: Applied AI is the trend of the year

Artificial intelligence remains the technology with the highest transformative potential across sectors. Applied AI is an umbrella term for practical AI applications that solve real-world problems (for insurance, that includes detecting fraudulent claims, assessing risk profiles and appraising damage).

The 2024 AI insurance technology trends come down to two main groups: GenAI and ethical AI use.

GenAI

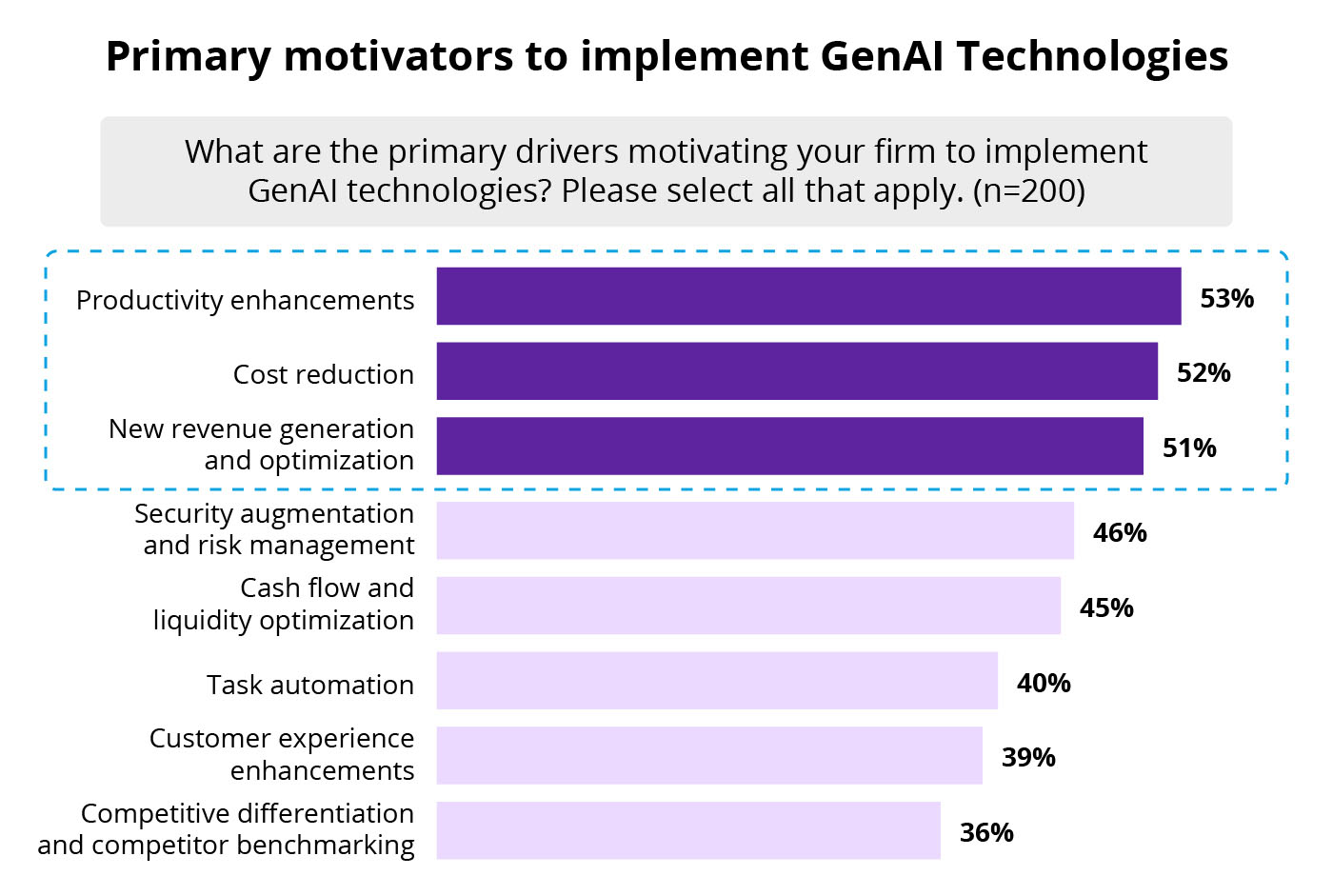

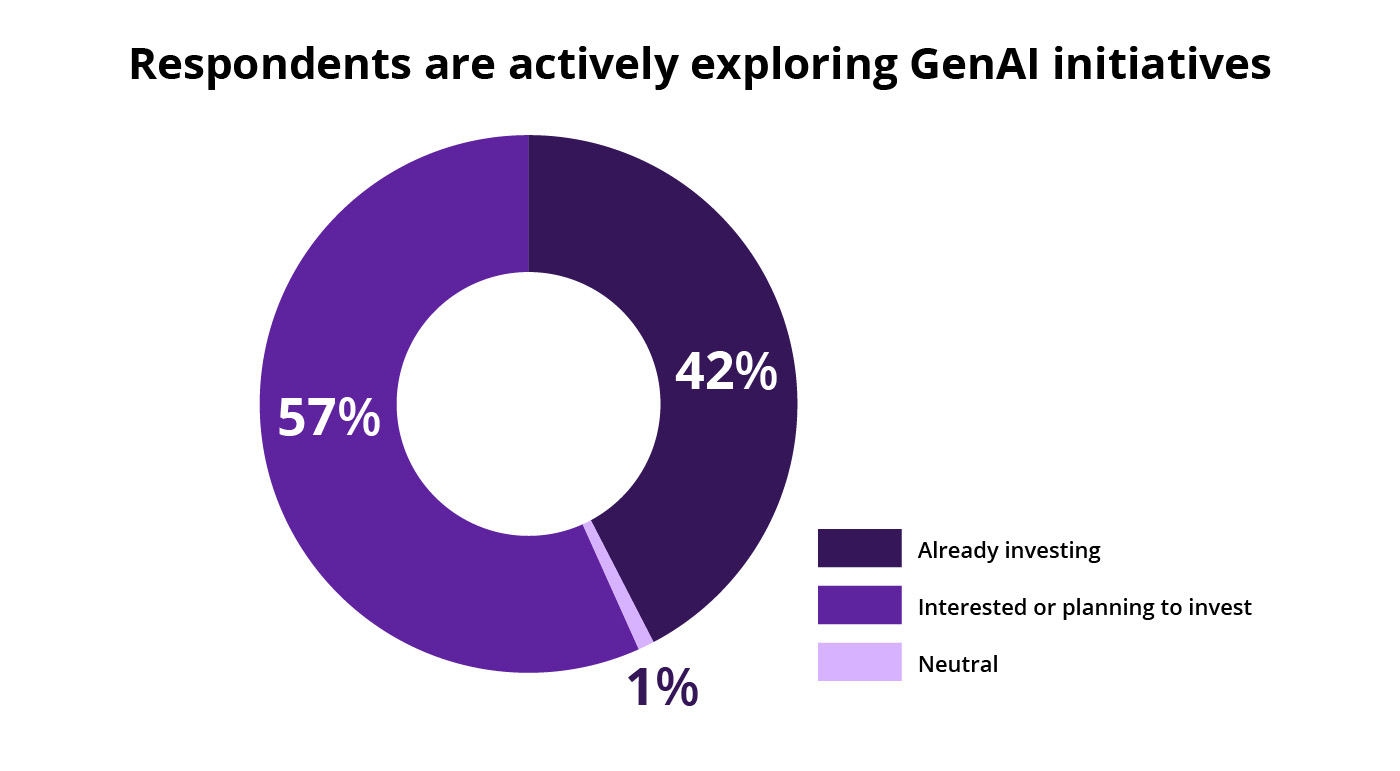

Capgemini ranks GenAI as the number one insurance industry trend for both P&C and life insurance. According to EY, 42% of insurers are already investing in GenAI, and 57% more are interested or planning to invest.

Productivity enhancements, cost savings and new revenue generation are the top three drivers of GenAI adoption in the insurance industry.

Large language models (LLMs), an advanced form of natural language processing (NLP), dominate the conversation on GenAI in the insurance industry.

As insurance technology, GenAI’s applications are many:

- Productivity tools: Cross-functional solutions like AXA’s Secure GPT can increase employee productivity. Role-specific copilots like Google’s Agent Assist for contact centers offer features tailored to the role, such as real-time answer suggestions

- Self-service customer support: Chatbots can replace a customer service representative in handling run-of-the-mill requests, such as comparing insurance policies. However, they should work alongside the in-person interactions that remain the preferred channel for more complex customer journeys like policy purchasing

- Unstructured data capture: GenAI tools can collect and categorize data from unstructured sources like emails and messages. This can be used for automated claim triage and advanced risk assessment

Responsible AI

In the United States, Colorado set the highest bar for AI use with its 2023 regulation on predictive model governance. NAIC also adopted its model bulletin to help state regulators set the framework for ethical AI use.

The European Union made headlines with its AI Act.

Insurance companies need to ensure their AI use is responsible and ethical to mitigate regulatory and compliance risks (and gain consumer trust). This is also critical for avoiding biased or inaccurate results.

2: Omnichannel customer experiences

Insurance customer experiences must be more cohesive. A recent McKinsey survey revealed that one in six consumers don’t hear from their insurance company after the first interaction. And while consumers use both online and offline channels, the transition between them can be practically non-existent.

Three industry-specific challenges to overcome

Before implementing an omnichannel CX strategy, insurance companies should weigh in on these challenges:

- Consumer preferences vary across sectors. For example, in the P&C insurance sector, customers are more likely than their life insurance counterparts to use websites

- In-person interactions still matter. Customers are more likely to opt for in-person interactions when buying a policy or encountering an issue

- Digital capabilities may fall short. A third of insurance customers are dissatisfied with the UX quality of the available digital channels. Only 20% say digital channels are their go-to channel choice

Four ingredients for a superior omnichannel experience

Implementing an omnichannel strategy requires:

- A unified customer data platform. This solution aggregates all customer data and makes it accessible across the organization

- Harmonized customer journeys. Business processes and customer experiences must be identical whether the consumer uses the website, mobile app or chatbot. Existing digital touchpoints and journeys should be optimized for simplicity and convenience

- Data analytics. Data analytics can extract valuable insights from customer data to personalize interactions and whole insurance products

- API-based integrations. Application programming interfaces (APIs) allow for a secure and seamless data flow and interaction between applications

3: Automation and virtualization power efficiency

AI remains the driving force behind automation and virtualization. It allows insurers to streamline and automate claims processing, underwriting and more. Digital twins and intelligent automation are the two automation insurance technology trends to watch.

Digital twins

While 65% of insurers say digital twins are a vital insurance technology, only 16% possess mature digital twin capabilities.

Digital twins enable companies to run simulations of the impact of specific changes on real-world objects and systems. Those simulations can be continuously updated based on real-time data.

In insurance, digital twins can be used to:

- Identify automation and intelligence opportunities within the organization to improve insurance operations

- Gain quick insights into the insured event using telematics and other data

- Enable predictive maintenance to mitigate risks

- Provide a more nuanced appreciation of risks during underwriting

- Create virtual customer behavior models to power marketing and personalization

- Identify inconsistencies and anomalies in insurance claims processing

Intelligent automation

Powered by advances in AI, intelligent automation’s high-impact use cases include:

- Claims management. IoT data analytics can fully automate the first notice of loss (FNOL). Claim resolution can be streamlined with AI solutions that take on manual tasks from damage appraisal to claim triage

- Underwriting. Data ingestion and verification can be fully automated, enabling underwriters to focus on providing the personal touch

- Regulatory compliance. From enabling AML/KYC compliance to automating reporting, intelligent automation can transform risk and compliance

4: Predictive analytics drives better risk management

Powered by machine learning, predictive analytics is one of the persisting insurance technology trends, even though insurers are struggling to keep up. According to Capgemini, only 27% of insurers possess advanced predictive modeling capabilities.

In predictive analytics, the three insurance technology trends to watch are: advanced risk assessment, risk management adapted to new types of risk and fraud detection/prevention.

New-generation risk management

Addressing new vulnerability types, e.g., climate and cyber risks, requires ingesting and analyzing new data from fresh sources. For instance, the following novel data streams enhance predictive climate risk modeling:

- Satellites

- Drones

- IoT sensors

- Terrestrial sensors

Predictive risk modeling can then power real-time pricing, dynamic underwriting, micro-segmentation, risk prevention and automated claim processing.

Advanced risk assessment

According to Capgemini, streamlining underwriting with predictive analytics and smart devices is one of the top 10 trends in life and P&C insurance. Predictive risk assessment is also a top priority for half of the insurers surveyed by EY.

Predictive analytics algorithms assess risk profiles using hundreds of data points from internal and external sources to streamline underwriting. More granular risk assessments enable insurers to compete on price and reach underinsured segments with affordable products.

Insurance fraud detection and prevention

Insurers worldwide are seeing an increase in exaggerated claims following natural disasters, and novel fraud schemes are popping up in their wake.

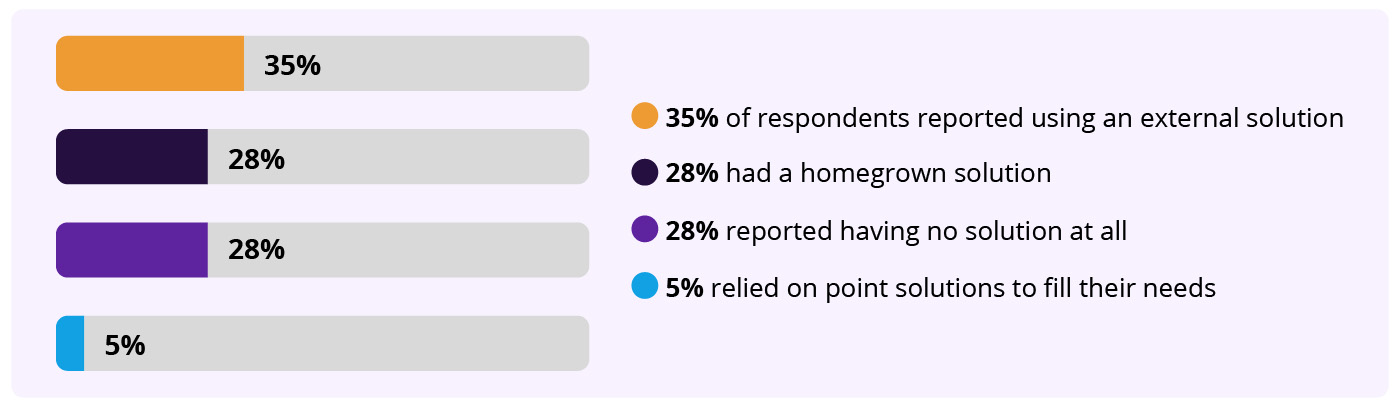

External solutions remain the leading fraud detection/prevention enablers. Alarmingly, 28% of insurers have no fraud detection solution at all.

Predictive analytics assess a vast range of first- and third-party data to identify fraud in both underwriting and claims, including:

- Claims history

- Fraud lists

- Loss history

- Vehicle history

- ID records

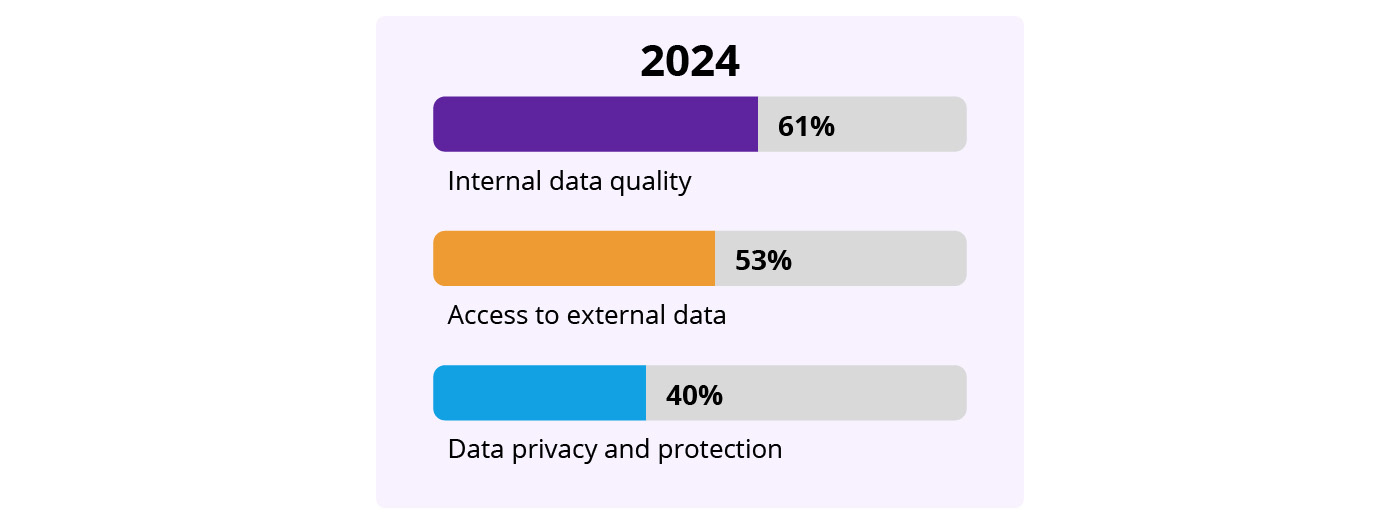

Internal data quality and access to third-party data remain the top challenges in detecting fraud using insurance technology.

5: Insurance chatbots are everywhere

Advances in GenAI have ushered in a new generation of insurance chatbots. These chatbots handle more complex queries than previous generations and return hyper-personalized responses.

However, as hallucination remains a key limitation of GenAI technology, explainability must be a prime concern for chatbot adopters.

Five insurance chatbot use cases to consider

One of the top insurance technology trends, chatbots serve a variety of purposes, including:

- Providing instant quotes for prospects, comparing insurance policies and advising on the best option (e.g., Lemonade’s AI Jim)

- Summarizing insurance policies for existing customers and responding to questions on coverage and premiums 24/7 (e.g., Zurich Insurance’s Zuri)

- Onboarding new customers with personalized Q&As on insurance policies and procedures

- Implementing fundamental changes to policyholder accounts and coverage

- Accepting insurance claims and updating customers on their claim’s status (e.g., Liberty Mutual‘s LiMu)

6: Low-code/no-code development as a means of digital transformation

Low-code and no-code (LCNC) tools accelerate migration from legacy systems and democratize automation among citizen developers. For example, Zurich leverages the Mendix low-code platform to replace its 1,400 legacy applications and prevent shadow IT.

How LCNC tools boost efficiency

According to Capgemini, 82% of insurance companies implementing LCNC tools report increased operational efficiency. A third of them estimate the efficiency increase at between 21% and 40%.

Use cases for this insurance technology include creating:

- Agent and customer self-service portals for policy management and claims processing

- Underwriting automation tools to streamline application and approval processes

- Dashboards for monitoring claims and policy metrics in real time

- Simple customer feedback tools

- Insured event reporting and claim intake apps for customers

- Basic analytics dashboards for tracking client interactions

However, LCNC is not the be-all and end-all

Implementing LCNC tools requires a reflection on the following:

- Required features: Some LCNC platforms may lack insurance-specific features

- Staff training: Adopting LCNC with internal and external development teams is likely to have a significant learning curve

- Customization: LCNC platforms are great for standard use cases, but prebuilt components limit customization

- Required integrations: Integrating with legacy systems can be a challenge, but it’s crucial for maximizing efficiency and ensuring a seamless dataflow

7: IoT provides masses of valuable data

As IoT connections are likely to more than double between 2024 and 2030, insurers continue to capitalize on the massive amounts of data supplied by telematics, smart home devices and wearables. However, not all customers are open to IoT-powered services.

For example, a 2023 SwissRe study revealed that telematics sponsors are typically millennials and Generation X with less than 5 years of driving experience. Customers opposing telematics tend to be baby boomers with over 10 years of experience.

Key IoT technology trends in the insurance industry include automated FNOL and risk prevention services.

Risk prevention

In health and life insurance, data from IoT devices, like smartwatches, can predict health risks and encourage customers to get preventative care. For example, in 2023, Vitality announced it would harness data from customers’ Apple watches to track their health status.

In P&C insurance, IoT sensors detect when equipment is likely to break down, triggering a maintenance alert. That equipment could be anything from vehicle brakes to industrial equipment and domestic pipework.

Automated FNOL

IoT sensors detect insured events and alert the insurer without policyholder involvement. The FNOL contains a multitude of data captured during the insured event, streamlining claims processing in due course.

Telematics adopters cite an automatic emergency system in severe car crashes as a top three value-added service.

8: Cloud adoption. A done deal?

Capitalizing on most of the insurance digital transformation trends — IoT, GenAI and predictive analytics — is impossible without cloud computing. On-prem infrastructure can’t handle the volumes of data and computations cost-efficiently.

Adoption rates skyrocketed between 2020-2023

In 2020, only a third of insurance companies were using cloud. According to Capgemini, that share more than doubled to 85%-88% in 2023.

In other words, cloud adoption is no longer an emerging trend in the insurance industry; it’s the new norm. If your organization isn’t capitalizing on the cloud, it’s lagging behind.

Drivers for cloud adoption

Cloud adoption comes with substantial benefits across the insurance value chain, such as:

- Enabling robust security measures for better fraud detection and compliance

- Scaling up and down automatically to suit changing needs

- Eliminating the cost of maintaining on-prem infrastructure

- Accelerating time-to-market for new features, services and products

- Facilitating secure and seamless access to data across locations

- Ensuring high uptime for critical services

All these benefits make cloud adoption irreplaceable for achieving operational excellence and enhancing customer experiences.

9: Computer vision continues its conquest

Considering its many use cases, this AI-powered insurance technology deserves its own entry on this list. Computer vision powers automated damage appraisal, aids fraud detection and informs underwriting.

Damage appraisal

Computer vision solutions like Tractable automate damage assessments for auto and homeowner insurance claims. These solutions generate repair cost estimates using photos and video footage to inform payout calculations. They also help detect and prevent claim fraudsters using exaggerated damages.

Data capture

Computer vision can be leveraged to:

- Extract text data from scanned documents and images

- Obtain data on the loss event from videos and pictures (e.g., scene and weather from dashcam footage)

- Extract data from drone-captured footage to inform underwriting

10: New business models arise

Increasing inflation is forcing insurers to find new ways of competing on price, e.g., usage-based insurance and microinsurance.

Usage-based insurance (UBI)

The global UBI market value is expected to increase almost tenfold between 2022-2032, amounting to a 26.2% CAGR. It consists of two key segments:

- Pay-as-you-drive (or pay-per-mile): Policies link premiums to the distance driven over a specified period in a continuous underwriting process. In other words, the more you drive, the more you pay

- Pay-how-you-drive: Policies use telematics data to analyze driver behavior, assign a risk score and use it to calculate premiums. Examples: Tesla Insurance, GEICO’s DriveEasy

Pay-how-you-drive products are moving away from relying on IoT data, marking another one among insurtech trends. For example, GEICO’s DriveEasy captures data from a mobile app, allowing anyone to sign up for a UBI policy.

Microinsurance

While microinsurance isn’t expected to show a CAGR as tremendous as that of UBI (6.7% between 2023 and 2030), it can’t be ignored. Microinsurance products aim to cover low-income, underinsured segments, offering affordable plans tailored to specific customer needs. Typically, they cover a single requirement for a particular period. Common examples include event, crop, livestock, tech, theft and travel insurance. Coverage for specific health needs can also be provided.